-

The agency is looking to clarify existing regulations around how these accounts are handled, based on questions it received.

June 4 -

Sen. Pat Toomey of Pennsylvania, the Banking Committee's top Republican, is talking up the prospects of a bipartisan deal to overhaul Fannie Mae and Freddie Mac. But Democratic leaders sound less motivated to change the status quo for the government-sponsored enterprises.

June 4 -

Net production income was down from its peak in the third quarter of last year, but it set a survey record for the period between January and March.

June 3 -

The departures of Bryan Schneider and Peggy Twohig come as the Biden administration's nominee to run the consumer bureau awaits Senate confirmation.

June 3 -

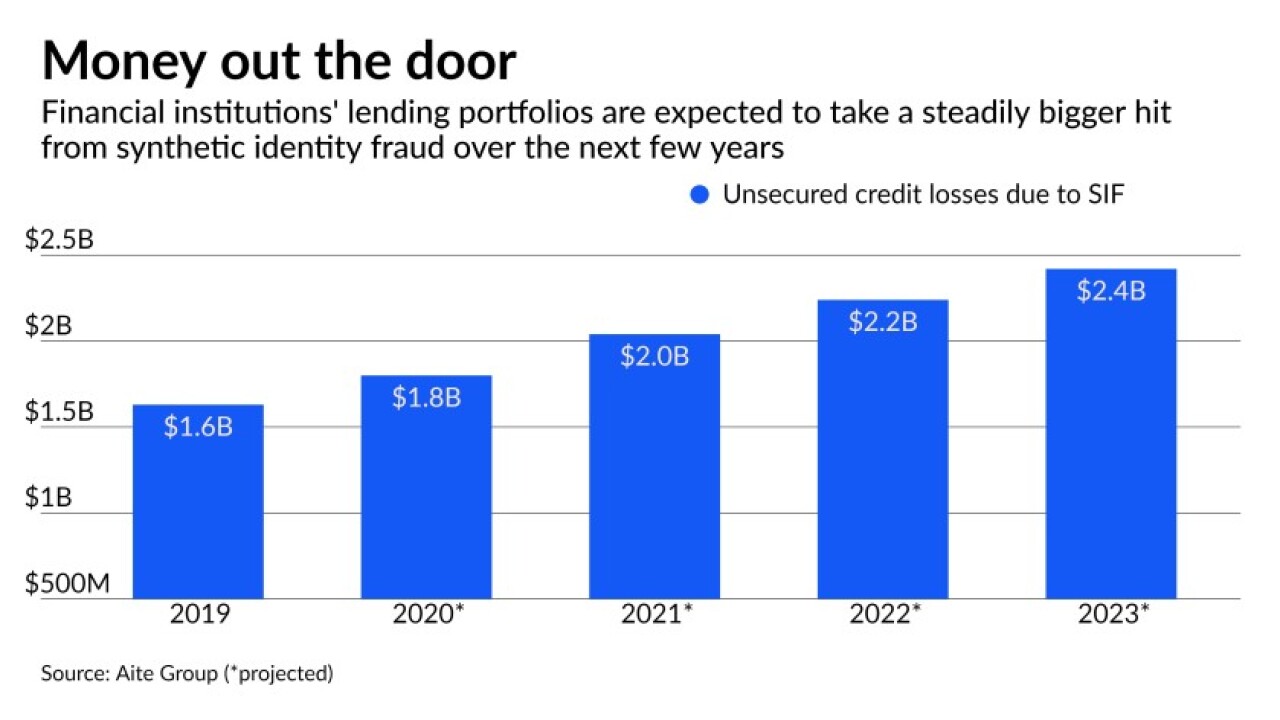

Scams in which a real person’s information is used to create fictitious businesses or individuals have led to $6 billion in credit losses. The Federal Reserve has developed a standard definition for synthetic identity fraud so lenders can distinguish it from traditional identity theft.

June 2 -

The MBA’s Market Composite Index decreased a seasonally adjusted 4% last week, dropping to a point not seen since February 2020.

June 2 -

Borrowers with loans secured by personal rather than real property made up 46% of manufactured housing borrowers in 2019 and of this group, only 5% used the loans to refinance.

June 1 -

Storm-related reconstruction costs — a large share of which may be concentrated in the New York City area — are estimated to total $1.9 trillion for water damage and $8.5 trillion for wind damage.

June 1 -

Federal Reserve Vice Chair Randal Quarles has made it clear that banks failing to make the transition away from the benchmark rate could face supervisory consequences.

June 1 Treliant

Treliant -

Mynd expects to purchase about 20,000 single-family rental homes in the U.S. in the next three years.

June 1 -

The increasing regulatory costs may give the Biden administration reason to encourage the rollback of some zoning restrictions that hamper construction.

May 28 -

This is the multi-hyphenate company’s sixth deal since the start of 2020 — a series of acquisitions in a variety of sectors within the industry, ranging from analytics to artificial intelligence.

May 28 -

With Rohit Chopra’s nomination now in its fourth month, some of the consumer bureau's rulemaking efforts remain on hold. Experts say Democrats first want the Senate to confirm a new member of the Federal Trade Commission to replace Chopra so that Republicans don't gain control.

May 28 -

“Our goal is by after Labor Day to effectively be back to where we were in January of 2020,” Chief Executive Brian Moynihan said.

May 28 -

The steady pace of refinance activity has also continued, as borrowers seek to take advantage of sub-3% rates.

May 27 -

The Treasury secretary previewed President Biden's budget by urging lawmakers to fund the Financial Crimes Enforcement Network's establishment of a beneficial ownership regime.

May 27 -

The former senior vice president and credit officer takes over the role that Andrew Bon Salle left at the end of 2020.

May 27 -

DeVito takes over on June 1, replacing interim CEO Mark Grier, who returns to his seat on the government-sponsored agency's board.

May 26 -

While purchases increased, refinancing activity slowed considerably compared to its pace over the past month.

May 26 -

While last year’s high valuations protected the wealth embedded in consumer residences, a new report suggests that they can also be an indication of rising risk.

May 24