-

Bank jumbo mortgage underwriting standards weakened in the third quarter by the most in three years and as profitability remains under pressure, loosening should continue at an accelerated pace, a Moody's report said.

November 16 -

While all portions of mortgage credit underwriting standards have slipped since the early post-crisis period, it is the deteriorating conditions that most increases vulnerability for future loan quality, a Moody's report said.

October 29 -

Rising mortgage interest rates not only will continue to constrain banks' once-robust revenue from this business, they will also affect existing borrower credit quality, a report from Moody's said.

October 19 -

Moody's Investors Service downgraded JPMorgan Chase's prime jumbo mortgage originator assessment to its second-highest rating, citing the bank's growing reliance on correspondents with delegated underwriting authority and shortcomings in its technology infrastructure.

August 24 -

Fannie Mae and Freddie Mac enjoy considerable advantages because of their lower cost of capital and significant government subsidies. But with some conforming loans, the private market is finding a way to compete.

July 3 -

Commercial mortgage bonds are getting stuffed with the lowest-quality loans since the financial crisis by one measure, according to Moody's Investors Service.

June 1 -

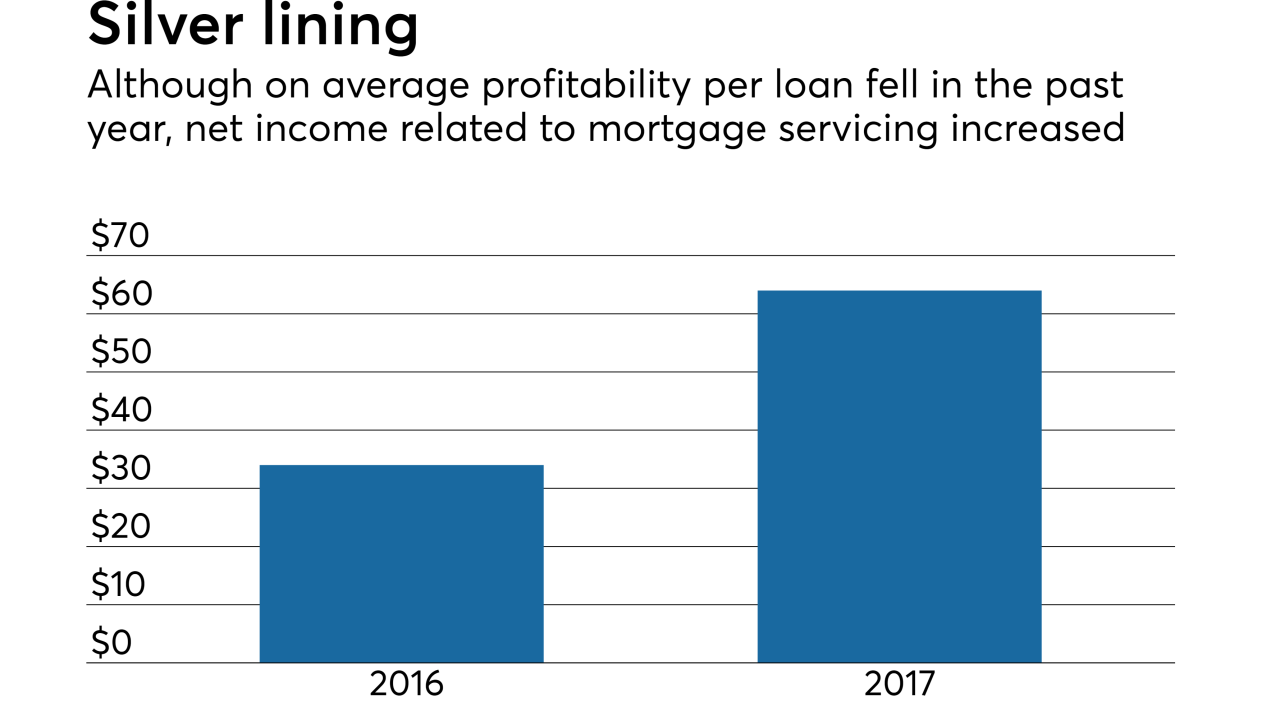

Mortgage servicers growing due to acquisitions or the increased value of servicing in the market could remain under pressure if these strategies don't outweigh other rising costs they face.

May 7 -

Lender and servicers are increasingly using nontraditional methods such as "hybrid" appraisals and broker price opinions in an attempt to cut costs, but some are more reliable than others.

February 21 -

The supply-demand outlook in commercial real estate markets took a slight dip nationwide for the first time since early 2016 and financing for some CRE property types is getting more difficult to arrange.

November 10 -

The 4,443 single-family rental homes securing Starwood Waypoint Homes 2017-1 have an average age of 30 years, older than any previous transaction by the sponsor, but are bringing in more than $1,700 apiece in monthly rent.

September 6 -

Managing portfolios for an influx of servicing rights investors helps mortgage companies augment revenue and keep rising costs and compliance risks in check.

June 19 -

New entrants in mortgage servicing are rethinking how business is done, creating more division between holders of mortgage servicing rights and the entities that actually manage loans.

June 13 -

Canadian government officials delivered a vote of confidence in the country’s housing sector and banking system, telling lawmakers that Vancouver and Toronto’s real estate markets are supported by fundamentals that leave risks well-contained.

May 19 -

The next single-asset CMBS to hit the market is backed by the land under an iconic Manhattan address known as the Lipstick Building.

May 5 -

Consolidation among large independent mortgage bankers is likely as several lack the financial wherewithal to deal with the changing environment, Moody's said.

March 31