-

Revisions to the TILA/RESPA integrated disclosure that go into effect this fall drove the changes Ellie Mae made in its latest update to the Encompass loan origination system.

August 6 -

An increase in millennials making home purchases is a call to the mortgage industry for a quicker, more efficient digital process.

August 1 -

Ellie Mae saw a 20% year-over-year increase in second-quarter revenue with more loans closed using Encompass, but net income fell nearly 50% on an accounting change and acquisition costs.

July 26 -

As purchase mortgages continue to dominate overall industry volume, lenders aren't letting the extra work required to close these loans affect their productivity.

July 18 -

The average millennial borrower credit score remained unchanged in May, but values by city painted very different pictures, according to Ellie Mae.

July 11 -

Access to mortgage credit inched up in June, as competition for jumbo loans resulted in looser underwriting, but government lending standards got more restrictive, the Mortgage Bankers Association said.

July 10 -

Higher interest rates on home mortgages drove the share of loans used to purchase houses rather than refinance to new heights in May.

June 20 -

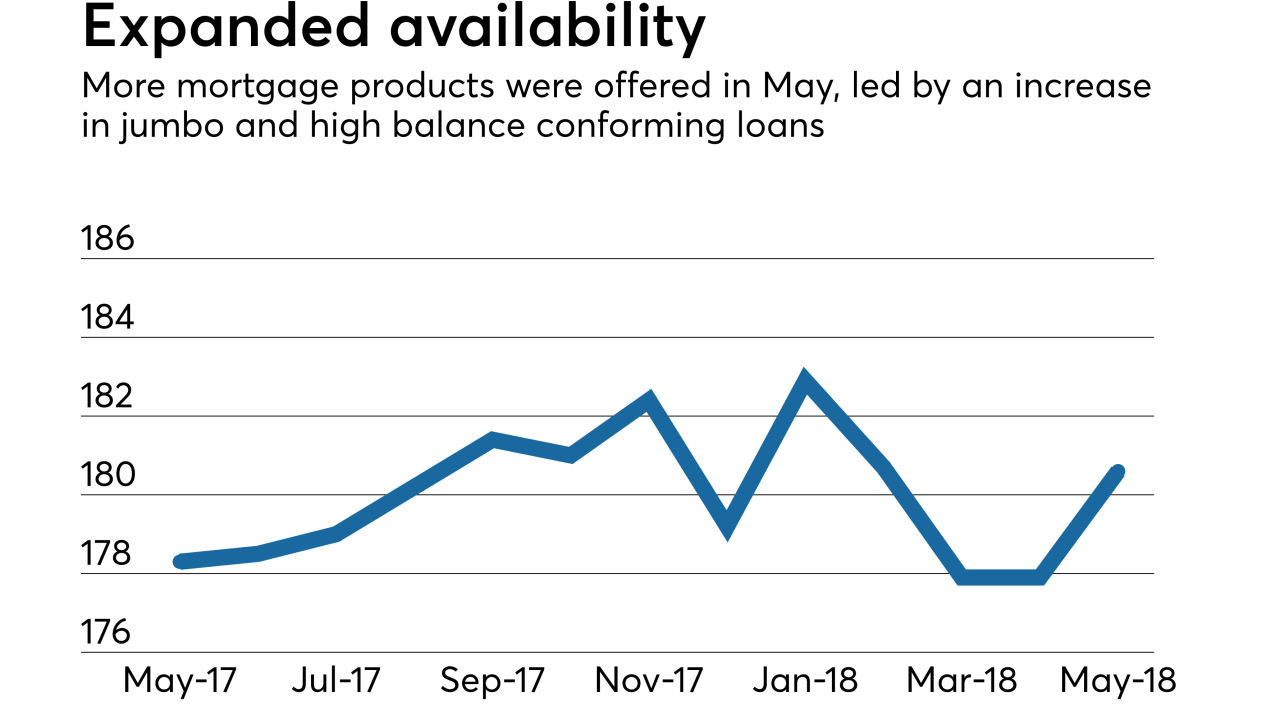

Mortgage credit availability increased in May by 1.5% as more jumbo and high-balance conforming loan products came on the market, the Mortgage Bankers Association said.

June 13 -

A new integration between Blend and Ellie Mae seeks to improve the use and accessibility of electronic mortgage documents, the latest in an ongoing industry effort to create a more simplified and consistent borrower experience.

May 24 -

As mortgage rates continued rising, the percentage of closed home purchase loans grew to its highest level in about four years, according to Ellie Mae.

May 16 -

Mortgage credit availability was unchanged in April, as originators tightened their government lending programs but made more jumbo offerings available.

May 8 -

As the mortgage industry makes more strides with technology, the time it took millennials to close loans for new-home purchases shrank to its fastest time yet.

May 2 -

Ellie Mae's first-quarter net income of a little over $2 million was lower than last year's due to some one-time expenses, but continuing operations numbers exceeded analysts' expectations.

April 27 -

Publicly traded mortgage technology firms seeking growth could eventually end up squaring off against or buying privately owned point of sale system startups.

April 17 -

Mortgage credit availability tightened during March to its lowest level in over a year, adding another headwind to a market challenged by rising interest rates and a shortage of homes for sale.

April 5 -

Purchase loans made to millennial mortgage borrowers rose month-over-month in February despite interest rates increasing at the start of the year, according to Ellie Mae.

April 4 -

Closing times for refinances have fallen dramatically due to mortgage lenders' increased emphasis on home purchase loans.

March 21 -

While the industry continues adopting digital mortgage methods, homebuyers expect to be able to apply for a mortgage and complete the application online, but still want human interaction, according to Ellie Mae.

March 20 -

Loan program revisions made by one large conventional mortgage investor led to a decrease in total residential home finance credit availability in February.

March 8 -

Refinance mortgages accounted for 45% of mortgage volume, the highest share in a year, according to Ellie Mae.

February 21