The mortgage industry has a data problem. Diverse systems and a deluge of new data sources make management and accuracy difficult throughout the mortgage space.

And after a year rife with data breaches, cybersecurity is a top concern, even as lenders and servicers lean on new technologies to create a more seamless and savvy borrower experience.

Often misunderstood because of its connection to bitcoin, blockchain technology facilitates cryptocurrency transactions, but stands separate from the digital currency itself.

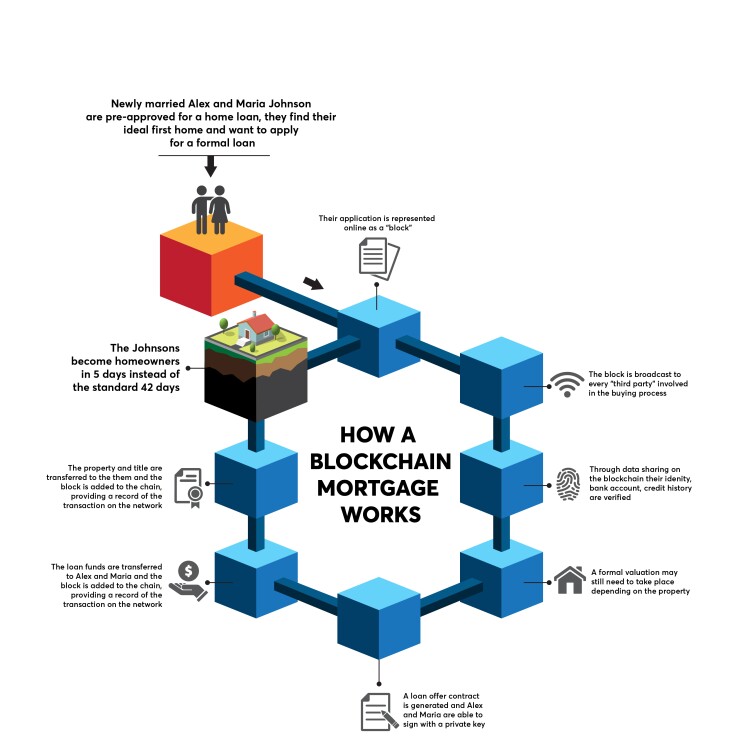

A blockchain is a decentralized record-keeping platform, or ledger, that is incorruptible, enforces transparency and promotes data integrity. The tool uses a growing list, called blocks, and links and secures them together through cryptography. Transactions on a blockchain ledger are also time-stamped and recorded.

"It's important to understand that it's not just a technology — it is an enabler. It is an approach to a way to free ourselves and be able to do things that we can't do in a traditional sense when you're using it the right way," said Brian Martin, director of technology at Sapient Global Markets.

The mortgage industry may be an ideal candidate for blockchain technology. It is a functionally driven space requiring information to flow down a river of parties. Having all loan documents on a blockchain will help deliver information more quickly and directly, simplifying the distribution of data and requiring less support from intermediaries. This also means leaving less room for error when data switches hands.

There are several potential use cases for blockchain technology across all sectors of the mortgage industry. In origination, lenders will already have borrower information from their lead generation process, eliminating the need to recollect it. In the secondary market, a nationwide blockchain of land records could replace the disparate collage of county records and render the Mortgage Electronic Registration System obsolete. And

Whether a blockchain is managing bitcoin or mortgages, transactions are more transparent because all changes are recorded in the same place and can be easily tracked. What's more, blockchains are designed to adhere to a set of rules, easing the stress of compliance during a time of regulatory uncertainty for the mortgage industry.

But none of this will happen overnight and many hurdles remain. As of now, blockchains can be slow moving, and wouldn't prove efficient in handling larger-scale transactions. Lack of understanding from the industry also causes hesitance. And while some industry players are actively embracing blockchain technology, a consortium-based approach is required to realize the full potential.

At its core, mortgage lending is all about data, which creates immense potential for blockchains.

"From a data perspective, it is the grand consistency of a distributed ledger that makes blockchain so attractive in the mortgage space," said Martin.

"From a user, usability, functional, capability perspective, there's an even bigger side to this — much of the actions and reactions and monitoring and execution of the mortgage life cycle is simply 'if X then Y,'" he added.

Blockchain technology can support a number of core data issues plaguing the mortgage industry, including data integrity, security, distribution and compliance.

During the mortgage process, documents need to circulate to myriad parties, putting the accuracy of the information at risk. Since every file on a blockchain is an original, there's much less room for error when files change hands. Any amendments are timestamped and recorded, presenting all history of a document on the blockchain.

In addition to ensuring information is valid, blockchain tech helps ensure that data is secure. This is especially important after an eventful year for

"It's important to understand that it's not just a technology — it is an enabler."

— Brian Martin, director of technology, Sapient Global Markets

"It's a decentralized ledger, which means that everything on that blockchain is not in one server. It's across a variety of servers; they call them nodes. It's across the world or a vast geographic area, and because of that, it makes it harder for a cyberhack because you need a majority of those decentralized computer nodes to be hacked," explained Debbie Hoffman, CEO and co-founder of Symmetry Blockchain Advisors.

In essence, one breach wouldn't compromise the security of information on a blockchain, as it would require at least 51% of computer nodes to be hacked in order for information to be jeopardized.

During a climate of

A blockchain ledger shows records of all transactions, ensures an audit trail without needing to duplicate any steps, can be used as proof of transfer and serves as a record of all actions taken, said Hoffman.

"When you put something on a blockchain, it's immutable," she said. "So if you have an auditor come in and look at it, first of all, they know it hasn't been tampered with, they know that what they're looking at is the original. Number two is, there's less work on the front end of having to get ready for a regulator or an auditor, because it's already there."

Blockchain's ability to embed rules within a blockchain also ensures steps taken during a mortgage process abide by regulatory rules.

The benefits of blockchain technology can be reaped across the origination, secondary market and servicing sectors.

"There's no question that blockchain could be used right at the beginning of the stage at lead generation, which would really mean either identifying borrowers or identifying homes," Hoffman said.

Lenders collect data even before a loan application is completed. A blockchain can preserve that information upfront for reference throughout the loan life cycle. Similarly, a blockchain could be used in a multiple listing service to track records of property details and how often a home is bought and sold.

Underwriters can also experience a simpler process. Underwriters are decision makers, but their duties to assess risk are often decelerated by verification processes and the need to establish all information is accurate. Blockchain technology can also help hasten document authentication and eliminate the need to double-check data since all the original files are on the blockchain.

"Blockchain would totally change the way that companies like Fannie Mae and Freddie Mac would manage underwriting," Martin said. "Not the underwriting process — but the technology to drive underwriting."

"It might change some of the process from the technical perspective and the execution perspective, but it won't change the idea that underwriting is about assessing risk. What it will absolutely change is the visibility into data, the consistency of data, and the way that risk can be assessed," he continued.