Third party mortgage originators United Wholesale Mortgage and PennyMac are jumping the gun and raising their conforming loan limit ahead of the formal announcement by the Federal Housing Finance Agency.

The agency usually announces the new conforming loan limits by the end of November, based on a formula that accounts for home price movements. Changes in the conforming loan limits also affects

Given that

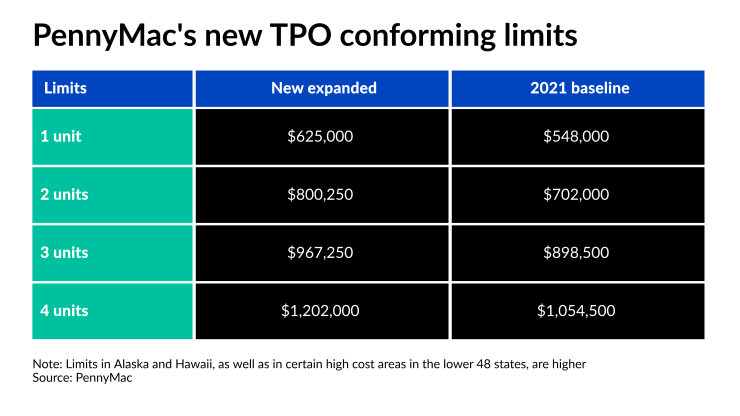

But both UWM and PennyMac raised their conforming limit effective immediately to $625,000 for most one unit properties. For Alaska and Hawaii, which have higher limits by law, the new ceiling is $937,500.

The

For certain high cost counties around the nation, PennyMac's broker channel will go as high as $822,375, a spreadsheet from the company shows.

"With the recent run-up in home price appreciation affecting many markets throughout the country, we wanted to step in and provide support for borrowers," Kimberly Nichols, senior managing director of broker direct lending at PennyMac, said in a press release. "This will specifically help those trying to purchase a home or access equity in their property while rates are relatively low."

The higher conforming limit applies to PennyMac's correspondent channel as well.

It is unclear whether other correspondent and wholesale lenders will follow in PennyMac and UWM's footsteps; NMN reached out to several competitors and has not yet received a response.