-

Government-sponsored enterprises Fannie Mae and Freddie Mac's guarantee fee pricing last year kept the playing field fairly level for different-sized lenders.

October 17 -

Fannie Mae is putting more than $2 billion in reperforming loans up for bid and also marketing a smaller package of more than $1 billion in nonperforming loans.

October 12 -

While the scale of destruction and suffering caused by Hurricanes Harvey and Irma is staggering, history suggests the local economy and housing markets in the affected areas will bounce back relatively quickly.

October 11 Arch Capital Services

Arch Capital Services -

Fannie Mae and Freddie Mac were not affected by a hacking incident against the accounting giant Deloitte, the companies said Tuesday, after a British newspaper alleged a server containing emails from government agencies was compromised.

October 10 -

Though FHFA Director Mel Watt stopped short of saying he would break with a Treasury agreement that forces all profits of the GSEs to go to the government, he emphasized that it couldn’t continue indefinitely.

October 3 -

Fannie Mae and Freddie Mac's regulator may have a travel kerfuffle of his own.

October 3 -

The Federal Housing Finance Agency's Duty to Serve program must increase manufactured housing lending in rural communities.

September 29 NeighborWorks America

NeighborWorks America -

Mortgage investors want Freddie Mac to align its policy with Fannie Mae's when it comes to how delinquencies related to Hurricane Harvey affect credit risk transfer deals.

September 19 -

Despite a direct request by six Democratic senators that Fannie Mae and Freddie Mac be allowed to rebuild capital, Treasury Secretary Steven Mnuchin did little to clarify the administration's thinking.

September 14 -

Former Ginnie Mae President Ted Tozer will join securitization pioneer Lewis Ranieri at a new housing policy team at the Milken Institute.

September 7 -

As head of Fannie Mae's single-family mortgage business, Andrew Bon Salle wants to ease the burden of loan-level price adjustments, streamline condo loan approvals and expand rep and warrant relief. But even he admits there are limits to his power.

September 7 -

Fannie Mae and Freddie Mac will adjust their risk-sharing deals so that they can accommodate high loan-to-value loans refinanced under the programs replacing the Home Affordable Refinance Program.

August 28 -

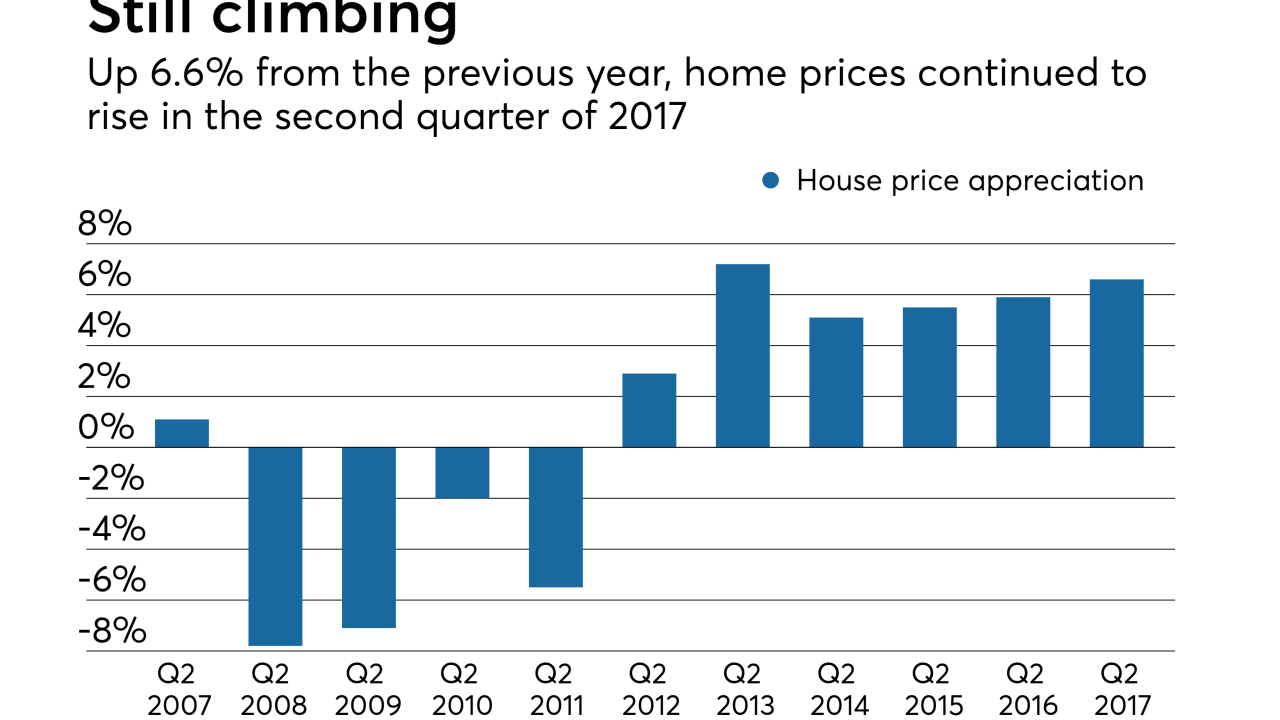

With inventory still low, home prices continued to rise in the second quarter of 2017.

August 23 -

Home prices increased 6.6% in the second quarter from a year earlier as buyers competed for a shrinking supply of listings.

August 22 -

The Federal Housing Finance Agency promoted Andre Galeano to oversee its regulation and supervision of the 11 Federal Home Loan banks.

August 9 -

The mortgage finance giants Fannie Mae and Freddie Mac could need nearly $100 billion in bailout money in the event of a new economic crisis, according to stress test results released Monday by their regulator.

August 7 -

The government-sponsored enterprise is still looking for the right balance between offering a product that's attractive to investors and a cost-effective way to reduce risk.

August 3 -

FHFA Director Mel Watt said Fannie Mae and Freddie Mac cannot use alternative credit models until other issues are resolved first.

August 1 -

A bipartisan duo of lawmakers is set Tuesday to introduce a bill designed to increase homeownership opportunities for “credit invisible” consumers.

August 1 -

Freddie Mac said it earned enough in the second quarter to send a $2 billion dividend to the U.S. Treasury, but the press release announcing the company’s financial results includes new language suggesting uncertainty as to whether the payment will be made as scheduled.

August 1