-

Third-quarter profitability fell to 2008 levels in the Mortgage Bankers Association's latest report, suggesting the seasonally slower fourth quarter could be particularly challenging this year.

November 29 -

The rush in holiday shopping also boosted the housing market as mortgage applications increased 5.5% from one week earlier, according to the Mortgage Bankers Association.

November 28 -

The proposal by Fannie and Freddie’s regulator to impose bank-like capital requirements would be relevant only if the companies leave conservatorship. But that hasn’t stopped lenders from requesting changes.

November 26 -

Mortgage application activity decreased 0.1% from one week earlier as refinance volume tanked, although interest rates fell, according to the Mortgage Bankers Association.

November 21 -

Borrowers buying new homes produced fewer loan applications than they did a year earlier due to October's rising interest rates.

November 16 -

Mortgage application activity decreased 3.2% from one week earlier as interest rates rose to eight-year highs and refinancings fell to an 18-year low, according to the Mortgage Bankers Association.

November 14 -

Mortgage delinquencies inched up, in part from natural disasters hindering homeowner performance, but a stronger economy is still keeping defaults low, according to the Mortgage Bankers Association.

November 8 -

Real estate and mortgage industry groups outspent proponents 3-to-1 to defeat Proposition 10, a measure to allow California municipalities to set local rent control laws.

November 7 -

Mortgage application activity dropped to its lowest level since December 2014 as interest rates reached an eight-year high, according to the Mortgage Bankers Association.

November 7 -

The Federal Housing Finance Agency is leaving the government-sponsored enterprises' multifamily caps for 2019 unchanged at $35 billion per agency, but is making other changes to prerequisites for excluded loans.

November 6 -

While the foreclosure crisis is over and federal regulators are being less assertive on enforcement actions, mortgage servicers must remain vigilant about compliance, as state agencies are stepping up their own oversight, according to Standard & Poor's.

November 6 -

The amount of mortgage credit available to consumers increased to a post-crisis high in October in reaction to more first-time homebuyers entering the market, the Mortgage Bankers Association said.

November 6 -

Hiring by nonbank mortgage lenders and brokers ebbed in September as the housing market prepares to pack it in for the colder months.

November 2 -

Mortgage applications decreased 2.5% from one week earlier as purchase activity compared with 2017 fell for the first time in nearly three months, according to the Mortgage Bankers Association.

October 31 -

Protecting consumers from intrusive cold calls and fax-spamming is having adverse effects on the mortgage industry as the Federal Communications Commission fails to reasonably interpret language under the Telephone Consumer Protection Act, according to the Mortgage Bankers Association.

October 25 -

High property values and low mortgage rates pushed commercial and multifamily originations beyond their projected totals in 2017 to a new market peak, according to the Mortgage Bankers Association.

October 25 -

An increase in refinance activity in the period after Columbus Day drove mortgage applications 4.9% higher from one week earlier, according to the Mortgage Bankers Association.

October 24 -

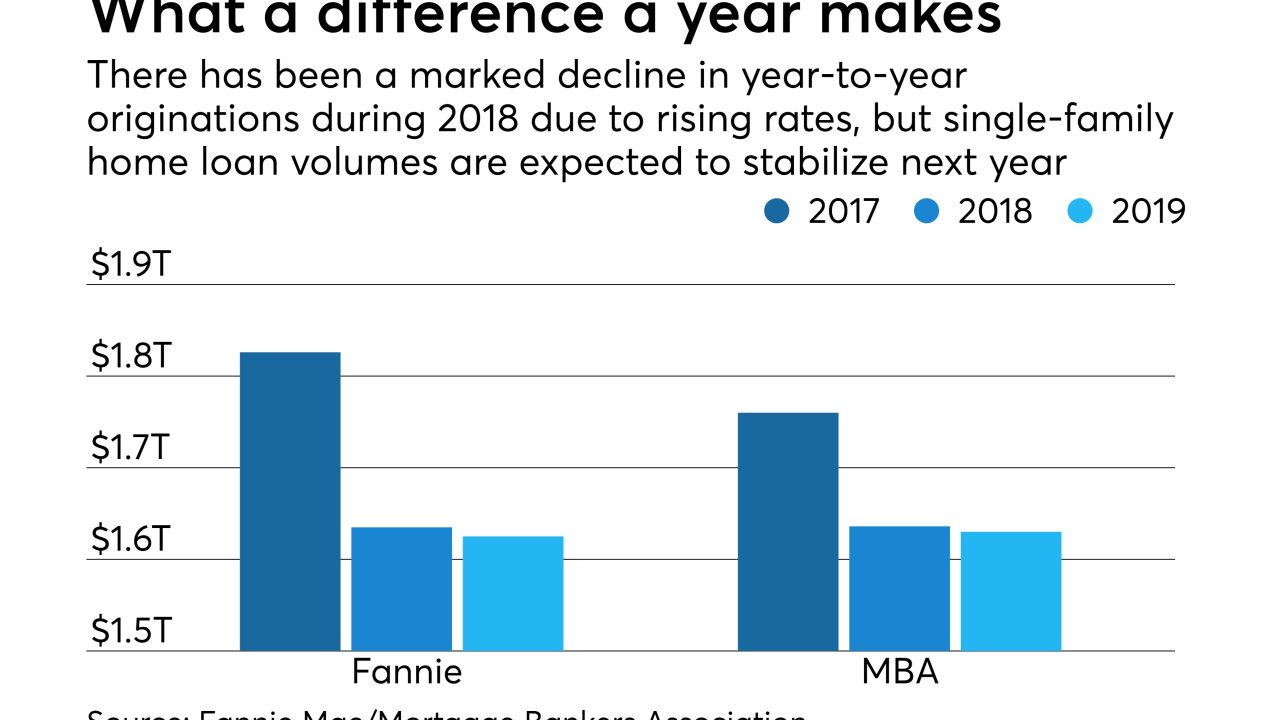

Increasing pessimism about housing is driving Fannie Mae's estimates for originations this year down a little further.

October 18 -

Former Chair Janet Yellen defended the Fed, expressed worry for the economy and gave advice to women on the rise at the MBA Annual Convention this week.

October 17 -

Mortgage applications decreased sharply from one week earlier as key interest rates stayed above 5%, although purchase volume grew from a year ago, the Mortgage Bankers Association reported.

October 17