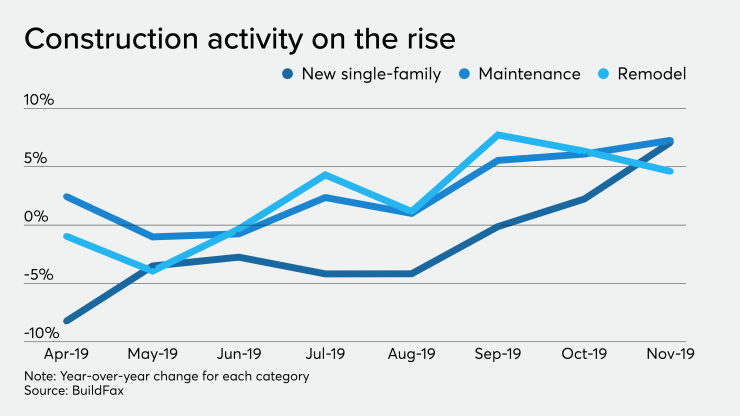

Even with an increase in both new and existing home construction activity during November, the slowdown over the previous 11 months will constrain inventory going into 2020, according to BuildFax.

For November, single-family construction authorizations increased 1.16%

Existing maintenance volume rose 7.26% over November 2018, while remodel volume — a subset of maintenance that includes renovations, additions, and alterations — increased 4.60%.

With more consumers looking favorably on buying a home due to

"Housing activity is seemingly on its way to a stabilization, as new and existing construction both saw increases this month," BuildFax Managing Director Jonathan Kanarek said in the report. "However, declining single-family housing authorizations in 2019 have led to an increasingly dwindling housing supply.

"Lower supply, in turn, will affect

The BuildFax report came out at the same time as the National Association of Home Builders/Wells Fargo Housing Market Index recorded

A year ago, BuildFax was worried about

"In line with last year's forecast, the probability of a recession increased to 42%," Kanarek said. "Fortunately, given a recent shift in key economic indicators, including single-family housing authorizations and the yield curve, the 42% probability is actually a de-escalation from September’s 50% peak.

"We're cautiously optimistic that continued increases in housing activity into 2020 will alleviate some of the economic uncertainty that the country has felt throughout this past year. As we move into 2020, single-family housing authorizations will continue to be a must-watch indicator to track how the market is moving," said Kanarek.

Separately, the Mortgage Bankers Association's most recent Builder Application Survey was down 17% from October, but up 27% from

New single-family home sales were running at a seasonally adjusted annual rate of 688,000 units in November, a decrease of 13% from the October pace of 791,000 units.

“On a seasonally-adjusted monthly basis, new applications decreased to the slowest pace since June 2019, which points to some weakness as this year comes to an end," said Joel Kan, the MBA's associate vice president of economic and industry forecasting in a press release. "The healthy job market, increased new home construction, and rising household formation support growth heading into 2020, but affordability challenges in many markets and economic uncertainty pose as headwinds."

On an unadjusted basis, there were 51,000 new home sales in November, a decrease of 16.4% from 61,000 new home sales in October, MBA estimated.

Conventional loans composed 69.2% of loan applications, Federal Housing Administration loans were 18%, Veterans Affairs, 12.2% and U.S. Department of Agriculture/Rural Housing Service, 0.6%. The average loan size increased to $337,943 in November from $335,235 in October and $331,732 in November 2018.