Delinquency rates on consumer loans last month hit their highest level since the spring of 2020, a potential sign that inflation and rising interest rates are taking a toll on household finances.

Banks are keeping a close watch on delinquency rates, spending trends and credit originations to determine the health of the most powerful driver of the U.S. economy. Consumer spending accounts for about 70% of the country's economic output, and banks and other businesses are eager to find out

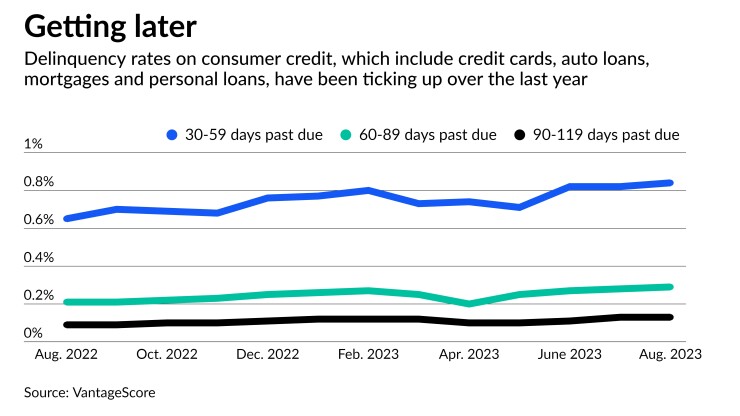

The share of consumer loans between 30 and 59 days past due rose 0.84% in August, up from 0.65% in August 2022, according to data from VantageScore. About 0.29% of loans were between 60 and 89 days past due in August, up from 0.21% a year ago. And 0.13% of consumer loans were between 90 and 119 days past due, up from 0.09% the previous year.

The delinquency rate for each of the three past-due timeframes was higher in August than any month since April 2020.

"People are relying on their credit more and in some cases are having trouble meeting their obligations," said Jeff Richardson, senior vice president at VantageScore Solutions, the consumer credit scoring company behind VantageScore.

The combination of inflation and rising interest rates over the past 18 months has made it more difficult for Americans to stay on top of their loan payments. When the costs of goods and services rise, consumers often face higher monthly debt payments, and they may have to choose between necessities and debt payments.

Credit cards and auto loans saw the largest jump in delinquency rates between August 2022 and August 2023, according to the VantageScore data. Because the interest rate paid on cards is tied to short-term interest rates, those monthly payments can rise more quickly than consumers had anticipated.

"Your monthly obligation, because of the rate increases, is much harder to meet now than it was 13 or 15 months ago," Richardson said.

Still, consumers as a whole are proving resilient, according to bank executives.

Consumer spending will likely help the U.S. avoid a recession in 2024,

Credit card utilization increased just 0.1% between July and August, according to VantageScore data, a potential indicator that consumers are wary about the prospect of taking on more debt. Originations for personal loans, auto loans and mortgages also fell in August, thanks to lenders' tighter standards and slowing demand growth for consumer loans. Only credit card originations increased in August.

Economic growth is expected to slow to 1.3% in 2024, down from 2.3% in 2023, according to a forecast released Wednesday by S&P Global. Lower consumer spending on nonessential items is expected to drive much of that decline, analysts said.

"The increase in subprime auto loan and credit card delinquencies suggests consumer discretionary spending will soon weaken," S&P analysts wrote. "Moreover, student loan payments restart next month at a time when excess household savings have been largely depleted."

Pandemic-era payment pauses and grace periods helped keep past-due rates on consumer loans low during the pandemic. Many U.S. consumers used stimulus funds and unemployment payments to stay up-to-date on debt payments and add to their savings accounts.

But much of those excess savings have since been spent, and consumers drove their credit card balances up by double-digit percentages in 2022. The high rate of spending continued for much of 2023 before slowing in recent months.

For banks, that means

Consumers are set to further "tighten their purse strings" in 2024, S&P analysts wrote.