One of most sizable wholesale lenders has begun accepting larger conforming loans at the anticipated 2024 limit, beating its biggest challengers to the punch

Rocket Pro TPO began offering the new loan limits Monday, ahead of the Federal Housing Finance Administration's expected move later this year. The wholesale arm of Rocket Cos. claims to be the first lender this year to raise the limits to give mortgage brokers and borrowers more leeway on

"You're going to lock, we're going to fund, Rocket is going to hold," said Mike Fawaz, executive vice president of the business. "We are estimating it'll be $750,000, and we're willing to take the risk on that."

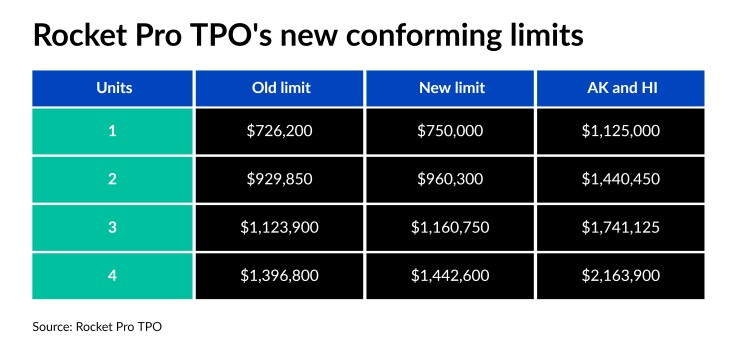

The company is setting the limit for a single family unit at $750,000, up from the FHFA's current $726,200 cutoff. The proposed 2024 limits reach new heights with a four-unit home loan in Alaska and Hawaii at $2,163,900.

The FHFA last year raised the conforming amounts at the end of November after several industry competitors raised their own loan threshold last September. Rocket in 2021 was the third major lender to raise its limits

Fawaz acknowledged Rocket's conforming limit could be higher or lower than the FHFA's eventual figure but said the lender is willing to risk any difference. The company didn't have any immediate data on how much volume the early loan limit move last year produced, Fawaz said, noting that brokers appreciated the leeway.

The industry is searching for more business at one of the worst times to buy a home in recent memory, with

The Detroit-based mortgage giant over the spring

Fawaz touted Rocket's rollout of One+ in July, which allows borrowers to put a 1% down payment toward a house alongside a 2% grant from the lender as a potential contributor to future gains. He also suggested Rocket Pro TPO will continue to grow as brokers industrywide

Rocket's announcement raises questions about whether United Wholesale Mortgage, its rival for the top originator title, will act next. UWM last year raised its own conforming limit

Fawaz, who has discussed the contention between the two firms in the past, did not discuss Rocket's chief competitor in this instance.

"It is time to provide, not a time to divide," said Fawaz.