Federal Reserve

Federal Reserve

-

Regulators are working intently on a proposal to reform how they apply the Community Reinvestment Act after previous attempts to modernize CRA policy drew mixed reviews.

March 9 -

Mortgage rates increased for the ninth consecutive week, moving in reaction to bond and stock market volatility.

March 8 -

Democrats used a hearing with Fed Chair Jerome Powell to lay the groundwork for an intraparty debate over the merits of the Senate’s regulatory relief bill.

March 1 -

The new Federal Reserve Board chairman's testimony in Congress was the driver of this week's mortgage rate increase, according to Freddie Mac.

March 1 -

The 30-year fixed mortgage rate moved up for the seventh consecutive week with further increases possible as bond yields rise over concerns about higher inflation.

February 22 -

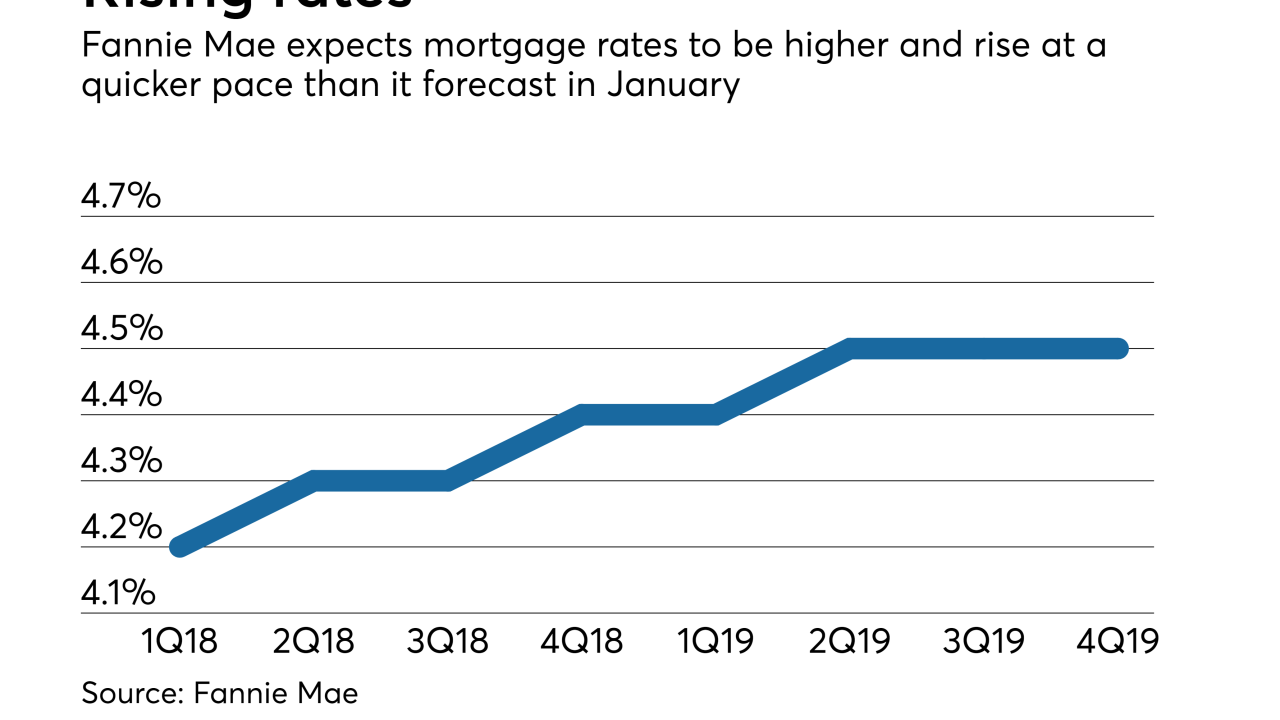

The recent bond market volatility will cause mortgage rates to rise to a higher level than previously projected, according to Fannie Mae.

February 15 -

Mortgage rates rose to their highest level in almost four years, as worries over inflation drove the 10-year Treasury yield to just shy of 3%.

February 15 -

Credit standards for commercial loans to medium and large firms showed some signs of easing over the last three months of 2017, even though demand stayed relatively unchanged.

February 5 -

Powell, a former investment banker who has served as a Fed governor, was confirmed by the Senate last month to a four-year term as chair of the central bank.

February 5 -

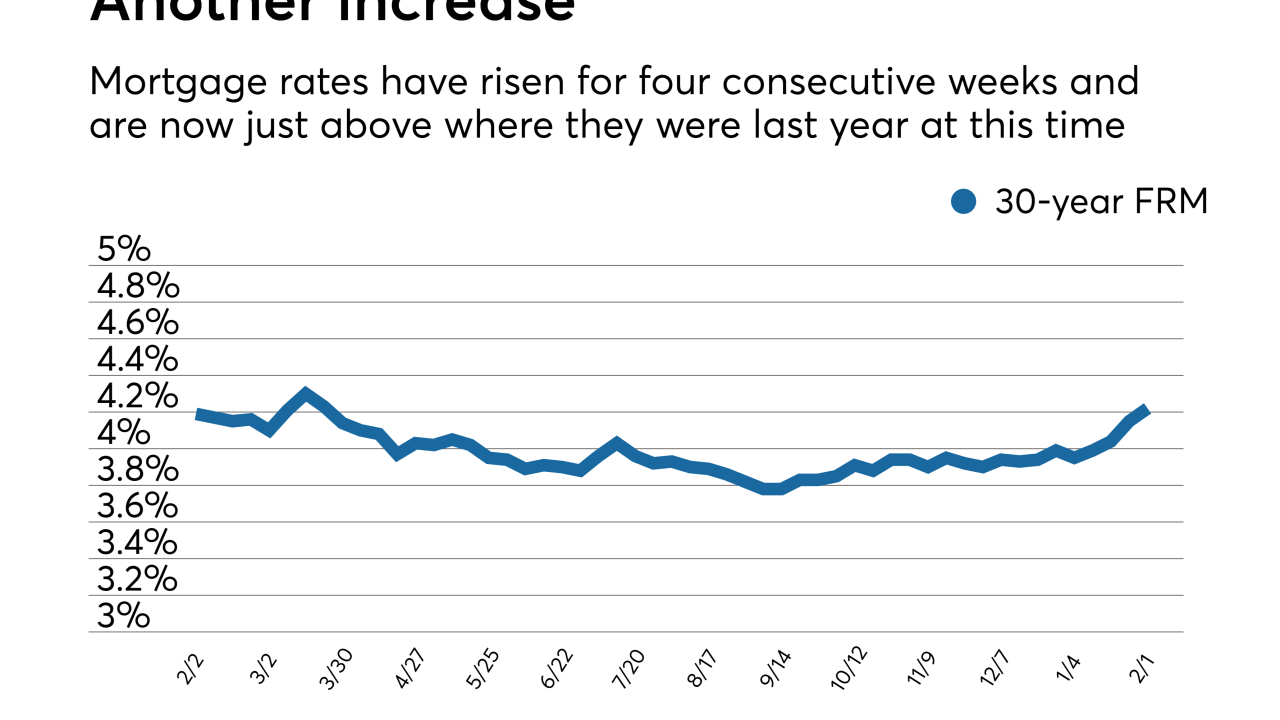

Mortgage rates, which are significantly higher since the start of the year, are likely to rise for weeks to come, according to Freddie Mac.

February 1 -

Regulators said they were taking steps to recognize contributions to the recovery made by banks anywhere in the nation.

January 25 -

Senators overwhelmingly approved Jerome Powell to lead the Federal Reserve Board despite vocal opposition from some Democrats.

January 23 -

Mick Mulvaney, acting director of the Consumer Financial Protection Bureau, said his zero-funding request for the agency is not meant to drain it of resources.

January 23 -

Given the improving U.S. economy, mortgage rates will probably not fall back under the 4% mark anytime soon.

January 18 -

Mick Mulvaney, the acting director of the Consumer Financial Protection Bureau, has requested no funding from the Federal Reserve in the second quarter and instead will use reserves to fund the agency.

January 18 -

The Senate Banking Committee had approved Powell already in December, but a revote was necessary after the Senate adjourned for the year without finalizing his confirmation.

January 17 -

The payments resolve a number of cases that date back to 2011 and were among the largest coordinated U.S. enforcement efforts in the years following the crisis.

January 12 -

More than 100 pending Trump administration nominees, including Fed Chair-designate Jerome Powell, must update their financial disclosures and have the White House resubmit their names for consideration by the Senate.

January 3 -

The Trump administration's Financial Stability Oversight Council is likely to remove the systemically important financial institution label for the remaining nonbanks on the list, but it might consider adding other firms such as Fannie Mae and Freddie Mac.

December 28 -

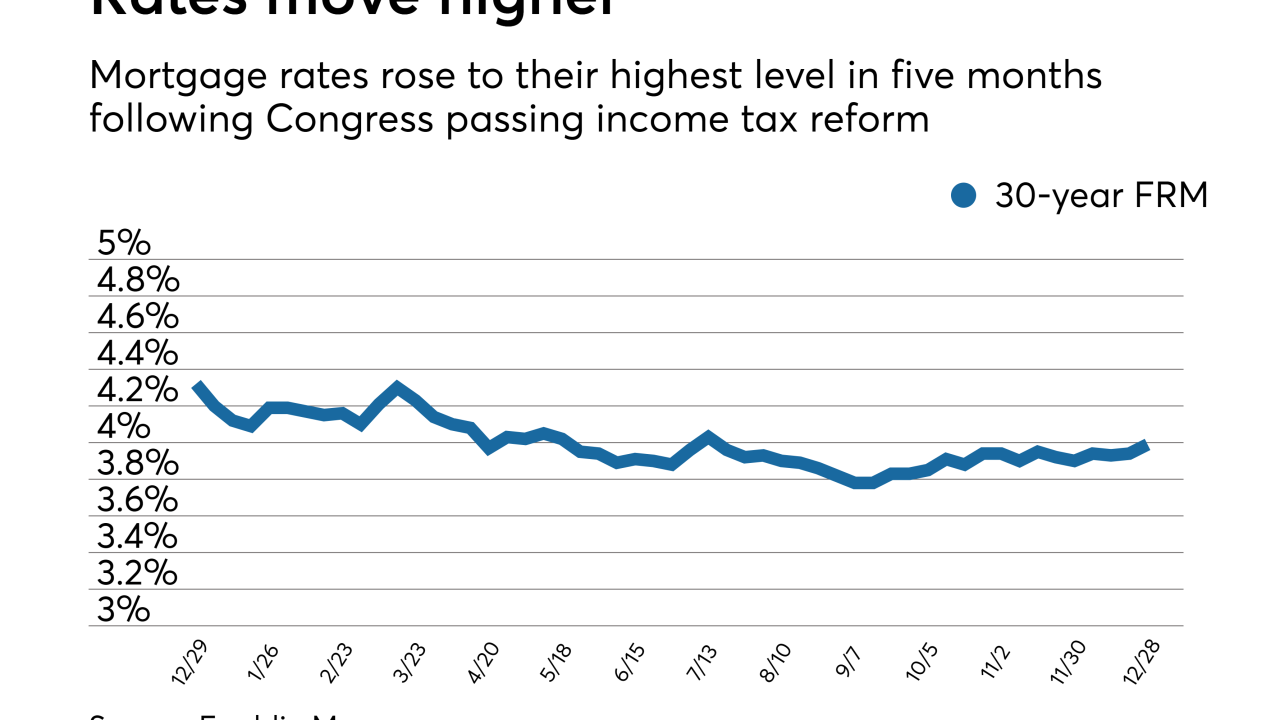

Mortgage rates rose to their highest level since the summer as predicted following Congress passing income tax reform, according to Freddie Mac.

December 28