-

No plan will be implemented as long as Fannie Mae and Freddie Mac remain in conservatorship, but a capital framework for the companies could still have a substantive impact.

June 15 -

Sales of nonperforming loans by Fannie Mae and Freddie Mac slowed during the past year as the number of delinquent loans on their books continued to drop.

June 14 -

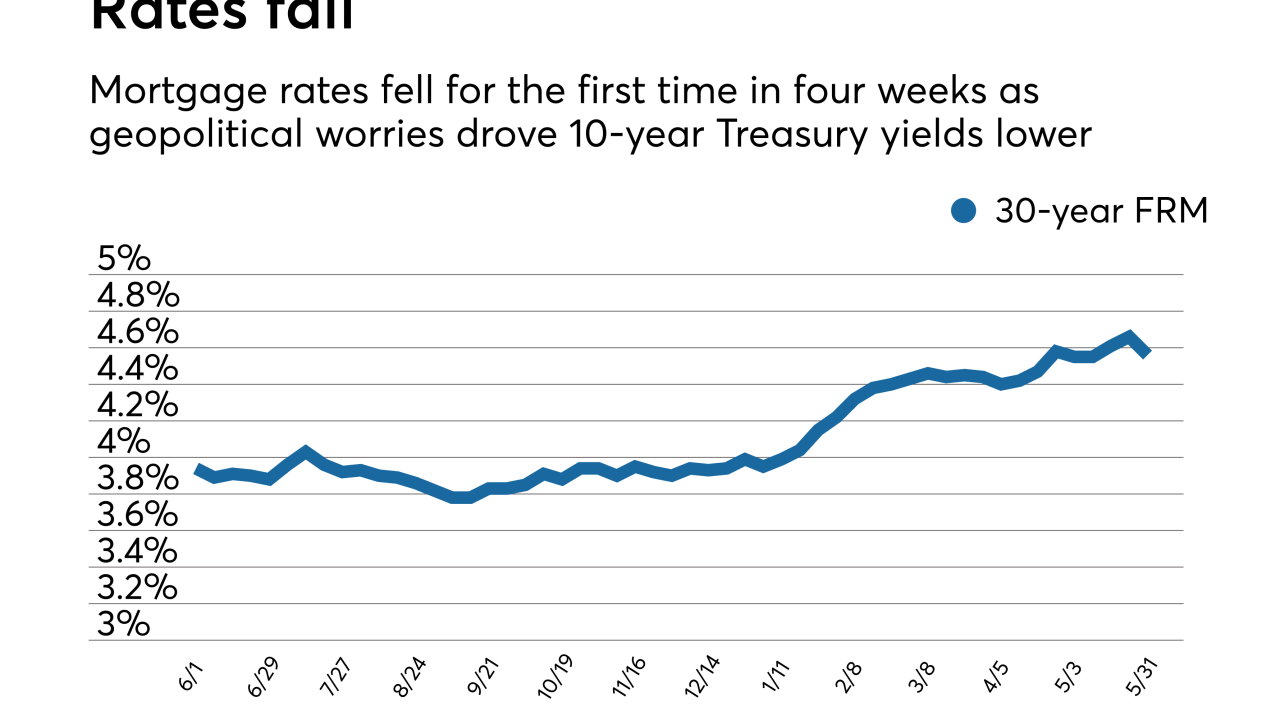

After declining for two straight weeks, mortgage rates reversed direction this week and rose to their second highest level this year, according to Freddie Mac.

June 14 -

Freddie Mac hit the $1 trillion mark on credit risk sharing for single-family mortgage loans with its second lower LTV deal of the year.

June 13 -

The agency proposed new minimum capital requirements for Fannie Mae and Freddie Mac that would only go into effect if the government ends its conservatorships.

June 12 -

Mortgage rates dipped for the second consecutive week although 10-year Treasury yields started to rise again, according to Freddie Mac.

June 7 -

The federal government has opened a criminal investigation into whether traders manipulated prices in the $550 billion market for corporate bonds issued by Fannie Mae and Freddie Mac, according to people familiar with the matter.

June 1 -

Mortgage rates fell for the first time in four weeks, dropping 10 basis points as investors' concerns over a government crisis in Italy drove bond yields lower.

May 31 -

Freddie Mac's economists took a more bullish outlook than others on the 2018 mortgage market, raising its forecast by $30 billion citing higher-than-projected refinance activity.

May 25 -

Mortgage rates continued their climb this week, jumping 5 basis points to their highest level since May 2011, according to Freddie Mac.

May 24 -

In the continued absence of legislation, Fannie Mae and Freddie Mac’s regulator announced work on a new capital framework.

May 23 -

Republican Bob Corker of Tennessee and Democrat Mark Warner of Virginia are acknowledging the legislative efforts to end government control of Fannie Mae and Freddie Mac are dead, at least for now.

May 23 -

Government-sponsored enterprises Fannie Mae and Freddie Mac are in a race to offer services and technology that help mortgage bankers raise cash from mortgage servicing rights.

May 23 -

For nearly a decade, the FHFA has restricted Fannie Mae and Freddie Mac from trying to influence the raging debate over whether they should live or die.

May 18 -

Mortgage rates have reversed course and reached a new high last seen seven years ago as the yield on the 10-year Treasury crossed the 3% threshold this week, according to Freddie Mac.

May 17 -

Unlike the sponsor's previous four deals, which were backed at least in part by jumbo loans, all of the collateral for FSMT 2018-3INV is eligible to be purchased by either Fannie Mae or Freddie Mac.

May 15 -

President Trump has nominated Michael Bright, the current acting president and chief operating officer of Ginnie Mae, to head the agency full time.

May 15 -

John Krenitsky, who previously managed compliance for Discover Financial Services and various banks, is joining Freddie Mac as senior vice president and chief compliance officer on June 1.

May 15 -

Mortgage rates were unchanged over the past week, but appear to be headed higher with a robust summer home sales season expected, according to Freddie Mac.

May 10 -

In a bid to cut time and costs from the mortgage process, Fannie Mae is testing whether appraisers can accurately determine a home's value without actually visiting the property.

May 7