The South and Midwest are more affordable for first-time homebuyers because of less competition for listings and lower prices, according to Zillow.

"As millennials reach the typical home buying age, they are coming into a tough housing market with low inventory and lots of competition," said Zillow Chief Economist Svenja Gudell in a press release.

"These markets have more favorable conditions for first-time buyers to become homeowners. More challenging metros aren't out of reach for new buyers, but they should be prepared to face a more competitive buying environment," Gudell said.

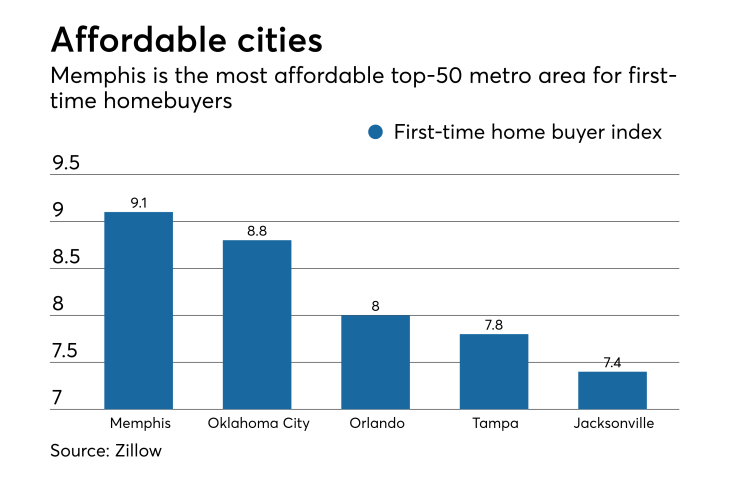

Zillow ranked metro area affordability for first-time buyers based on five criteria: a lower median home value, a strong forecast for price growth, a high inventory-to-household ratio, the length of time to breakeven and the share of for sale listings with price cuts.

Each of these five metrics were individually scored from zero to 10 and then averaged and rescaled.

Among the 50 largest metro areas, the highest score was for Memphis, at 9.1, with Oklahoma City at 8.8, Orlando at 8.0, Tampa at 7.8 and Jacksonville at 7.4.

The Bay Area markets of San Francisco (with a first-time homebuyer index score of 0.0) and San Jose (0.1), along with Los Angeles (0.2) and San Diego (0.2), were the least affordable for first time buyers.

A 5% down payment in the Bay Area is larger than a 20% down payment in most of the best markets for first-time buyers, Zillow pointed out.