Want unlimited access to top ideas and insights?

It's a critical time in Washington, with many key institutions in the mortgage and housing industries getting new leaders. At the Mortgage Bankers Association, which itself

Along with the MBA, the

"There's a lot of changing of the guard happening in Washington, D.C. We're likely going to have a change with the House in terms of the majority, which means we'll have a new speaker, which will mean we'll have a new head of Banking or Finance," Congressional committees, said Christopher George, the incoming chairman of the Mortgage Bankers Association.

With Mel Watt's term as FHFA director ending in January, it is imperative for his replacement to

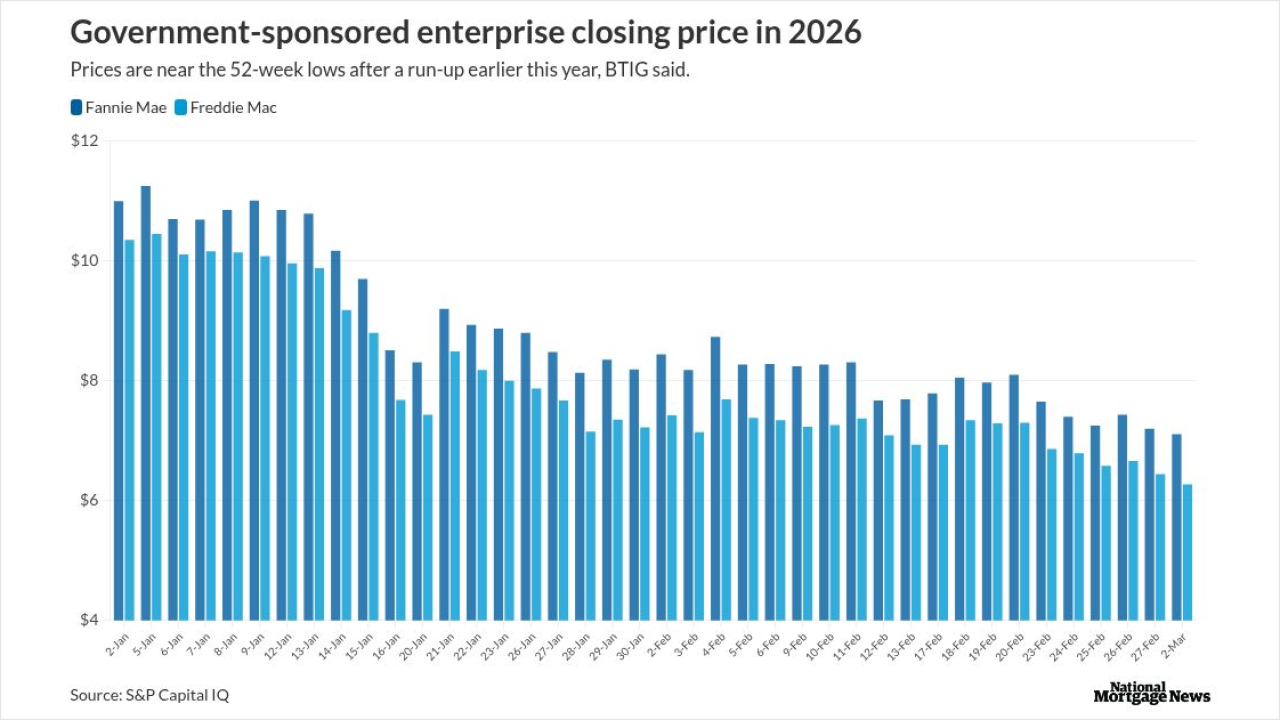

"I don't want to lose momentum on those key issues that are important to our membership — one being GSE reform or some form of protection of the important components of the mission of Fannie Mae and Freddie Mac. I think preservation on the 30-year fixed rate mortgage is critically important," said George, the founder and CEO of CMG Financial in San Ramon, Calif., told National Mortgage News.

George's other tent pole priorities for his time as MBA chairman include diversity and innovation. In addition to serving on the board of directors since 2012, he's also the 2018 chairman of the MBA's Diversity and Inclusion Committee. He wants to make sure industry inclusiveness happens internally and externally.

"We need to continue to become more diverse and inclusive, and not just within four walls of the offices we all occupy," said George. "While it is fantastic that as an industry we are embracing diversity, that should relate better serving a more diverse customer base and to a variety of different ways we can help folks become and maintain sustainable homeownership."

Much of the overhaul in the industry over the past 10 years has been focused on backward-looking issues and implementing reforms that ensures the problems that caused the last housing crisis do not resurface. Now, George wants to start focusing on the future of what the mortgage industry is going to look like and how the emerging homeowner will get served. Innovations are critical to making mortgage process smoother and the way it operates.

"In my experience after doing this for 36 years, there is a handwringing throughout the entire mortgage purchasing process…even loan officers will comment how anxiety-ridden it is," George said. "Innovation is helping that process. You're getting much more predictability on whether or not you're qualified, how much you can qualify for and how you will come up with your down payment. Whether you're a first-time or last-time homebuyer."

To fix the forward-facing issues of the industry, George knows it'll take more than just the MBA. While chairing the association gives him a cadre of experts to lean on, collaborating with real estate agents, builders, community bankers, credit unions and other organizations creates a louder, unified voice for addressing concerns.

"We're coming together as a true industry and tackling problems that sometimes get caught in the gummed-up wheelworks that exist in Washington," George said.

George is being sworn in as the MBA's 2019 chairman Sunday during the opening of this year's

George's plan of attack isn't new. The chairman he's succeeding, David Motley, worked across different groups in his time at the helm. Motley's biggest issue was

"I think we impressed upon the CFPB about the importance of advanced guidance and they're taking steps to do that. There's been legislation put forth that would require that, which is certainly a good thing," Motley said in an interview with NMN. "With the new administration at the CFPB, there's been more of a willingness to listen to concerns of lenders, who are just trying to satisfy consumers trying to get into a house. So we need to be working together along those lines a bit more and the current administration seems to be hearing that."

Of course, the elephant in the room with housing is the deficit in inventory. Motley met with the National Association of Home Builders, some state associations and local jurisdictions to try to raise housing supply as an issue. It was an effort to get people focused and thinking about eliminating some of the barriers holding back home construction.

"With rates on the way up, those people who refinanced or bought into the market at a 3.5% interest rate on a 30-year fixed, those folks don't want to leave. So there's less activity in the resale market," said Motley. "New home construction has been stuck now for 10 years. We have a significant shortage of housing supply and it's caused prices to go up at a faster rate than incomes have. Housing supply isn't something we solved but we were successful in raising awareness about the issue and it's on a lot of people's radar to a greater extent than before."