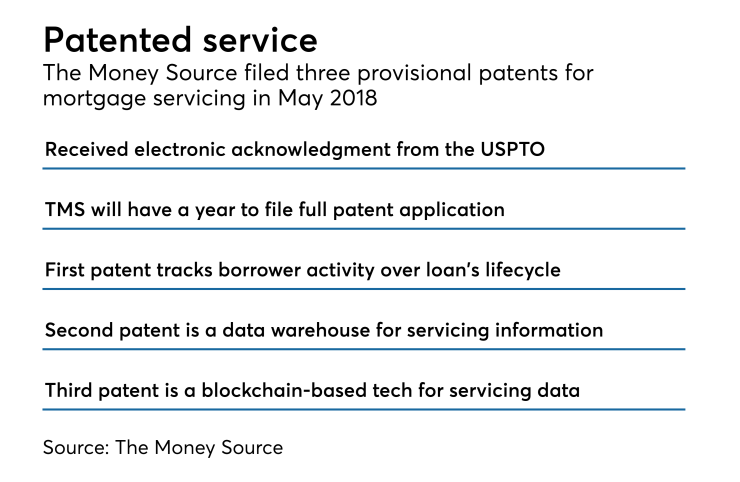

The Money Source has filed three provisional patent applications as part of its efforts to develop new innovations in mortgage servicing, including the use of blockchain technology.

The Melville, N.Y.-based servicer and correspondent aggregator filed the three provisional patent applications with the U.S. Patent and Trademark Office in May 2018. Provisional patent applications are not reviewed or approved by the USPTO. However, they're generally the precursor to an inventor filing a full patent application that gets reviewed for the potential awarding of patent protection. Inventors have a year after filing a provisional patent to submit a full patent application, during which they can claim their invention is "patent pending."

All three concepts leverage the company's internally developed platform, Servicing Intelligence Made Easy, an interface that integrates with its system of record to manage various servicing workflow tasks.

The first — entitled "how to make loan servicing – servicing as a service" — tracks borrower activities over the life of a loan. It provides analytics around borrower payment behavior and uses that data to better assess loan performance.

The second, called "data access layer – an automated, object model persistence and caching system," is similar to a warehouse developed to manage loan servicing data. The third, "blockchain – servicing connection," is a crypto-based technology for servicing data.

"This is a giant and exciting step forward for servicing technology," Ali Vafai, president of The Money Source, said in a press release. "We're proud to be pioneering these ground-breaking advancements that enhance how servicing data is being used across the country, tapping into the wealth of data that is out there to better benefit consumers and equip lenders."

Blockchain technology has permeated the mortgage industry over the past handful of years. The cryptography has been linked to everything from