Contrary to what you may have seen on TV, home flipping has become less speculative, more self-controlled and — at the risk of overusing a buzzword — more sustainable in the wake of the Great Recession.

This more sustainable approach to home flipping is also the responsible one that benefits not just real estate investors, but also the neighborhood, local economy and eventual resident of the home being flipped.

"We changed our approach to renovations in 2011 after seeing first-hand the negative effects that low-cost renovations and deferring maintenance can cause," said Chris Clothier, co-owner of Memphis Invest, a company that buys and rehabs properties that it sells as turnkey rentals to real estate investors.

"This approach has benefited our owners, the residents of the properties and even the surrounding homeowners who all benefit from a better looking and performing property."

Local business benefit

Case in point is a Memphis property that Clothier's company purchased at foreclosure auction in January 2018 for $37,000 — 47% below the property's full after-repair market value at the time of sale, according to an automated valuation model from Attom Data Solutions.

The company then spent $39,000 renovating the property, and not just on cosmetic items — they installed a new roof, new air conditioner and furnace and also made plumbing, HVAC and electrical repairs recommended by licensed contractors.

"Local business owners from locksmiths to yard companies as well as electricians, plumbers and laborers, all benefit from a commitment to raising the standards of work when renovating properties," noted Clothier.

Memphis Invest sold the property 123 days later in May 2018 for $99,000 — a 34% premium above its estimated market value of $74,000 at the time of sale based data from Attom. While that produced a solid net profit of $18,000 after an additional $5,000 in holding costs, it also benefited surrounding home values and general neighborhood quality, according to Clothier.

"By focusing on doing better work, using higher grade materials and addressing all deferred maintenance issues on a property, we are seeing longer occupancies and fewer maintenance items for owners, and the properties themselves are valued higher," he said.

Shift to value-add flipping

The fix-and-flip formula employed by Memphis Invest — buy distressed properties at a discount and perform high-quality renovations that justify reselling at a premium — is the rule, not the exception, among flippers operating in the post-recession market, according to an in-depth analysis of home flipping from 2002 to 2018 by real estate data firm

"We also find evidence that flippers are shifting away from price speculation and toward adding value to properties," writes study co-author Ralph McLaughlin in a

McLaughlin goes on to explain that the study used the company's public record data and models to identify how investors were making money during a flip: buying at a discount, selling at a premium or speculating on price appreciation. During the last housing boom of 2002 to 2007, investors were much more heavily relying on price appreciation to make profits. But that has shifted in recent years, with the average purchase discount hitting a new low of close to $50,000 in early 2018.

"This is yet more evidence that flipping today is less risky and less speculative than during the 2000s," McLaughlin writes.

More mom-and-pop flippers

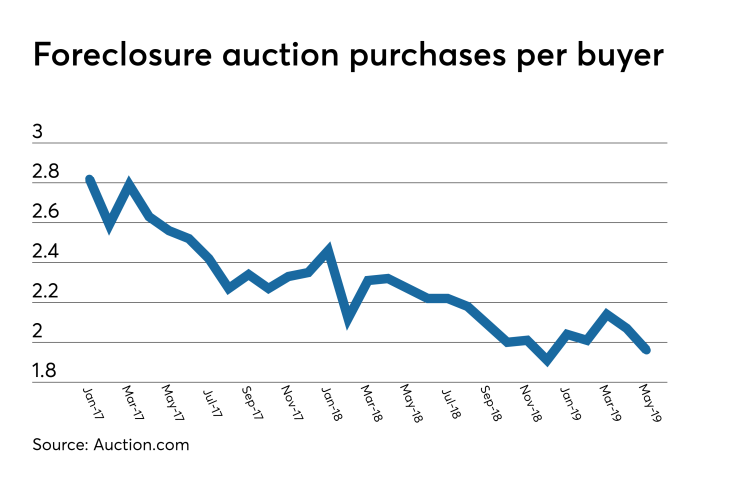

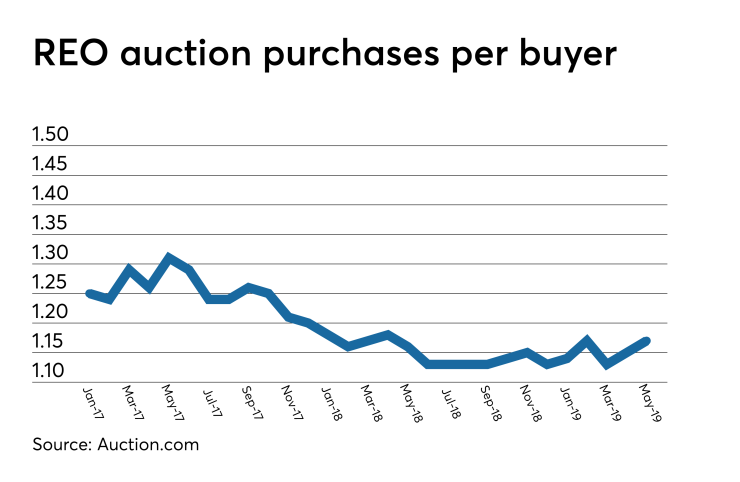

Proprietary data from the Auction.com marketplace shows that the average number of purchases per buyer on the platform has been trending down in the last two years, both for properties sold at foreclosure auction — typically on the courthouse steps — and for properties sold via bank-owned (REO) auction — typically online.

The majority of homes being flipped by foreclosure auction buyers are ending up in the hands of owner-occupants within a year. That’s according to an Auction.com analysis of more than 4,600 properties that were resold within 12 months after being purchased at foreclosure auction in the three months ending March 2018. The analysis, which utilized public record data from Collateral Analytics, shows that 68% of those homes were owner-occupied one year later.

Even for the roughly one-third of home flips that are held as rentals, the high-quality renovation approach that many home flippers are employing in today's tight market means that the tenants are more likely to be happy with the home, which in the long run is good for them, the neighborhood and the investor holding that property.

"It may be more attractive to hold down the initial costs by doing fewer renovations, but for every dollar saved on the front-end, there are multiple dollars spent on the back-end," said Clothier. "(With fewer renovations) residents tend to move out quicker and investors are saddled with repair costs and vacancies."

More homeowners and happy renters

Flip became a four-letter word in the fallout from the last housing crash, which has been blamed at least in part on speculative home flippers who added little value to homes, relying primarily on home price appreciation to fuel their profits.

But most home flippers in the post-crash market are operating on a much more sustainable business model: buy distressed properties at a discount and transform those properties into move-in ready homes through extensive renovation. This new-and-improved home flipping model is responsibly raising home values and stabilizing neighborhoods with increased homeownership and happy, long-term renters.