Lower mortgage loan origination volume in 2018, on top of 2017's decline, will lead to further reduction in title insurer profitability and a possible increase of merger activity.

Still the outlook for the industry is stable because of seven years of strong net income that allowed underwriters to increase their statutory surplus, a report from Kroll Bond Rating Agency said. This will make "a few quarters" of lower mortgage originations manageable.

Of the 47 title insurance underwriters that have over $2 million of statutory surplus (a measure of financial reserves), over 90% should report positive earnings for 2017. Over three-quarters of those firms will have an increase in their surplus.

However, KBRA projects an industry-wide decline in net income of between 12% and 17% for 2017, to between $750 million and $800 million. Title insurance revenue is highly correlated to mortgage origination activity, and loan production is expected to decline by 12.3% in 2017 from the previous year, according to the Mortgage Bankers Association.

For 2018, the MBA projects

There has been a lack of M&A activity among title underwriters, with most of the recent interest being in agency consolidation and underwriters purchasing agencies. But that could change with lower volume and profitability.

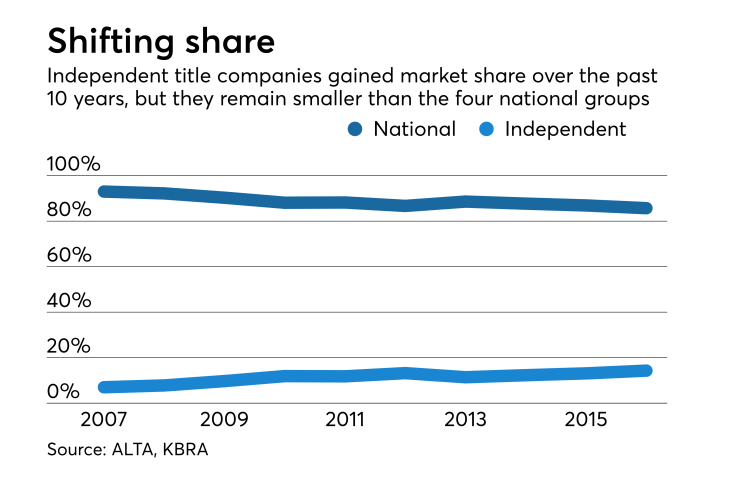

"KBRA notes many of the top independent title underwriters have been adding market share in recent years, and believes M&A could be the means to accelerate market share growth," the report said.

Moreover, the nation's fourth largest title underwriter, Stewart Information Services Corp., is in play, following the announcement with its third-quarter earnings that it is considering strategic alternatives, including merger or sale.

But a merger or sale within the title industry could be difficult given Stewart's size, KBRA said. Currently 85% of the title insurance market share is controlled by four companies: Fidelity National Financial, First American Financial, Old Republic International and Stewart.

"KBRA thinks that regulators would likely have a concern if one of the three larger groups acquire Stewart, having 85% of the market share lie within three groups," the report said.

On the other hand, because it is much larger than any of the independent underwriters, Stewart being acquired by one of them is also unlikely. Still, the market share of the independent underwriters has more than doubled to 14.3% at the end of 2016 from 7% in 2007.

Stewart could consider merging its two title underwriting subsidiaries, one domiciled in Texas — which has one of the most conservative statutory premium reserve requirements — and the other in New York. Moving the merged operation to New York or elsewhere could free up statutory reserves and allow for an increase in policies underwritten, the ratings agency said.

Title underwriters will also benefit in the future from an increase in e-closings, e-mortgages and the use of other related technology such as blockchain, which should reduce the costs associated with a less paper-intensive process, KBRA said.