-

Five Florida Keys men ripped off the federal government and received thousands of dollars in recovery money after Hurricane Irma struck last year, the Monroe County State Attorney's Office said.

December 14 -

As ominous as the dark smoke that choked the Bay Area while California's most destructive wildfire raged 200 miles north, a second tragedy now is looming over the state — the loss of thousands of homes in an already housing-starved region.

December 5 -

Destruction from Michael's storm surge and flooding has potential to affect 57,000 homes, with a worst-case total of $13.4 billion in reconstruction cost value, according to CoreLogic's latest estimates.

October 9 -

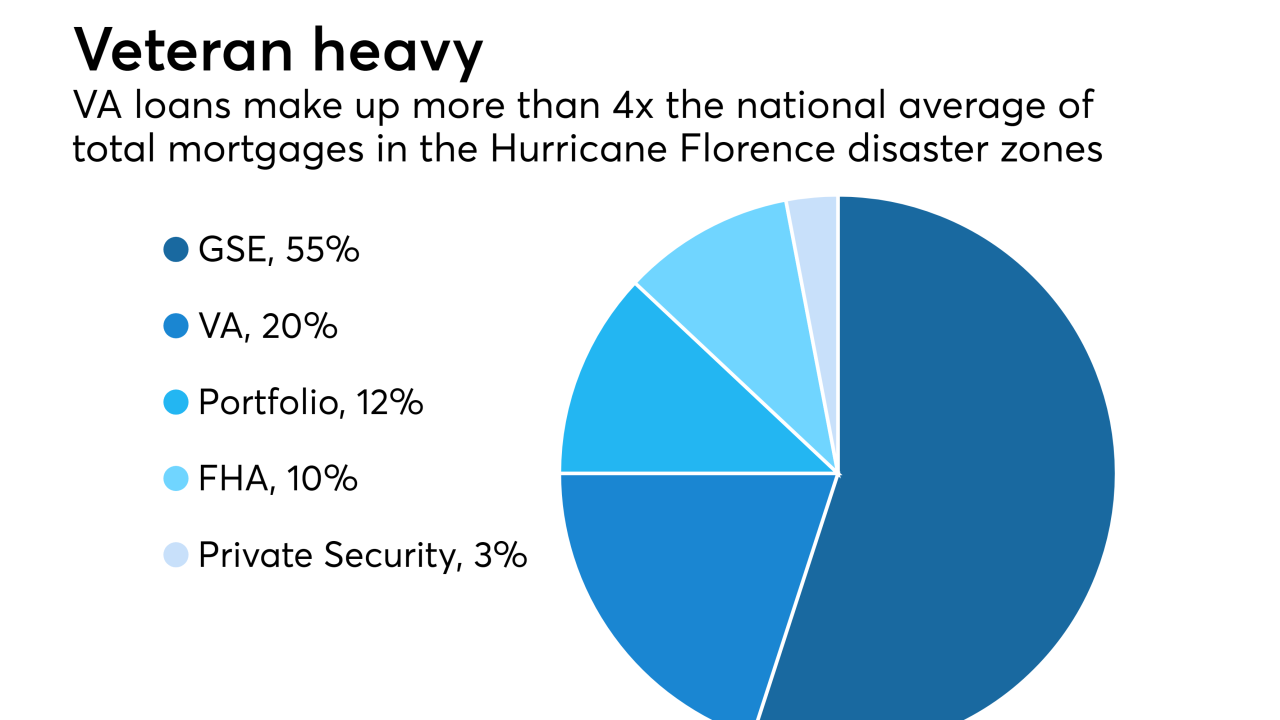

Delinquencies will be on the rise and Veterans Affairs loans have greater density within FEMA-declared disaster zones from Hurricane Florence, according to Black Knight.

October 8 -

Similar to estimates published by Moody's and Morningstar, the data provider reckons that more than half of the loans are securitized by Fannie, Freddie or Ginnie.

October 1 -

Florence's flooding and wind destruction affected about 700,000 residential and commercial properties across North Carolina, South Carolina and Virginia, according to CoreLogic's latest estimates.

September 25 -

The mortgage delinquency rate dropped to its lowest level in over 12 years, but servicers should expect an increase following the impact of Hurricane Florence, according to Black Knight.

September 24 -

The federal government has paid out $163.9 million in flood insurance for 1,100 homes in North Carolina with severe repeitive losses, which is almost 60% of their combined total value.

September 21 -

While the severity of Florence was reduced prior to Friday morning's landfall, mortgage servicers are taking proactive steps in addressing the emergency situation.

September 14 -

The serious mortgage delinquency rate sank to its lowest June reading in 11 years, though recent natural disasters pose risk to loan performance in affected areas, according to CoreLogic.

September 11 -

It would be impossible to pick out a single video or photograph that sums up Irma, which dropped from a hurricane to a tropical storm by the time it smacked Lake County, Fla., one year ago today.

September 11 -

The Federal Housing Administration is providing a new waiver that gives mortgage companies the ability to start inspecting properties affected by Kilauea Volcano lava flows in Hawaii.

September 5 -

With the program set to expire July 31, the House bill will have to be reconciled with Senate legislation that includes a longer extension.

July 25 -

Reps. Ed Royce, R-Calif., and Earl Blumenauer, D-Ore., introduced a bipartisan package of legislation Tuesday to extend the National Flood Insurance Program through Nov. 30.

July 18 -

Once again, congressional inaction on reauthorizing the National Flood Insurance Program is prompting concerns about what a lapse in coverage could mean for loan closings.

July 9 -

Lawmakers want the agency to utilize two programs to help families still struggling to recover from the aftermath of Hurricane Maria.

July 2 -

Communication between all parties in the chain, from borrower through guarantor, is the best way to minimize mortgage losses after events like last year’s hurricanes and wildfires, according to servicers and federal officials.

February 8 -

Likely changes to the National Flood Insurance Program are poised to raise costs for many Jersey Shore homeowners, perhaps substantially.

February 6 -

From responding to natural disasters to emerging technology strategies, here's a look at six top trends on the agenda for the 2018 MBA Servicing Conference.

February 2 -

Commissioners Court is considering slowing the growth of the Harris County, Texas, budget as officials continue to grapple with Hurricane Harvey's widespread destruction and potential impact on property tax revenues.

January 30