-

Freddie Mac has quietly started extending credit to nonbanks that issue mortgages, a move it says will help the companies maintain access to a crucial stockpile of cash if their home loans go sour.

May 7 -

Mortgage rates dipped slightly over the past week as yields on the 10-year Treasury retreated after breaking the 3% barrier, according to Freddie Mac.

May 3 -

In its latest effort to reach first time home buyers, Freddie Mac is launching a new 3% down payment program that casts aside a number of restrictions in its existing low down payment offerings.

May 2 -

If Freddie Mac's credit-risk transfer activities continue to grow, mortgage lenders could eventually see a reduction in the guarantee fees they pay to the government-sponsored enterprise, according to CEO Donald Layton.

May 1 -

The Treasury secretary said reforming Fannie Mae and Freddie Mac will come into focus more in 2019, when Federal Housing Finance Agency Director Mel Watt’s term will end.

April 30 -

The Federal Housing Finance Agency's plan to combine Fannie Mae and Freddie Mac mortgages into a single security starting in June 2019 promises to bring both benefits and challenges to the mortgage sector.

April 27 -

Mortgage rates rose to their highest level in over four years, as 10-year Treasury yields broke the 3% ceiling this past week.

April 26 -

Mortgage and title insurance companies licensed in New York need to file disaster response plans this year in line with increased state attention to business continuity planning.

April 25 -

A special agent who used to work for an investigative arm of Immigration and Customs Enforcement pleaded guilty to defrauding Freddie Mac and SunTrust Mortgage through a short sale.

April 23 -

A data validation integration Freddie Mac is adding to its technology platform could also deliver representation and warranty relief to lenders when it verifies self-employed borrowers' incomes.

April 20 -

Mortgage rates jumped across the board to their highest point this year as 10-year Treasury yields rose in the past week over economic headlines, according to Freddie Mac.

April 19 -

MGIC Investment Corp.'s first-quarter net income beat analysts' estimates due to favorable loss development and that should be seen with the other private mortgage insurers.

April 18 -

Cloudvirga, in collaboration with Freddie Mac, has created the capability for loan officers to submit mortgage loan data to both government-sponsored enterprises' automated underwriting systems simultaneously with a single click.

April 12 -

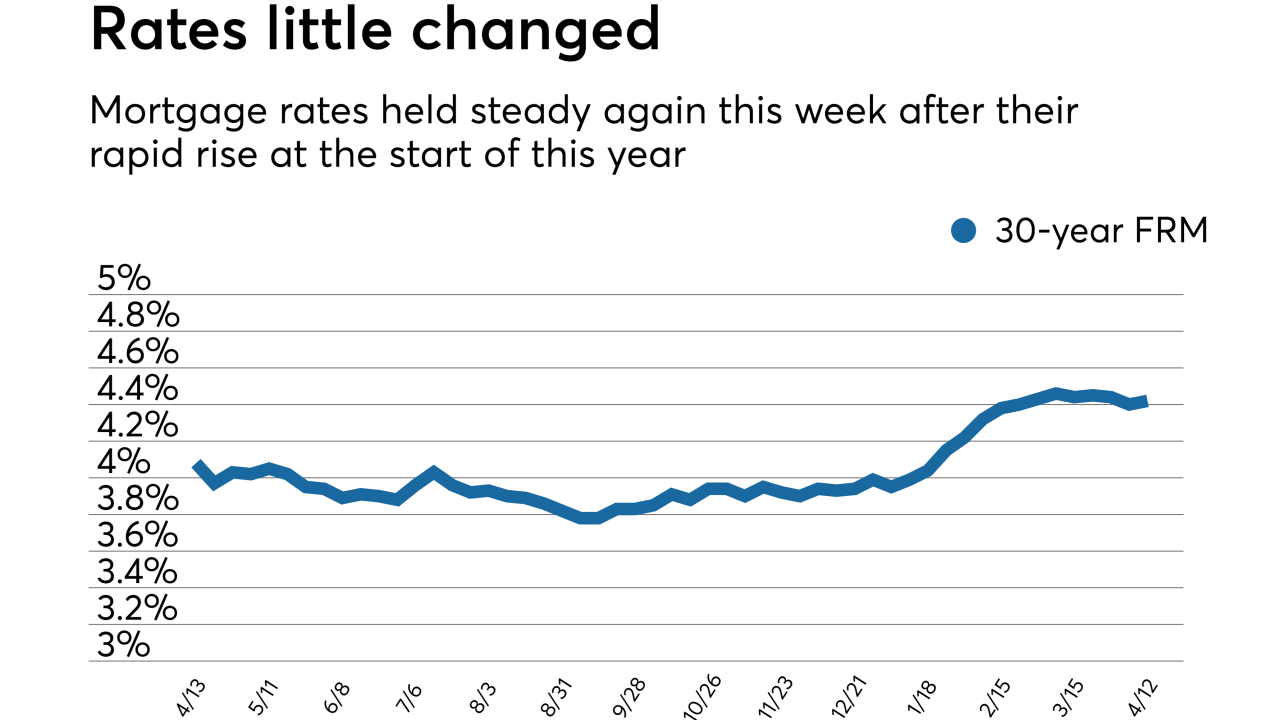

Mortgage rates increased a scant two basis points this past week, holding steady recently after their rapid rise at the start of this year, according to Freddie Mac.

April 12 -

The use of appraisal management companies does not result in higher quality property valuation reports, according to a working paper published by the Federal Housing Finance Agency.

April 11 -

The future secondary mortgage market entities will receive high investment grade ratings, even as there is no clarity on their scope or form, Fitch Ratings said.

April 10 -

The reserve bank's proposal to address banks and nonbanks that remain "too big to fail" does not include two of the largest such institutions: Fannie Mae and Freddie Mac.

April 9

-

Mortgage rates dropped as the stock market downturn at the start of the week drove yields on the 10-year Treasury lower.

April 5 -

The annual progress report on the Fannie Mae and Freddie Mac conservatorships reiterated that a new credit score model will likely not be operational until after the implementation of a new Single Security Initiative.

March 29 -

Mortgage rates held largely steady for the week, dropping only 1 basis point, according to Freddie Mac.

March 29