JPMorgan Chase

JPMorgan Chase is one of the largest and most complex financial institutions in the United States, with nearly $4 trillion in assets. It is organized into four major segmentsconsumer and community banking, corporate and investment banking, commercial banking, and asset and wealth management.

-

The result could play a big role in whether banks see more regulatory relief next year or policymakers can coalesce around a housing finance reform plan.

October 25 -

Rising mortgage interest rates not only will continue to constrain banks' once-robust revenue from this business, they will also affect existing borrower credit quality, a report from Moody's said.

October 19 -

Providing borrowers with an incentive to create financial reserves after closing is a better tool to prevent mortgage loan defaults than measures taken at underwriting, a JPMorgan Chase Institute study declared.

October 18 -

Mortgage-related earnings at five banks were lower due to the effect of higher interest rates on loan volume this year, even though late-season homebuyers improved consecutive-quarter origination numbers at three companies.

October 12 -

JPMorgan Chase is eliminating 400 positions in its mortgage banking unit, the latest lender to trim staff as a result of lower-than-expected demand in 2018.

October 5 -

Residential mortgage loan exchange provider Maxex has closed a new $38 million funding round it will use to improve and expand various aspects of its platform.

September 25 -

Moody's Investors Service downgraded JPMorgan Chase's prime jumbo mortgage originator assessment to its second-highest rating, citing the bank's growing reliance on correspondents with delegated underwriting authority and shortcomings in its technology infrastructure.

August 24 -

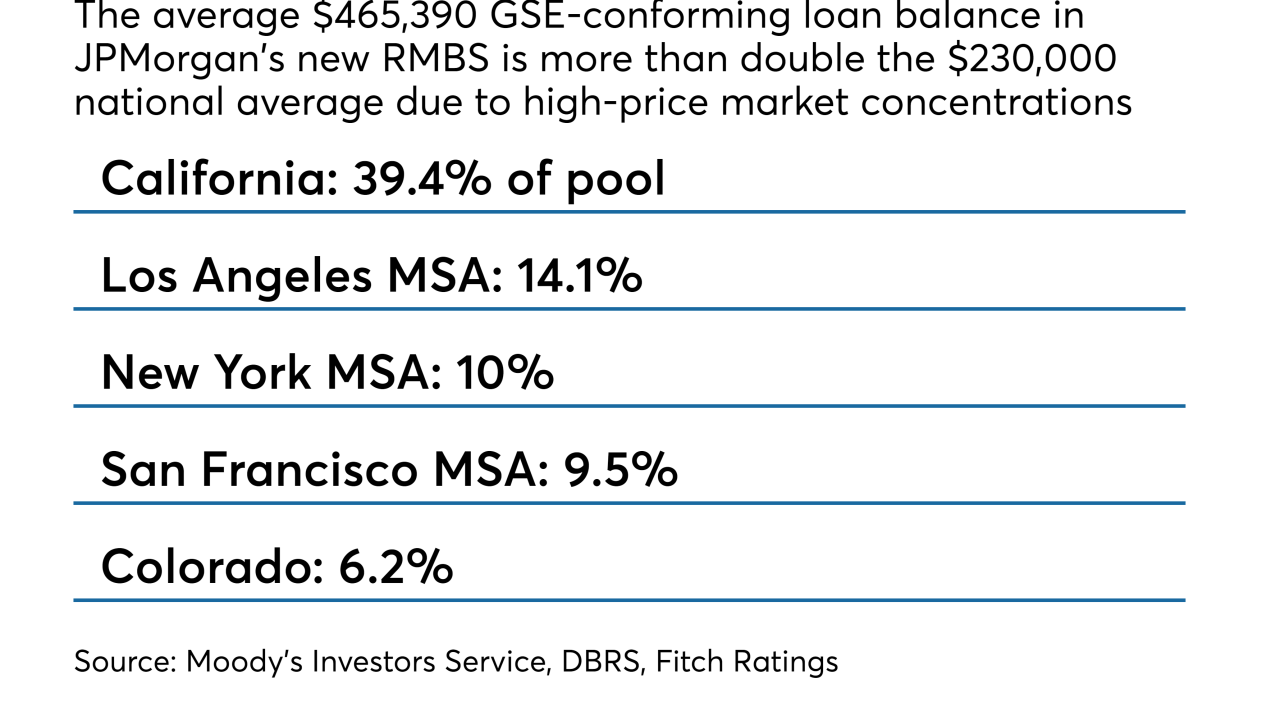

Nearly half the loans were derived outside J.P. Morgan's retail channel, a level not seen in its conforming and prime jumbo securitizations since 2017.

August 15 -

This year's sluggish spring home buying season led to generally softer mortgage-related second quarter results at Wells Fargo, JPMorgan Chase, Citigroup and PNC Financial Services Group, but First Republic Bank bucked the trend.

July 13 -

Banks could shed as much as 20 million square feet of office space over the next five years as they shift many functions to high-tech operations centers in markets with cheaper rents.

July 6