-

Fannie Mae is lowering down payment requirements and lender fees on manufactured housing loans to improve affordable housing access.

June 6 -

MountainView is brokering a $3.6 billion nonrecourse package of Fannie Mae mortgage servicing rights with a high refinance loan concentration.

June 4 -

Seasonal hiring gave employment among nonbank mortgage lenders and brokers a boost in April and partially reversed an earlier decline despite growing signs of consolidation in the industry.

June 1 -

The federal government has opened a criminal investigation into whether traders manipulated prices in the $550 billion market for corporate bonds issued by Fannie Mae and Freddie Mac, according to people familiar with the matter.

June 1 -

Fannie Mae is warning mortgage lenders and servicers about possible fraud schemes in Los Angeles County involving "34 apparently fictitious employers being used on loan applications."

May 30 -

To make its technology more relevant to the mortgage industry, Fannie Mae is taking a new approach to developing tools that engages lenders earlier in the process and makes lending more efficient.

May 29 Fannie Mae

Fannie Mae -

Freddie Mac's economists took a more bullish outlook than others on the 2018 mortgage market, raising its forecast by $30 billion citing higher-than-projected refinance activity.

May 25 -

A group of low- and moderate-income first-time homebuyers tracked in a Fannie Mae study did not properly prepare to get a mortgage, which created a prolonged and complicated purchase process.

May 24 -

In the continued absence of legislation, Fannie Mae and Freddie Mac’s regulator announced work on a new capital framework.

May 23 -

Republican Bob Corker of Tennessee and Democrat Mark Warner of Virginia are acknowledging the legislative efforts to end government control of Fannie Mae and Freddie Mac are dead, at least for now.

May 23 -

Government-sponsored enterprises Fannie Mae and Freddie Mac are in a race to offer services and technology that help mortgage bankers raise cash from mortgage servicing rights.

May 23 -

For nearly a decade, the FHFA has restricted Fannie Mae and Freddie Mac from trying to influence the raging debate over whether they should live or die.

May 18 -

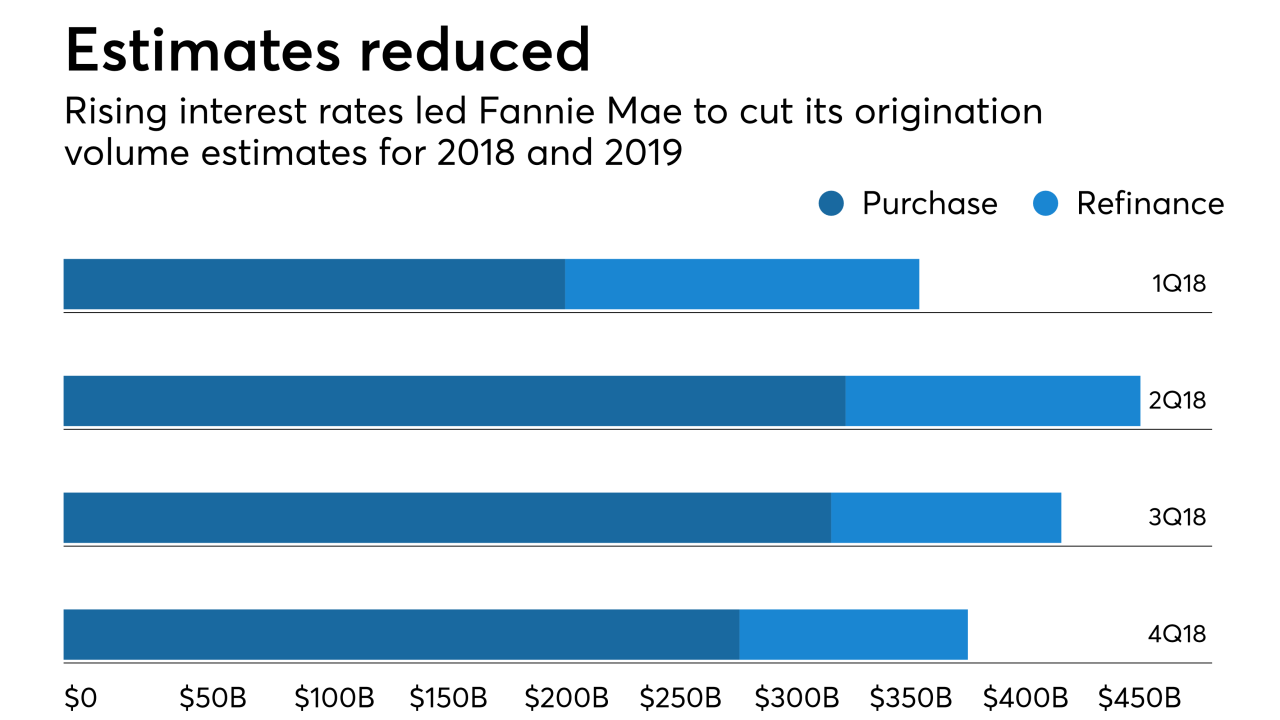

Fannie Mae reduced its mortgage origination volume forecast for 2018 and 2019 as rising interest rates are affecting refinancings now, and will curtail purchase activity going forward.

May 17 -

Unlike the sponsor's previous four deals, which were backed at least in part by jumbo loans, all of the collateral for FSMT 2018-3INV is eligible to be purchased by either Fannie Mae or Freddie Mac.

May 15 -

President Trump has nominated Michael Bright, the current acting president and chief operating officer of Ginnie Mae, to head the agency full time.

May 15 -

In a bid to cut time and costs from the mortgage process, Fannie Mae is testing whether appraisers can accurately determine a home's value without actually visiting the property.

May 7 -

Housing confidence hit an all-time high as more consumers report it's a good time to sell, while also anticipating a rise in home prices but a drop in mortgage rates, according to Fannie Mae.

May 7 -

Freddie Mac has quietly started extending credit to nonbanks that issue mortgages, a move it says will help the companies maintain access to a crucial stockpile of cash if their home loans go sour.

May 7 -

Fannie Mae's first-quarter profits were enough for it to rebuild its minimum capital buffer and pay the Treasury Department dividend after being forced to take a draw during the previous fiscal period.

May 3 -

The Treasury secretary said reforming Fannie Mae and Freddie Mac will come into focus more in 2019, when Federal Housing Finance Agency Director Mel Watt’s term will end.

April 30