-

Fannie Mae and Freddie Mac have new technology-driven initiatives planned for 2018 that are expected to help lenders improve the borrowing experience for home buyers and make full use of the government-sponsored enterprises' credit box.

December 26 -

The announcement Thursday that Treasury Secretary Steven Mnuchin and Federal Housing Finance Agency Director Mel Watt agreed to let Fannie Mae and Freddie Mac each build a $3 billion capital buffer avoided a potential crisis.

December 21 -

The tax reform bill Congress sent to President Trump's desk this week is likely to prompt at least a short-term spike in mortgage rates.

December 21 -

Fannie Mae and Freddie Mac will be allowed to build capital buffers to protect against losses under an agreement between the Treasury Department and the Federal Housing Finance Agency announced on Thursday.

December 21 -

For decades, Fannie Mae and Freddie Mac helped working-class Americans get mortgages. That essential and powerful role in the national economy is fading.

December 20 National Community Reinvestment Coalition

National Community Reinvestment Coalition -

The government-sponsored enterprises are at the heart of our housing finance problems, not the solutions.

December 20 American Action Forum

American Action Forum -

The two government-sponsored enterprises have relied on the “classic” FICO credit scoring model for the past 12 years. But the Federal Housing Finance Agency is weighing whether the GSEs should upgrade to more recent scoring alternatives.

December 20 -

Updated dynamic and interactive versions of Fannie Mae and Freddie Mac's redesigned Uniform Residential Loan Application are out.

December 20 -

Fannie Mae and Freddie Mac's final Duty to Serve plans are moving ahead with expanded support for manufactured housing through both single-family and multifamily programs, including controversial personal property loans.

December 18 -

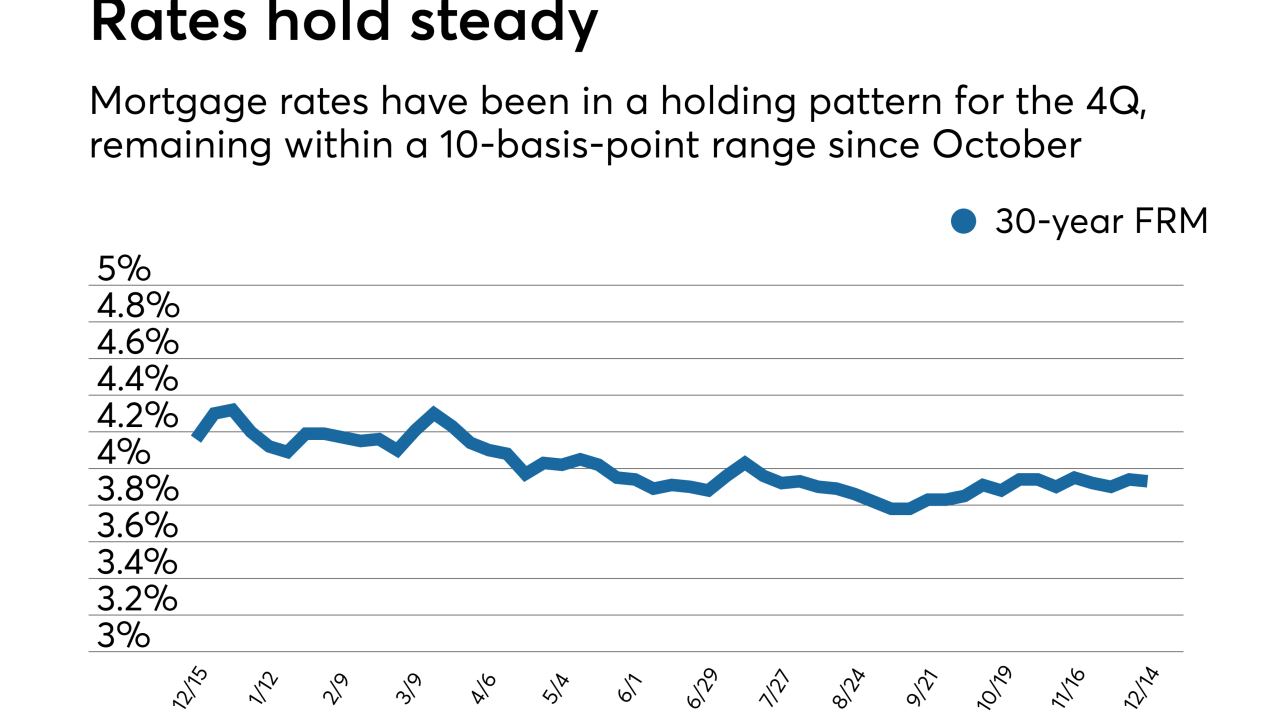

The mortgage market had already priced the Federal Open Market Committee's 25-basis-point hike into its rates so there was little change, according to Freddie Mac.

December 14 -

Freddie Mac is broadening its capital markets vehicles with its first offering of participation certificate securities backed by multifamily tax exempt loans.

December 13 -

Just over half of the collateral for the $883 million deal is eligible to be purchased by Fannie or Freddie; the bank itself contributed nearly half.

December 12 -

The $1.5 billion FREMF 2017-K1 has a in-trust stressed loan-to-value ratio of 120%, as measured by Kroll; that's projected to fall to 108.7% when the deal matures.

December 12 -

Fannie Mae and Freddie Mac will suspend the evictions of foreclosed single-family properties during the holiday season, according to the government-sponsored enterprises.

December 11 -

Until recently, there was a consensus among policymakers that Fannie Mae and Freddie Mac needed to be eliminated. That just changed. Here's why.

December 8 -

Freddie Mac on Thursday priced the first transaction to result from its pilot in the single-family rental market.

December 7 -

Mortgage rates ticked up this week, but a larger rise is possible next week depending on what Congress does about tax reform and the budget.

December 7 -

House Financial Services Committee Jeb Hensarling shifted tactics on housing finance reform Wednesday, acknowledging that a bill he’s pushed for years to virtually eliminate the government’s role in the mortgage market lacks the support to become law.

December 6 -

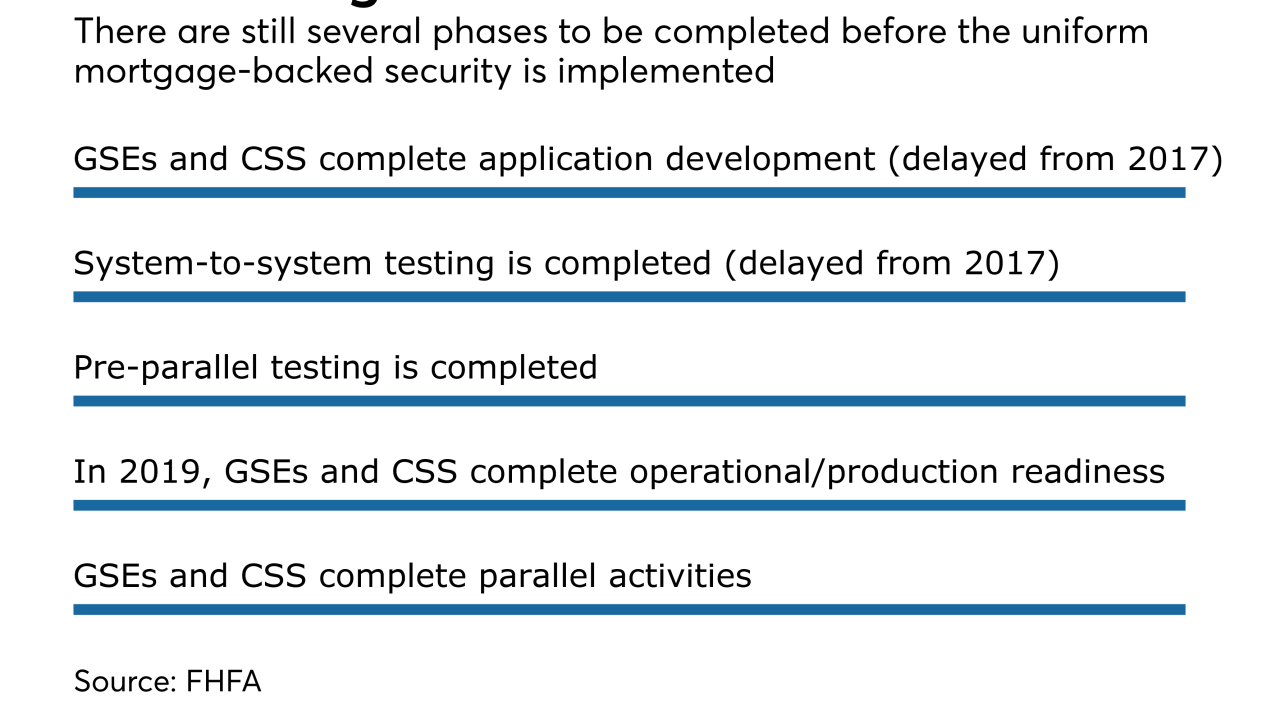

Testing of the common securitization platform is taking longer than expected, but the Federal Housing Finance Agency said it won't delay the 2019 launch of Fannie Mae and Freddie Mac's new single "uniform mortgage-backed security."

December 4 -

A provision in the original Senate tax reform bill would have required companies acquiring mortgage servicing rights to pay taxes upfront for their anticipated servicing income.

December 1