A tightening job market and relatively low interest rates along with the inventory shortage means there is a small probability that home prices will decline in the next two years.

However, the nation is not headed towards another housing bubble, a report from Arch Mortgage Insurance Co. said.

"People waiting for home prices to fall before buying may want to change their strategy, as the overall housing market is expected to stay strong for the foreseeable future," Ralph DeFranco, the global chief economist, mortgage services of Arch Capital Services Inc., said in a press release. "Our research shows no housing bubble is forming in the United States, with prices overall near historic norms compared to incomes."

Home prices are 10% below their peak during the housing boom when adjusted for the current purchasing power of the dollar.

Meanwhile, over the next two years, the probability of home price declines in the nation's 401 largest cities averaged just 4%, which is an unusually low number, Arch said.

Looking at historical values is only a starting point for making comparisons on whether the market is overvalued, Arch's Fall 2017 Housing and Mortgage Market Review said.

Denver and Dallas, cited as two hot markets, became more diversified in type of employment over the past 20 years, so they are getting people moving in from higher-cost areas such as California.

"Thus, higher values relative to the past don't automatically imply a crash is coming, but it does suggest that if a large economic shock occurs, it could result in larger price declines," the Arch report said. "In short, the current strength in these hot markets appears to be due to broad-based economic growth and not a bubble."

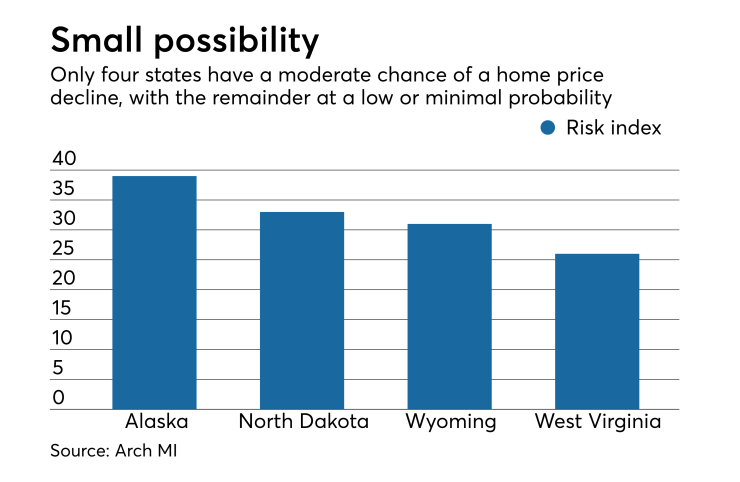

There are four states at moderate risk — the highest level found among all 50 states and the District of Columbia in the report — of price declines: Alaska, North Dakota, Wyoming and West Virginia. There are three others at low risk: Oklahoma, Louisiana and New Mexico. All other states are considered to have a minimal risk of price declines.