-

Fintech adoption among real estate and title agents is accelerating, though their optimism on the housing market has tanked, according to First American Financial Corp.

November 27 -

Rising interest rates are holding back existing homeowners from listing their properties, driving the gap between existing and potential sales even as that disparity narrows, First American Financial said.

November 19 -

There was a 1.3% uptick in mortgage application defects in September from the previous month, with states affected by Hurricane Florence showing preliminary spikes in activity following the storm, according to First American.

October 26 -

All four national title insurance underwriters saw an increase in third-quarter net earnings compared with one year prior even as new orders declined because mortgage origination volume fell this year.

October 25 -

Property values have grown enough for households to establish equity and make a profit, but homeowners continue staying put, causing sales to underperform their potential.

October 18 -

First American Mortgage Solutions is stepping up its digital mortgage game by offering electronic closing capabilities.

October 16 -

Mortgage application defect risk is down from a year ago, but Hurricane Florence will likely tear through results in affected areas in the coming months.

September 26 -

Future reductions in loan application defect risk are likely because of mortgage lenders' fintech investments, even as the purchase origination share grows, said First American Financial.

August 31 -

Tech-focused startups are knocking on the door of a $15 billion industry that's dominated by just four companies: Title insurance.

August 22 -

From Washington to Baltimore, here's a look at the 12 best housing markets for homebuyer purchasing power, where median house values and mortgage rates are more favorable.

August 6 -

Loan defect risk rose in only three states and a handful of metropolitan regions in June thanks to the continuing spread of digital mortgage initiatives that improve data quality.

July 31 -

Radian Group's second-quarter earnings beat consensus estimates because of lower loan loss provisions than forecast, along with record new mortgage insurance written.

July 26 -

Purchasing power took a plunge in some of the nation's hottest housing markets, as a competitive spring purchasing season continues to drive home prices higher.

July 3 -

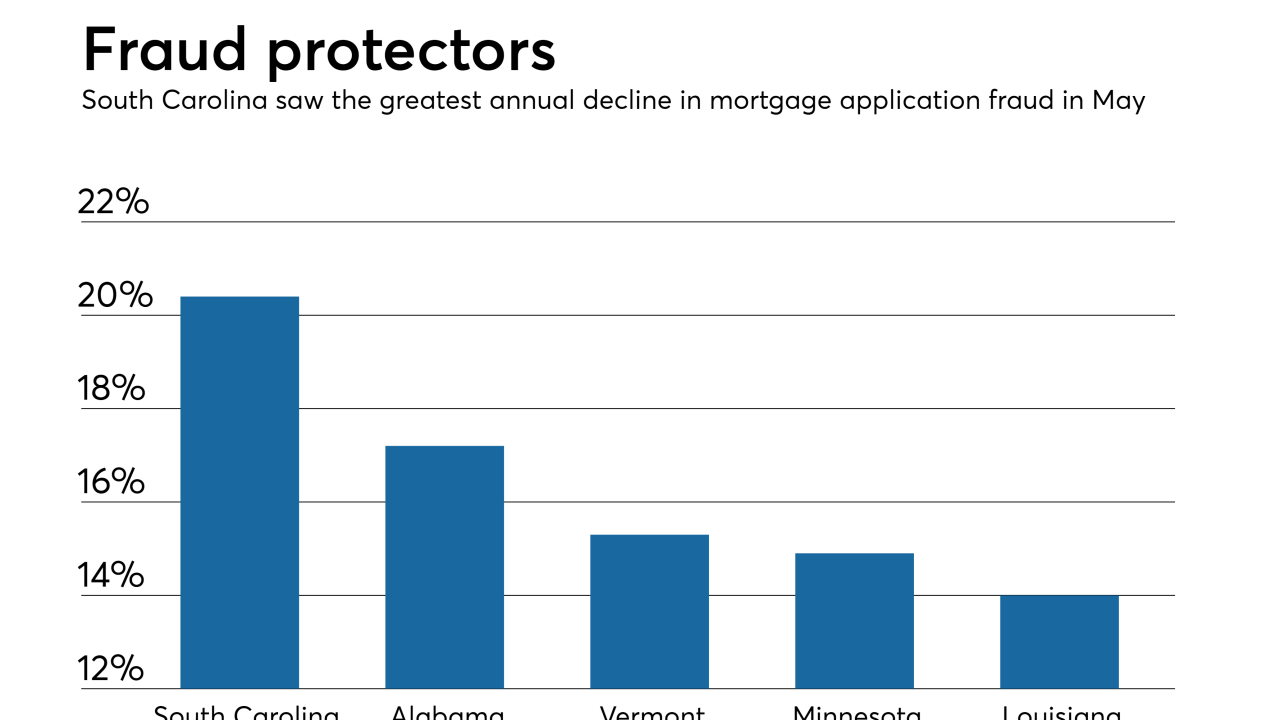

While purchase mortgages account for a growing share of overall volume, industrywide investments in more automated and efficient underwriting processes have helped lower instances of fraud.

June 28 -

While rising mortgage rates are top of mind for the industry after last week's increase in the federal funds rate, the housing market should be more concerned about limited home inventory, according to First American Financial Corp.

June 18 -

The ability-to-repay standard is responsible for the reduction in loan application defects over the past four-plus years, according to First American Financial.

May 30 -

From D.C. to Chicago, here's a look at the 12 cities where homebuyers are getting the best bang for their housing buck.

May 29 -

The home buying season is already shaping up to be especially competitive this year, as rising prices and mortgage rates are putting a damper on purchasing power in many once-affordable housing markets.

May 10 -

Here's a look at 12 cities where median home prices are under $200,000 and the combination of local wages and interest rates offer buyers the most purchasing power.

May 1 -

While mortgage application defect risk declined overall in March, at the local level it varied considerably, according to First American Financial Corp.'s Loan Application Defect Index.

April 27