JPMorgan Chase

JPMorgan Chase is one of the largest and most complex financial institutions in the United States, with nearly $4 trillion in assets. It is organized into four major segmentsconsumer and community banking, corporate and investment banking, commercial banking, and asset and wealth management.

-

The company's fourth-quarter trading revenue declined notably more than analysts had expected, while its business and consumer lending each dropped 1% year over year.

January 14 -

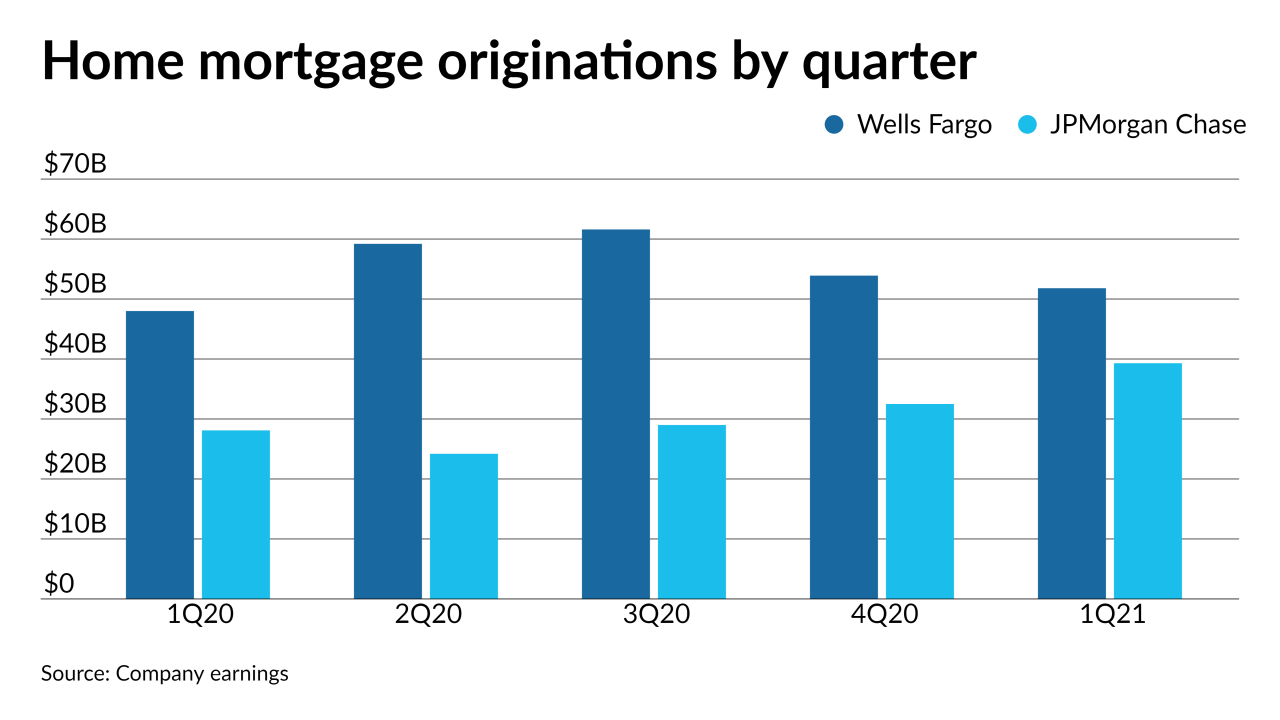

Their numbers suggest that the quarter’s home lending may be stronger than industry forecasts for a 6 to 13% decline.

April 14 -

JPMorgan Chase is going on the “offensive” in mortgages as home prices rise across the country, said Marianne Lake, the bank’s chief executive for consumer lending.

November 9 -

The company says it plans to originate 40,000 mortgages for Black and Hispanic households and finance 100,000 affordable rental units over five years.

October 8 -

The Mortgage Industry Standards Maintenance Organization drew up the recommended wording in consultation with a group of lenders and investors after the passage of the Taxpayers First Act last year.

September 30 -

Wall Street won big buying up homes during the foreclosure crisis and renting them out. Now, it's headed back to the suburbs in hopes of scoring again.

September 25 -

Perry Hilzendeger’s new role as president of mortgage servicing for Home Point Financial is in line with a previous role he had, and follows broader executive changes at Wells.

August 14 -

Deferrals on residential mortgages and home-equity loans have been a common theme at JPMorgan Chase, Bank of America, Wells Fargo and Citigroup since the start of the coronavirus pandemic.

August 5 -

JPMorgan Chase Asset and Wealth Management Private Bank is pooling over 400 seasoned mortgage loans from its high-net worth clients. The loans are considered low-risk, but were not tested against CFPB qualified-mortgage standards.

July 23 -

The national conversation around systemic racism has compelled large banks to withdraw support from the “disparate impact” proposal. But community banks maintain that the proposed reforms would reduce frivolous claims.

July 20 -

Rocket Cos. profits were over 35 times greater than what it disclosed for the first quarter.

July 17 -

The Minneapolis company said 75% transactions have been handled online since the pandemic hit.

July 15 -

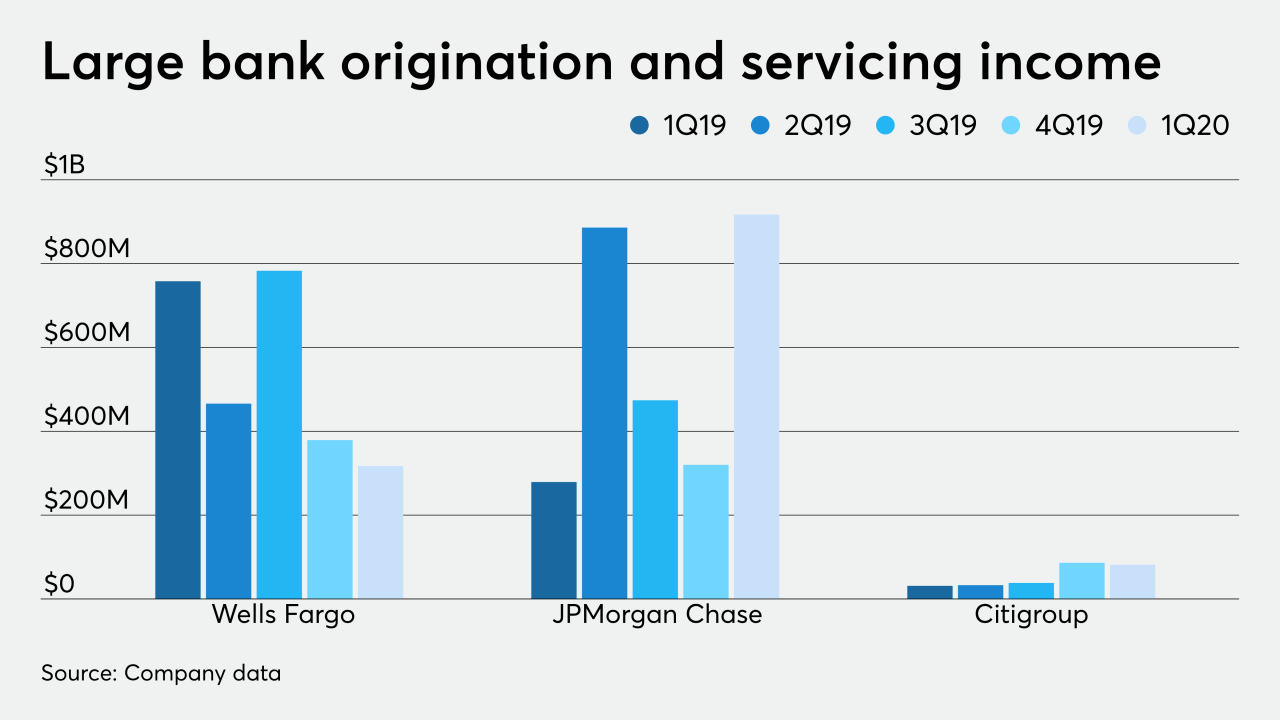

The banks logged strong year-over-year growth in gain-on-sale margins for mortgage loans.

July 14 -

As protesters continue to take to the streets to express outrage over racial injustice and inequality, banks — for the first time — will commemorate the date that marks the end of slavery in the U.S.

June 16 -

As they prepare to exit government conservatorship, Fannie Mae and Freddie Mac have enlisted the investment banks to help them boost capital and evaluate market opportunities.

June 15 -

Lenders are cautioning not only that second-quarter provisions might exceed the spike seen earlier this year, but also that credit costs could be elevated into 2021 if the economic slowdown drags on or fears of a second coronavirus wave are borne out.

June 11 -

Kalahari Resorts defaulted on a $347 million mortgage originated by JPMorgan Chase

May 27 -

JPMorgan Chase's asset-management unit and joint-venture partner American Homes 4 Rent are betting on the Las Vegas rental market.

May 14 -

A negative Federal Reserve policy rate is still improbable, but if it were to happen it could be a net benefit, according to a note from JPMorgan Chase.

May 13 -

Wells Fargo will temporarily stop accepting applications for home equity lines of credit, following a similar move by rival JPMorgan Chase.

April 30