-

Ocwen Financial Corp. recorded a deeper quarterly loss of $40 million after acquiring PHH Corp., but still expects the deal's economies of scale to eventually lower costs and restore profitability.

November 6 -

Ocwen is putting plans in place to realize $100 million in savings using resources from its acquisition of PHH Corp., which has just closed.

October 4 -

A judge denied the settlement terms in a TCPA lawsuit against Ocwen Financial Corp. over concerns that the proposed $17.5 million payment was insufficient.

October 1 -

A former Ocwen Financial executive is settling Securities and Exchange Commission charges that he engaged in insider trading related to his company's dealings with Altisource Portfolio Solutions following a CFPB enforcement action and its upcoming merger with PHH Corp.

September 28 -

Ocwen Financial Corp. has gotten the go-ahead to acquire PHH Mortgage Corp., subject to revised New York restrictions on acquisitions of mortgage servicing rights, and other conditions imposed by the state.

September 28 -

The mortgage servicer plans to add PHH advance receivables to the collateral once the acquisition closes, though these will only account for around 6% of the total pool.

August 8 -

PHH Corp. remained above the adjusted net worth and cash requirements for the company's proposed acquisition by Ocwen to take place, even though it lost $35 million in the second quarter.

August 3 -

Ocwen Financial took nearly a $30 million net loss in the second quarter due to expenses ahead of its PHH Corp. acquisition that outpaced its mortgage servicing profits.

July 26 -

Ocwen Financial is able to keep the answers to questions from the Consumer Financial Protection Bureau involving the improper handling of escrow accounts confidential, a federal magistrate ruled.

June 26 -

Ocwen Financial Corp.'s Chief Financial Officer Michael Bourque has resigned, becoming the second top executive to leave the company after it agreed to acquire PHH Corp.

May 29 -

PHH Corp. took a net loss in the first quarter but was able to surpass minimums for net worth and available cash necessary for Ocwen Financial to acquire the company.

May 9 -

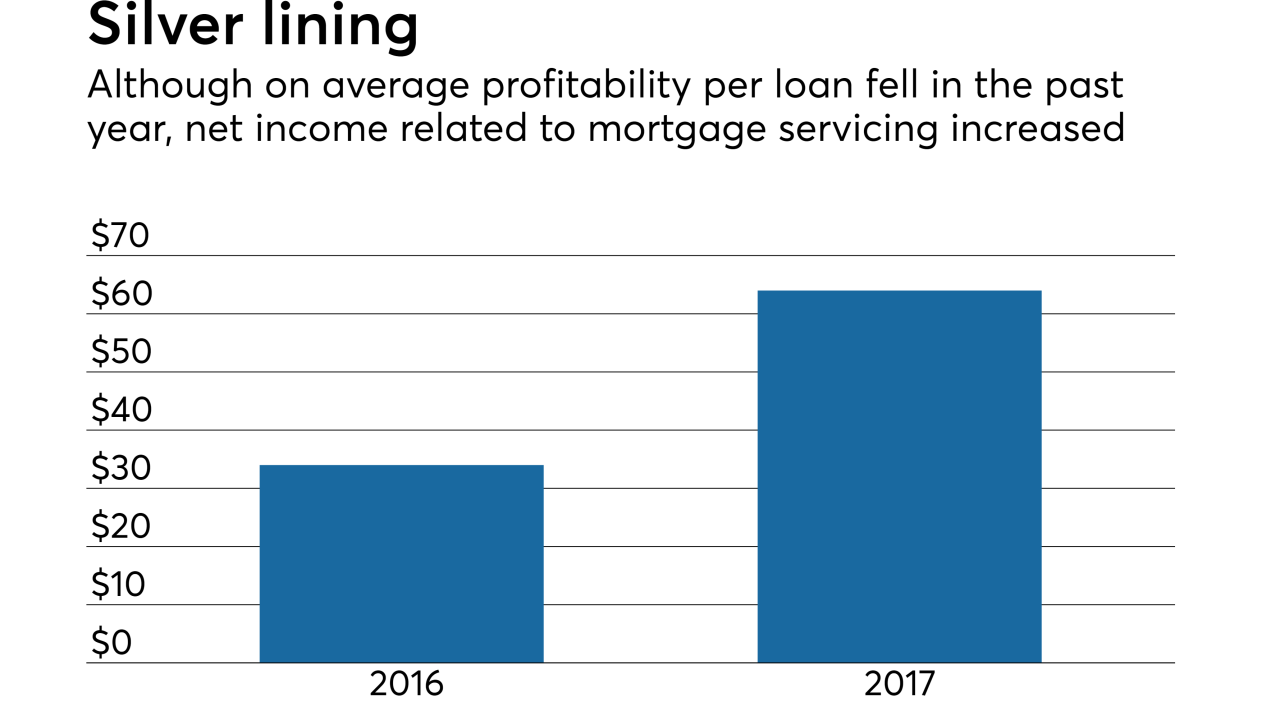

Mortgage servicers growing due to acquisitions or the increased value of servicing in the market could remain under pressure if these strategies don't outweigh other rising costs they face.

May 7 -

Ocwen Financial Corp. got back in the black during the first quarter after selling New Residential Investment Corp. $110 million in economic rights to mortgage servicing.

May 2 -

The Consumer Financial Protection Bureau has dropped an investigation into Altisource, a mortgage servicing technology firm with close ties to Ocwen Financial.

April 30 -

Ron Faris plans to retire as head of Ocwen Financial and pass on his position to former PHH Corp. CEO Glen Messina around the time Ocwen acquires PHH.

April 19 -

A new settlement with Massachusetts resolves all outstanding administrative actions against Ocwen Financial Corp. by a group of 30 states, but two states' legal actions against the servicer remain outstanding.

March 23 -

From investor angst to regulatory scrutiny, here's a look at three obstacles that must be addressed before Ocwen Financial can acquire PHH Mortgage.

March 1 -

The servicing business drove Nationstar Mortgage Holdings' fourth-quarter profitability and will be a major factor going forward after the company is acquired by WMIH.

March 1 -

Ocwen Financial Corp.'s acquisition of PHH Corp. will help the nonbank servicer rebuild scale that's been diminished by years of regulatory restrictions and the decline in distressed mortgage volume brought about by improvements in the overall housing market.

February 28 -

From accelerating its subservicing transformation to overcoming regulatory obstacles, here's a look at three reasons behind Ocwen Financial Corp.'s $360 million acquisition of PHH Corp.

February 27