A Department of Veterans Affairs change effective this year could help more borrowers with military backgrounds get financing in regions with higher home prices than the average one-unit conforming loan limit.

The VA previously would guarantee 25% of the mortgage balance up to the conforming limit for most loans. If borrowers took out larger VA loans with less than 25% guaranteed in the past, they generally would have to make up the difference with a down payment. With the change made Jan. 1 in place, the VA guarantees 25% of the loan with no limit for most first-time borrowers with a full VA entitlement. Service members or veterans with partial entitlements due to defaults or outstanding loans generally are still subject to previous limits.

"This has some significant impacts for high-cost areas," said Chris Birk, director of education at Veterans United Home Loans. "We definitely did have some veterans who decided to wait to close after the first of the year because of it."

The change stems from the final version of the

Fees this year are 2.3% of the loan balance for first-time benefits use and to 3.6% for subsequent uses in most cases. Last year, members and veterans of the U.S. military paid a 2.15% fee for first-time use of their benefits and 3.3% for subsequent uses. Higher fees were imposed on loans taken out by members of the National Guard and reserves. The new fees being charged do not make that distinction.

The removal of the required down payment in high-cost areas for some borrowers could reduce the upfront cash payment for a loan enough to be compelling, even with the fee increase in place.

"The rise isn't that big and the VA program is pretty accommodative in allowing you to finance those fees into the loan balance," said Michael Dubeck, CEO and president of Planet Financial Group.

But the no-down-payment option won't make sense in all circumstances, and borrowers will probably make "case by case" decisions about whether to use it, he said.

"You can lower your costs by paying more of a down payment, but I think it will be well-received," said Dubeck. "We have a branch in San Diego, for example, and there's plenty of interest this year. Is it going to raise our lending volume by 10%? Absolutely not. But does it create optionality for borrowers that deserve it? Absolutely."

The change could have the most impact in a high-cost real estate market where military personnel tend to be concentrated, like San Diego, and borrowers there are showing an interest in the new VA loan option, said Beau Hodson, owner and senior mortgage originator at local loan broker Transparent Mortgage.

"We just got a pre-approval for a client at $730,000 for a jumbo VA loan with zero down, so it seems this product does open up the financing for veterans to get zero down at higher price points," said Hodson. "Rates are down so that helps to absorb the funding fee increase. The changes to the limit have generated a little bit of interest, which I wasn’t sure they would. Sometimes new options are really effective on the street, and sometimes they aren’t. I do think one or two people contacted me about this after I wrote

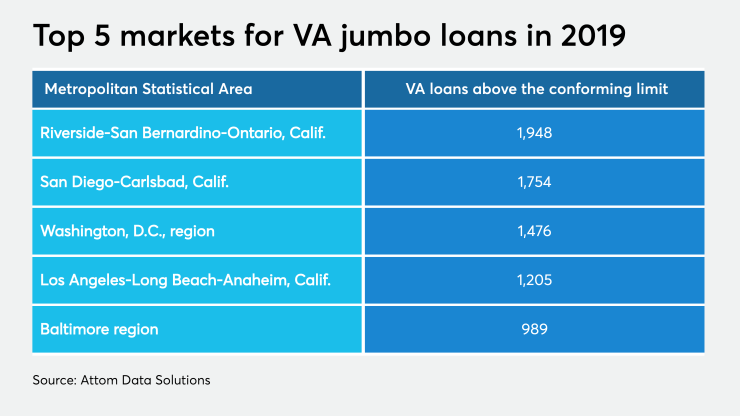

Southern California produced the two metropolitan statistical areas with the most VA loans originated above conforming limits in 2019, according to Attom Data Solutions.

The top five areas for VA jumbo loans last year were Riverside-San Bernardino-Ontario, Calif., with 1,948 loans; San Diego-Carlsbad, Calif., with 1,754 loans; the Washington, D.C., area, with 1,476 loans; Los Angeles-Long Beach-Anaheim, Calif., with 1,205 loans; and the Baltimore area, with 989 loans.

As much as 3% of loans in the VA market overall or 6% of VA loans in high-cost markets exceeded the limit for a loan with no down payment in 2017, according to a recent Harvard Joint Center for Housing Studies.

In addition, 9% of loans were taken out at prices just shy of the limit. This suggests veterans that may have been interested in getting higher-priced homes in the past didn't because of the limit to what the VA will guarantee, said Birk.