-

Think you know your IRRRL from your LPMI? See if you can ace this quiz of 10 quirky abbreviations from the origination sector of the mortgage industry.

March 13 -

If GSE reform leads to the 30-year mortgage's demise, homebuyers' monthly payments could soar by $400, according to a recent Zillow estimate. But lenders aren't convinced this housing finance staple is in any danger of being replaced.

March 12 -

Essent Guaranty is marketing $360.75 million of notes linked to the performance of a pool of residential mortgages that it insures; its following in the footsteps of Arch Capital.

March 12 -

Mortgage rates increased for the ninth consecutive week, moving in reaction to bond and stock market volatility.

March 8 -

A Senate proposal calling for a federal guarantee on mortgage-backed securities would only benefit the largest banks and increase the risk of bailouts.

March 8

-

The success of the government-sponsored enterprises' credit risk transfer programs shows that they can be the basis for housing finance reform.

March 7 -

Commercial and multifamily fourth-quarter mortgage delinquency rates improved for most investor types compared to one year prior as the U.S. economy continued its recovery.

March 6 -

From investor angst to regulatory scrutiny, here's a look at three obstacles that must be addressed before Ocwen Financial can acquire PHH Mortgage.

March 1 -

The new Federal Reserve Board chairman's testimony in Congress was the driver of this week's mortgage rate increase, according to Freddie Mac.

March 1 -

Freddie Mac is delaying the soft launch of its Phrase 3 updates to the Uniform Loan Delivery Dataset by a week.

February 26 -

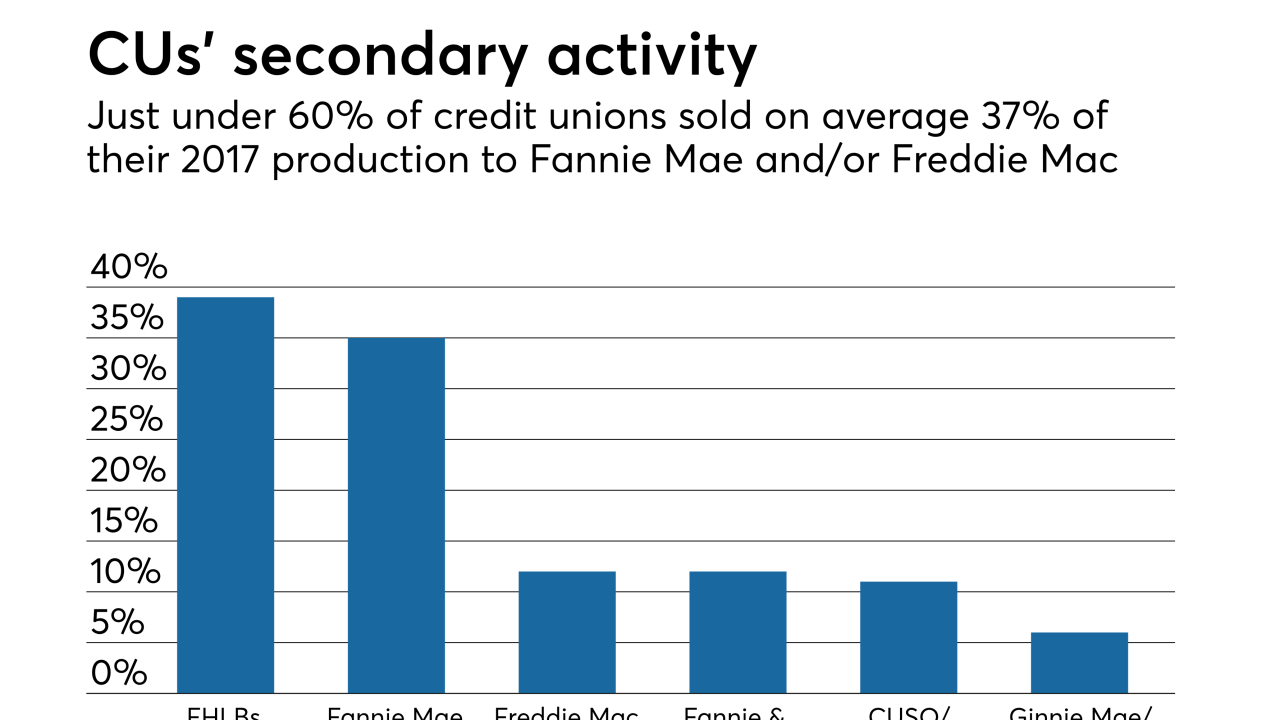

Credit unions favor housing finance reforms that would keep the government-sponsored enterprises or something similar in place, but add an explicit government guarantee to their mortgage-backed securities, according to a recent survey.

February 26 -

The 30-year fixed mortgage rate moved up for the seventh consecutive week with further increases possible as bond yields rise over concerns about higher inflation.

February 22 -

The Supreme Court dealt hedge funds and other big investors a blow Tuesday by refusing to revive core parts of lawsuits that challenged the federal government’s capture of billions of dollars in profits generated by Fannie Mae and Freddie Mac.

February 20 -

As the debate over housing reform heats up, policymakers should give careful consideration to a plan that recapitalizes the government-sponsored enterprises.

February 16 -

The House Financial Services Committee chairman is calling out Fannie Mae and Freddie Mac's regulator for authorizing payments to two housing trust funds while the mortgage giants have their own financial struggles.

February 16 -

Freddie Mac is now accepting bids on $420 million in nonperforming loans, its first NPL sale of 2018.

February 16 -

Freddie Mac posted a fourth-quarter net loss of $3.3 billion and will request $312 million from the Treasury after recent tax reform legislation forced it to write down the value of deferred tax assets.

February 15 -

Despite a legislative push by some senators and other stakeholders to jump-start housing finance reform, efforts to form consensus over a bill once again are stuck in neutral.

February 15 -

Mortgage rates rose to their highest level in almost four years, as worries over inflation drove the 10-year Treasury yield to just shy of 3%.

February 15 -

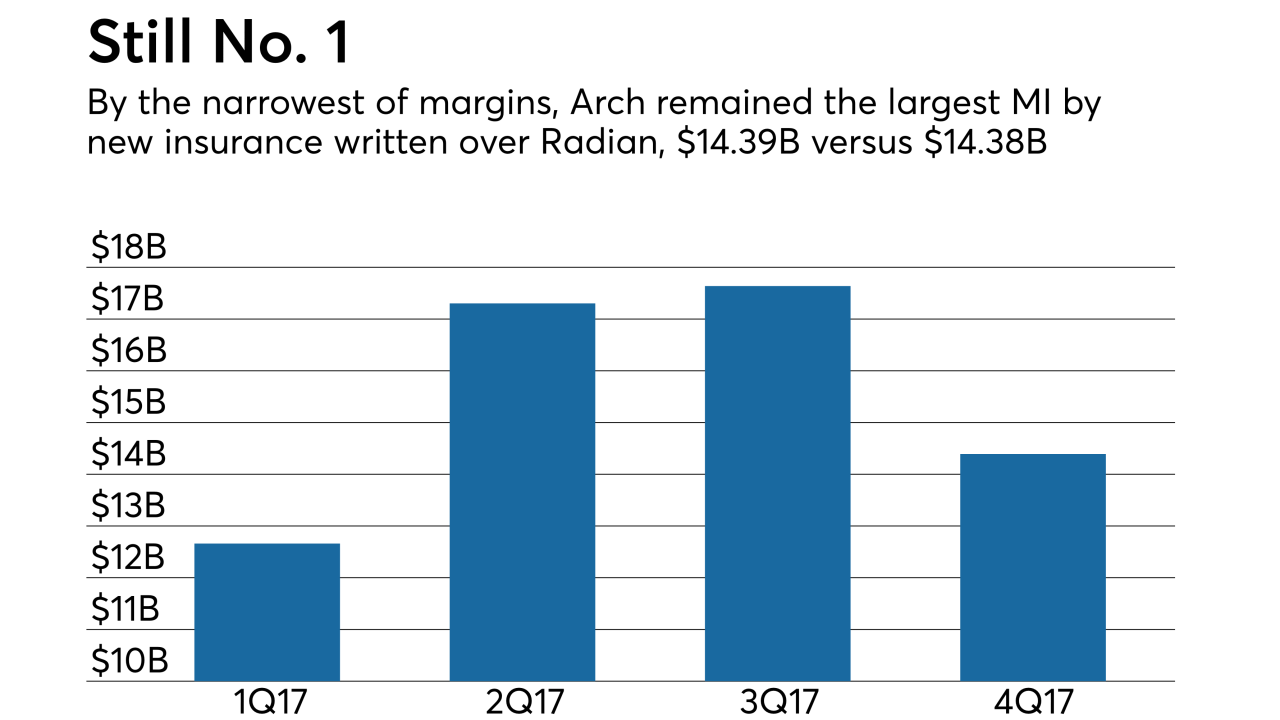

Arch Capital Group's mortgage insurance subsidiary increased its cushion under the secondary market capital standards in the fourth quarter even as its delinquent inventory grew.

February 13