Homeowners who want to tap their hard-to-access nest eggs have a new option.

A fintech startup called Point is allowing consumers sell a piece of their home equity to investors, rather than borrowing against the value of their houses. The Palo Alto, Calif., firm, which is currently operating in California and Washington state, announced Tuesday that it has raised $8.4 million in a second round of fundraising.

Point is touting its product as a way for households that cannot qualify for a home equity loan — a product that has become harder to obtain in recent years — to tap into their equity. Customers can use the funds, anywhere from $40,000 to $250,000, to remodel their homes, pay off debt or buy other properties.

The firm evaluates applicants based on an analysis of both homeowner and the property, under the theory that homeowners have some influence over the future trajectory of their property values.

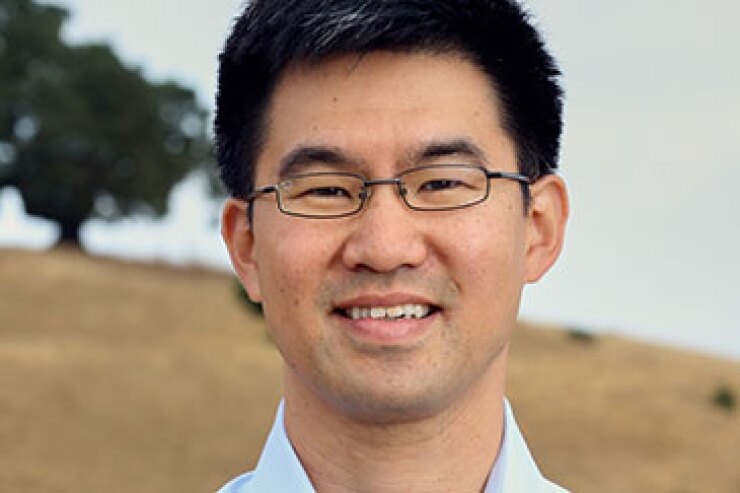

In an interview, Chief Executive Officer Eddie Lim said that Point is looking for homeowners who have at least 30% to 35% equity in their properties. That equity gets purchased by accredited investors — including both individuals and institutions — that invest their money through the firm's platform.

One of the company's main selling points is that homeowners receive a lump-sum payment upfront, and they do not have to repay a loan. "It's really this alternative to debt with no monthly payments," Lim said.

But the deal also carries some significant downsides for homeowners.

First, the home equity is sold to investors at a markdown of 10% to 20% from the appraised value. And second, Point's contracts have a 10-year term, which means that homeowners will typically have to sell or refinance their properties within that timeframe.

Point received its initial seed funding in January 2015. The company's latest fundraising found was led by the venture-capital firm Andreessen Horowitz. Former Citigroup Chief Executive Vikram Pandit is an angel investor in the firm.

Point plans to use the new funds in part to expand into additional states and to bolster its marketing efforts, the company said in a press release.