A Rocket executive made a subtle dig at

"We are investing in the mortgage broker channel, and we are winning," said Julie Booth, chief financial officer. "Hundreds of broker partners joined our network during the first quarter, and our partner volume has continued to be strong into the second quarter."

Rocket plans to invest "tens of millions of dollars" in 2021 to support the broker business and "our near term priority in this channel is to drive volume and incremental profits," said Booth.

Mortgage brokers will also play a key role in Rocket's push to become the largest retail purchase lender in the next two years.

They are an alternative to Rocket's call center retail business model, CEO Jay Farner said, pointing out the "thousands and thousands" of mortgage brokers that Rocket works with being willing to make office visits to real estate agents who desire that personal contact.

"We publish that broker on our website, we provide great technology to that broker and we're happy to have the agent work that way," Farner said.

Rocket Cos., which besides mortgage lending, also offers home sales, title and settlement services and

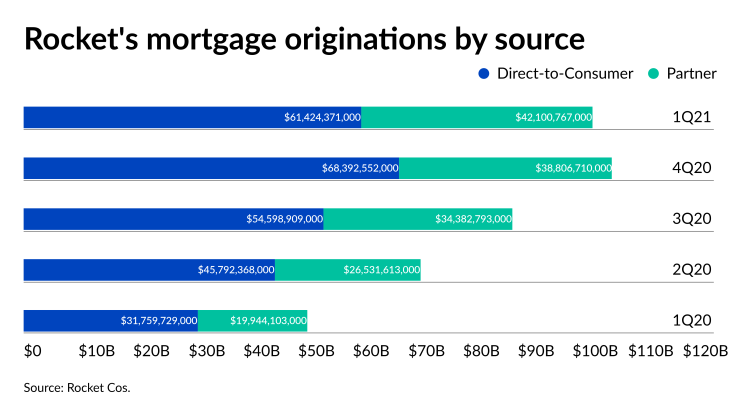

It originated $103.5 billion in the first quarter, down from the fourth quarter's $107.2 billion but more than double the $51.7 billion on a year-over-year basis.

Gain on sale was 374 basis points, a decline from

Rocket Mortgage's direct-to-consumer channel funded $61.4 billion, compared with $68.4 billion in the fourth quarter and $31.8 billion in the first quarter of 2020.

This channel's gain on sales margin for the period for this business was 536 basis points, compared with 589 bps in the fourth quarter and 469 bps one year ago.

Segment net revenues, which include those derived from title and settlement services and mortgage servicing, totaled $3.7 billion, up from $3.6 billion in the fourth quarter and $1.0 billion in the first quarter of 2020.

Meanwhile originations at what Rocket calls its Partner Network, which includes the wholesale channel, were $42.1 billion, compared with $38.8 billion in the prior quarter and $19.9 billion for the same period last year. While Rocket does not break out wholesale production, based on information it disclosed as the battle with

Gain on sale for this channel was 193 bps, well down from the 257 bps in the fourth quarter but higher compared with 79 bps on a year-over-year basis.

Net revenue for the partner channel of $722 million was down from $960 million in the fourth quarter but higher than the $235 million reported in the first quarter of 2020.

Based on what was a strong purchase business month in April, Rocket is predicting second quarter closed loan volume of between $82.5 billion and $87.5 billion and gain on sales margins between 265 bps and 295 bps.