-

Sales of previously owned homes dropped in May by more than forecast to the lowest level since October 2010 as the coronavirus pandemic sent demand skidding along with the rest of the economy.

June 22 -

While home-buying season was on hold due to the coronavirus, a dearth in supply could hamper any big rebound in sales.

June 22 -

A bankruptcy judge will be asked to sign off on the sale of BHF's Shoreline portfolio in Chicago and will hold an initial Chapter 11 hearing on another portfolio.

June 19 -

Compared with the week prior, approximately 57,000 fewer loans from all investor types were forborne.

June 19 -

How the mortgage and housing industries react to the current civil rights moment could shape policies and bridge the homeownership divide for the Black community.

June 19 -

The coronavirus lockdown walloped California house sales in May, resulting in a 41.4% drop in transactions from the previous year, the California Association of Realtors reported.

June 19 -

Potential sales last month rose compared with April as homes became more affordable due to low mortgage rates.

June 18 -

Prices have continued to rise, although the pandemic closures have slowed that down: The region's median sales price last month was $257,048, up 1.6% from May 2019, according to Georgia MLS.

June 18 -

Mortgage rates fell 8 basis points this week to a new low as the economy remains shaky and there are new flare ups of the coronavirus, according to Freddie Mac.

June 18 -

The coronavirus put a dent in May's home sales and inventory, but some indicators offer hope for a turnaround on the horizon.

June 18 -

The number of existing, single-family home sales that closed last month fell 51.1% compared with the same month last year and the median price dropped 2.5%, according to the California Association of Realtors.

June 18 -

New Residential Investment Corp., fresh off a substantial first-quarter reduction of its asset holdings, is now planning to securitize the receivables on its $200 billion servicing portfolio of Fannie Mae-owned mortgages.

June 17 -

Analysts think the company could be looking for an acquisition target.

June 17 -

The language most frequently spoken by LEP consumers is Spanish, followed by Chinese, Vietnamese, Korean and Tagalog. The Federal Housing Finance Agency's online clearinghouse translates CARES Act forbearance information into these languages.

June 17 -

The FHFA and FHA both announced for the second time that they were delaying the freeze to protect borrowers and renters during the coronavirus pandemic.

June 17 -

Purchase mortgage application volume was at its most in over a decade as consumer confidence continued to improve in the aftermath of the coronavirus shutdown, according to the Mortgage Bankers Association.

June 17 -

The report by Unison also advised investors to focus on "diversified residential real estate" over traditional retail and office spaces.

June 17 -

Credit unions have seen historic mortgage growth so far this year despite the pandemic, but there are concerns some institutions may be overly relying on refinancing and not focusing enough on generating new purchase business.

June 17 -

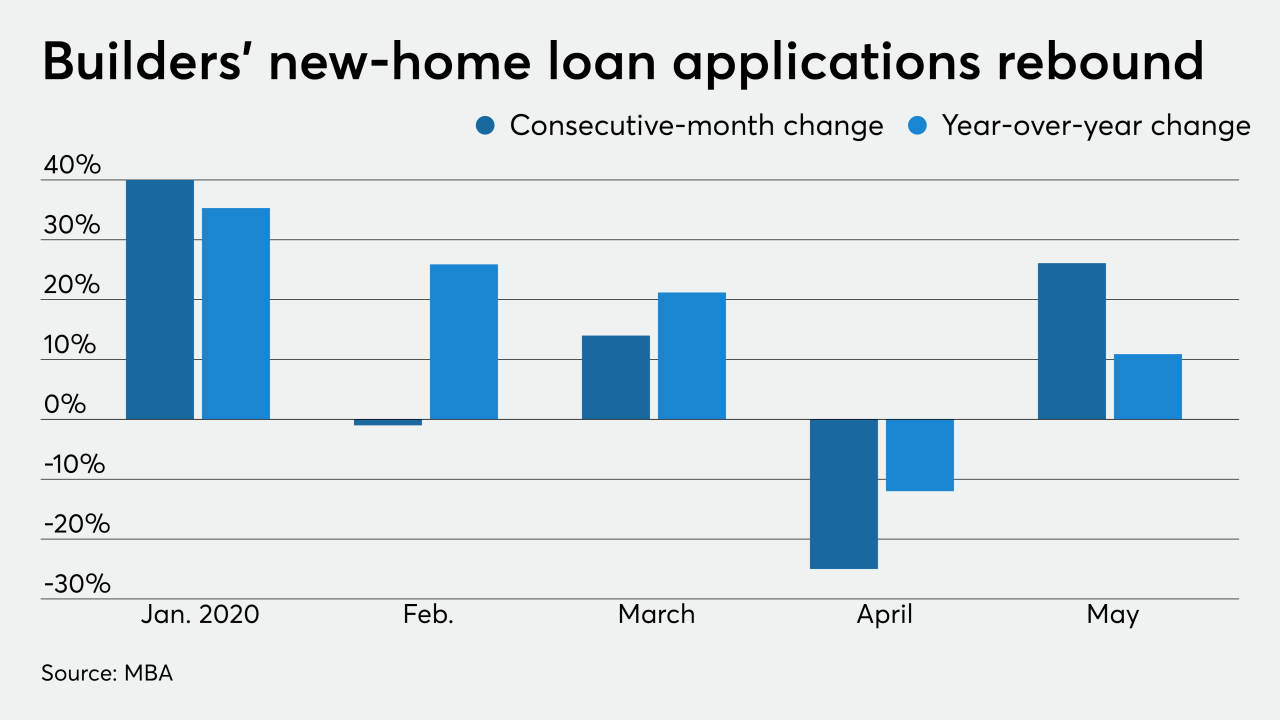

The availability of some loans used to build homes dried up due to the coronavirus. Opening up the economy may help if it doesn't lead to a spike in infections, and if consumer demand persists.

June 16 -

A lawsuit filed Tuesday argues that the bureau's establishment of the panel looking into regulatory changes violated the Federal Advisory Committee Act.

June 16