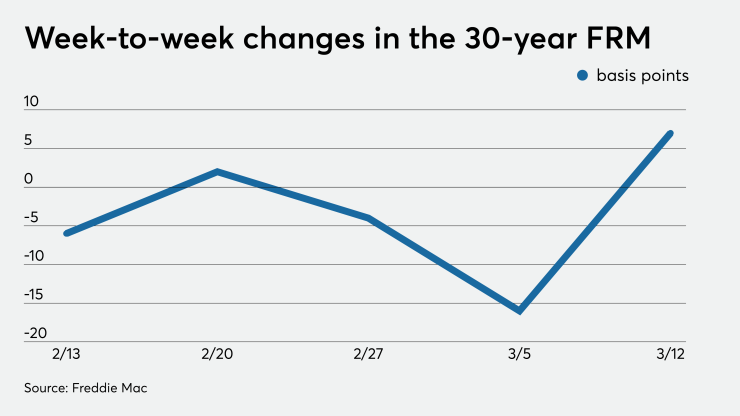

Not so long after Treasury bond yields experienced an unprecedented drop, the average 30-year mortgage rate rose, reflecting volatility related to the coronavirus as well as capacity issues on multiple levels.

The average weekly 30-year mortgage rate increased 7 basis points

“Some lenders are locking in record-low rates and some are raising their rates. As of today I saw rates were a little bit higher, but there were still people being locked in at record lows near 2.75%. I believe that there are still opportunities out there,” said Eric Fontanot, president of Texas-based Patten Title.

Some lenders raised rates because they can't handle the business coming through the door in response to the initial rate drop and priced defensively.

Capacity has been an issue in the secondary market as well.

“Bid/ask spreads have…started to widen, as dealers struggle managing the deluge of new origination and market volatility,” according to Mortgage Capital Trading’s daily market report on mortgage-backed securities.

The MBS market has not experienced this kind of volatility several years, according to Walt Schmidt, vice president, mortgage strategies, at FHN Financial.

“The spike in mortgage spreads over the past week has only had two historical precedents: a couple incidents in 2008 and another in 3Q2010,” he said in an email. “Even the whipsaw of QE/taper tantrum in 2012/2013 didn’t have the same result in MBS [option-adjusted spread] to such a magnitude over such as short period of time as what we have seen during the past week.”

Newly-created securitized MBS loan pools with record-low coupons experienced wide bid-ask spreads during the week. Additionally, there’s not much pay-up for higher-coupon MBS because their susceptibility to refinancing and prepayments diminishes their value, according to Emanuel Santa-Donato, director, capital markets at online mortgage lender Better.com.

“The market is really volatile,” he said.

In the primary market, capacity concerns may occur on more than one level. Not only are lenders concerned about the strain on their internal operations, but they also might have to address the limits of the credit lines they get from banks and other providers, and uncertainty related to whether those limits can be raised.

Lenders with more digital operations and strong sources of funding could hold an advantage in this market by being somewhat more scalable and to absorb more demand from repeat borrowers comfortable enough to submit applications with minimal loan officer interaction.

While borrowers prefer loan-officer guidance in many circumstances — particularly if they are first-time homebuyers — they may become more open to digital processing given the current levels of extraordinary demand if pricing or other factors are compelling enough for them to act now.

“People are looking for many different options and we provide all of them, but the value of the digital option gets a lot higher when the demand is incredible,” Santa-Donato said.