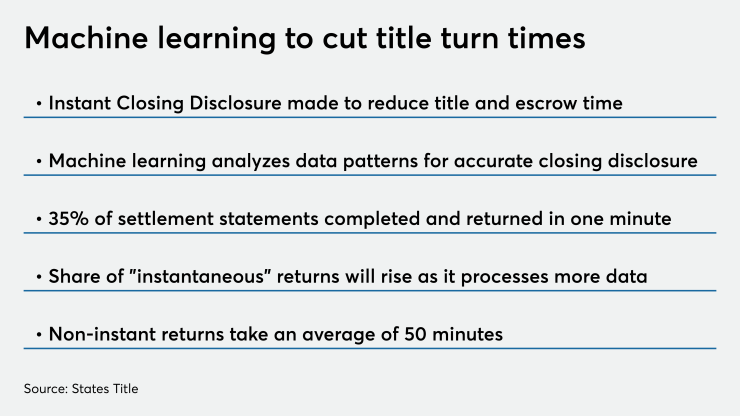

States Title recently announced the launch of its software tool, Instant Closing Disclosure, an automation tool designed to cut time spent collecting title and escrow data.

The product's machine learning capabilities analyze the patterns and trends from algorithms to generate accurate and nearly immediate closing disclosures, according to Kelsey Flittner, VP of brand and communications at States Title.

Completed settlement statements are currently returned in one minute about 35% of the time, but that share should grow as the machine learning gets smarter by processing more data, Flittner said.

"For those that cannot be instantly returned (where the algorithm has identified an area where human expertise is needed), settlement statements are returned within an average of about 50 minutes, which is about 40% faster than the 'old fashioned' turnaround time," Flittner said in a statement to NMN. "Reducing title and escrow time on our side helps us ultimately lower costs for our lenders and the end consumer."

States Title's new tool was developed in response to requests from its partner,

One of the

Many entities, like Freddie Mac, have

"Brick-and-mortar shops, whether it be lenders, title agents, homeowner insurance agents or appraisers … all those constituents are fundamentally struggling with the ability to do business," Vishal Garg, founder and CEO of Better.com,

While refinancing booms in the current mortgage rate landscape, title companies