-

Mortgage borrowers collectively hold more equity in their homes than at any other time on record, but they've been slow to borrow against this newfound wealth, according to Black Knight.

April 2 -

The number of mortgage borrowers with an interest rate incentive to refinance fell 40% during the first six weeks of the year and now sits at the lowest level in more than nine years.

March 5 -

Incenter Mortgage Advisors is putting up for bid a $712.8 million package of government-sponsored enterprise and Ginnie Mae mortgage servicing rights concentrated in the Southeast.

March 2 -

Home prices achieved a new peak in December while also marking 68 consecutive months in annual home price appreciation, according to Black Knight.

February 26 -

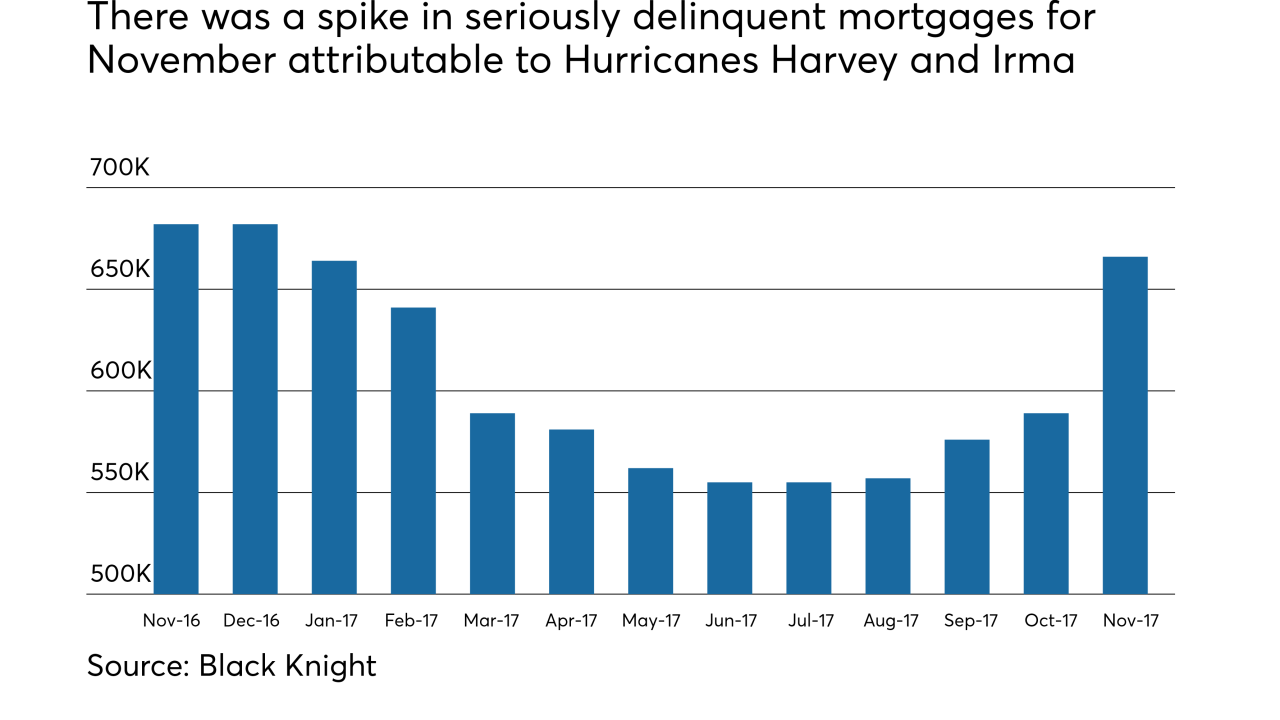

Delinquencies from Hurricanes Harvey and Irma are starting to subside, even as pre-storm foreclosures that were put on hold resume.

February 23 -

It was a record-setting year in terms of the low number of foreclosure starts, partially helped by the various post-storm moratoria, according to Black Knight.

February 5 -

After 67 months of consecutive home price appreciation, home prices hit a new peak at $283,000 in November 2017, according to Black Knight's Home Price Index.

January 29 -

Homeowners can tap into more home equity than ever before, but deciding between a home equity line of credit and cash out refinance mortgage has gotten more complicated following recently passed tax reforms.

January 8 -

Hurricanes Harvey and Irma contributed to a surge in seriously delinquent mortgages in November.

December 22 -

Here's a look at the 11 housing markets where the share of entry-level homes for sale is greater than the share of first time home buyer shoppers.

December 19 -

From Ellie Mae to Remax, here's a look at seven publicly traded companies in the mortgage and real estate industries expecting accelerated growth in 2018.

December 12 -

The lower mortgage interest deduction cap in House Republicans' tax bill would create a disincentive for existing homeowners to sell and add to already tight housing inventory concerns, according to Black Knight.

December 4 -

Florida's home prices increased during September, while in Texas there was a minimal decline from August, a sign the major storms that hit both states had little impact on values.

November 27 -

Late payments from borrowers living in areas hardest hit by Hurricanes Harvey and Irma were responsible for October's increase in loan delinquencies.

November 21 -

Despite continued growth in national home prices, housing remains more affordable today than long-term benchmarks, according to Black Knight.

November 7 -

Ocwen Financial Corp. will move its servicing portfolio to Black Knight's LoanSphere MSP system of record, following years of regulatory scrutiny of its existing technology provided by Altisource Portfolio Solutions.

November 1 -

U.S. home prices hit another new peak in August after just reaching a new high the previous month, according to Black Knight.

October 30 -

LoanCare, a Virginia Beach, Va.-based subservicer, can now service mortgages registered with MERS as e-notes by using DocMagic's e-vaulting technology.

October 20 -

Title insurance underwriter FNF Group broadened its offerings to real estate brokers through the purchase of a majority interest in SkySlope, which operates a digital real estate transaction management platform.

October 3 -

The majority of borrowers impacted by Hurricane Harvey have a significant amount of equity, while many in Hurricane Irma disaster areas have limited or negative equity, according to Black Knight Financial Services.

October 2