As housing demand continues to challenge low levels of supply, home prices rose 6.7% in July 2017 compared with one year prior, according to CoreLogic. In a month-over-month comparison, home prices rose 0.9% from

Of the nation's 100 largest metropolitan areas, 34% of cities have an overvalued housing stock as of July.

"Home prices in July continued to rise at a solid pace with no signs of slowing down," CoreLogic President and CEO Frank Martell said in a press release.

"The combination of steadily rising purchase demand along with very tight inventory of unsold homes should keep upward pressure on home prices for the remainder of this year," Martell continued. "While mortgage interest rates remain low, affordability cracks are emerging as over a third of U.S. top cities are now overvalued."

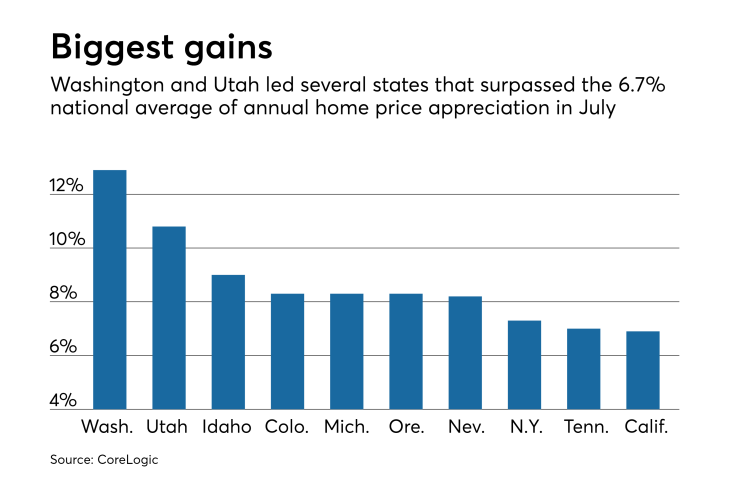

Home prices rose annually in 49 states and the District of Columbia. Washington and Utah showed the greatest appreciation of home prices from July of last year, with values up 12.9% and 10.8% respectively.

West Virginia was the only state whose home prices declined year over year, by 2.2%.

"In July, home price growth in the Pacific Northwest and mountain states led the nation with the highest appreciation rates," Frank Nothaft, CoreLogic's chief economist, said in the press release. "The sharp increase in prices in Washington and Utah has been especially striking, with home price growth in both states accelerating by 3 percentage points since the beginning of this year."

Home prices are projected to increase by 5% from July 2017 to July 2018, according to CoreLogic.