While the overall foreclosure rate fell in the first quarter of 2021, the majority of states saw rising shares of zombie properties, according to Attom Data Solutions.

A total of 175,414 homes went into the foreclosure process in the opening quarter of 2021 and 6,677 of them, a 3.8% share, sit vacant, according to Attom Data Solutions’ Vacant Property and Zombie Foreclosure Report. That fell from 200,065 and 7,612 units

Overall, zombie foreclosures — empty homes that are in the foreclosure process — represent one in every 14,825 U.S. residential properties, a widening ratio from 13,074 quarterly and 11,405 annually.

However, the rates of zombie foreclosures jumped from the fourth quarter in 29 states. Kansas had the most growth, increasing 4.4 percentage points to 20.7% from 16.3%. Arkansas came next, going to 6.6% from 3.1%, then Minnesota rising to 7.1% from 4.7%.

The dwindling zombie foreclosure numbers stand in contrast with the Great Recession when abandoned properties dotted many communities, according to Todd Teta, chief product officer with Attom Data Solutions. While zombie foreclosures dwindle and don’t currently pose an issue, it could turn into one depending on the economy

“The trend does remain on thin ice because foreclosures are temporarily on hold, and the market is still at risk of another wave of zombie properties when the moratorium is lifted,” Teta said in the report.

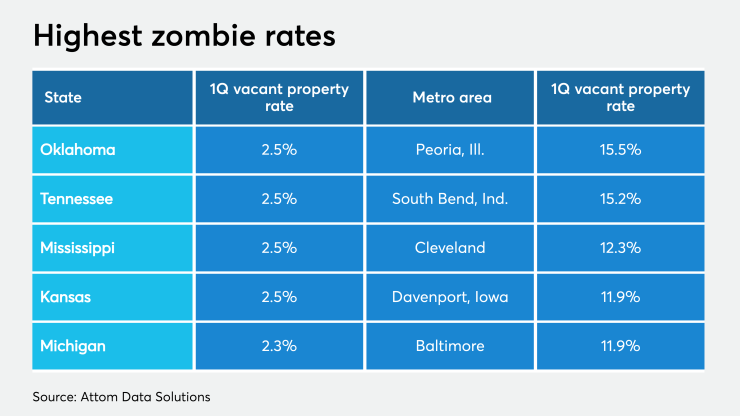

Oklahoma, Tennessee, Mississippi and Kansas all tied with the highest first quarter vacancy rate at 2.5%. At the metro level with populations of at least 100,000, Peoria, Ill., had the highest rate at 15.5%, followed by South Bend, Ind., at 15.2% and Cleveland at 12.3%.

Turning over the vacated housing stock could be one way to help ease

“If there’s an abandoned property, we need to get it back in the marketplace both for the good of the neighborhood and the supply shortages,”

Of the nearly 99 million homes in the U.S., 1.45 million sit vacant, totaling a 1.5%, share of single-family homes and condos.