While affordability remains a top challenge for homebuyers, rental costs are also soaring, which could bring even more house hunters to the market.

The national average rent rose to $1,405 in June, up 2.9% year-over-year and 0.9% month-over-month. The increase translates to about $40 per month and is a record high in Rentcafe's monthly analysis of national rent data.

As

But with rents also growing, there may be an opportunity for mortgage lenders to help more renters enter the market. If housing costs are high for both renting and buying a home, the investment aspect of owning a home may be more appealing to consumers — so long as people who want to own homes can find properties to buy.

Rental rates on two- and three-bedroom units drove much of the June increases, Rentcafe said. While this could mean consumers are choosing to divide housing costs among roommates, it could also signal that families, who are prospective homebuyer targets, are unwilling or unable to become homeowners.

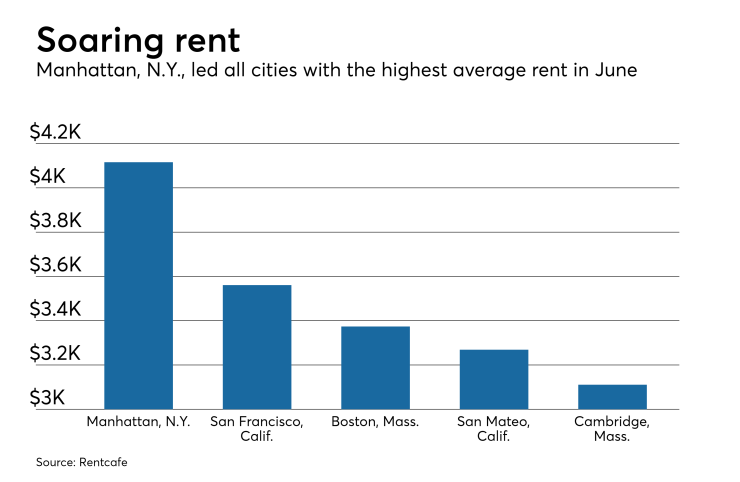

Manhattan, N.Y., beat cities with the highest average rent, with the cost rising to $4,116 in June. San Francisco and Boston were also among cities with the highest average rent, with prices hitting an average of $3,561 and $3,374, respectively.

At just $639, Wichita, Kan., had the cheapest average rent, with Brownsville, Texas, and Tulsa, Okla., following close behind, with an average of $675 and $676, respectively.

The Rentcafe report is based on data provided by Yardi Matrix, an apartment information service and sister division of RentCafe.