-

While the foreclosure crisis is over and federal regulators are being less assertive on enforcement actions, mortgage servicers must remain vigilant about compliance, as state agencies are stepping up their own oversight, according to Standard & Poor's.

November 6 -

The amount of mortgage credit available to consumers increased to a post-crisis high in October in reaction to more first-time homebuyers entering the market, the Mortgage Bankers Association said.

November 6 -

Hiring by nonbank mortgage lenders and brokers ebbed in September as the housing market prepares to pack it in for the colder months.

November 2 -

Mortgage applications decreased 2.5% from one week earlier as purchase activity compared with 2017 fell for the first time in nearly three months, according to the Mortgage Bankers Association.

October 31 -

Protecting consumers from intrusive cold calls and fax-spamming is having adverse effects on the mortgage industry as the Federal Communications Commission fails to reasonably interpret language under the Telephone Consumer Protection Act, according to the Mortgage Bankers Association.

October 25 -

High property values and low mortgage rates pushed commercial and multifamily originations beyond their projected totals in 2017 to a new market peak, according to the Mortgage Bankers Association.

October 25 -

An increase in refinance activity in the period after Columbus Day drove mortgage applications 4.9% higher from one week earlier, according to the Mortgage Bankers Association.

October 24 -

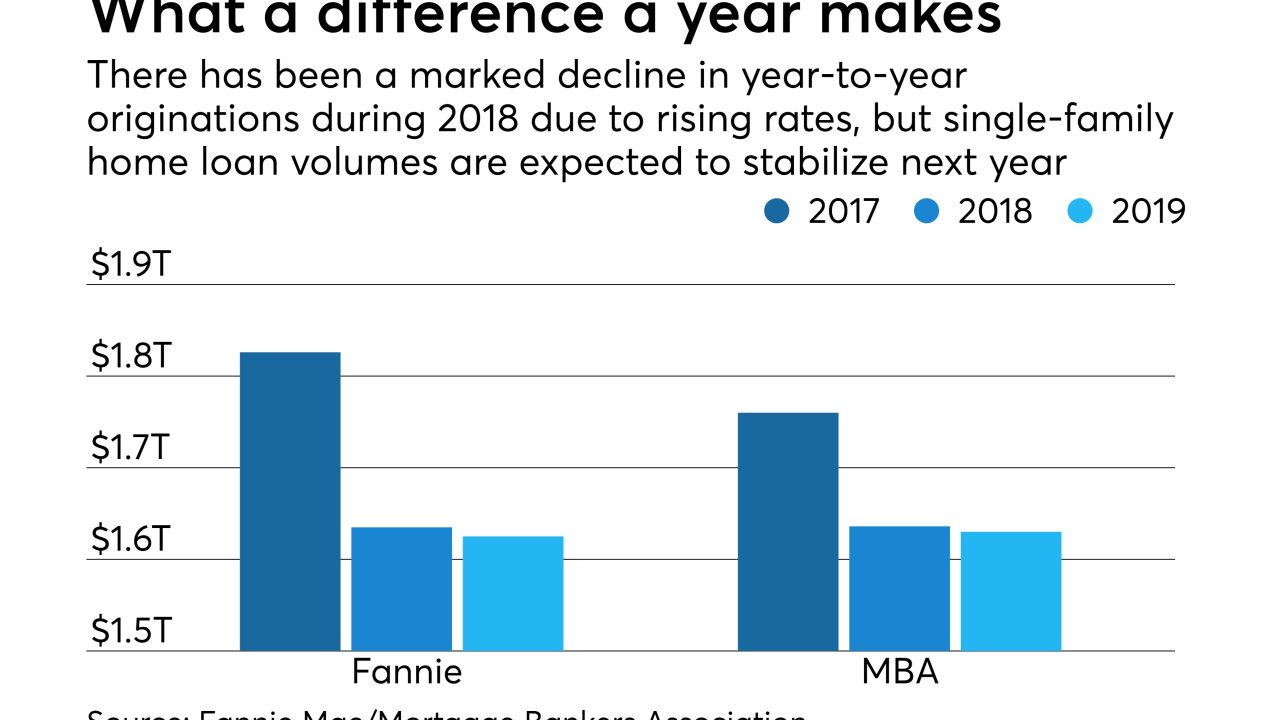

Increasing pessimism about housing is driving Fannie Mae's estimates for originations this year down a little further.

October 18 -

Former Chair Janet Yellen defended the Fed, expressed worry for the economy and gave advice to women on the rise at the MBA Annual Convention this week.

October 17 -

Mortgage applications decreased sharply from one week earlier as key interest rates stayed above 5%, although purchase volume grew from a year ago, the Mortgage Bankers Association reported.

October 17 -

While mortgage volume is expected to shrink next year, it should increase during the following two years and beyond as millennials start buying homes, the Mortgage Bankers Association forecasts.

October 16 -

The consumer bureau’s interim chief told an industry conference that “regulation by enforcement is done.”

October 15 -

The Federal Housing Administration is looking to streamline its single-family loan servicing requirements to align them with industry standards and upgrade outdated technology.

October 15 -

Ex-Ginnie Mae President Joseph Murin is among several industry veterans joining Ainsworth Advisors, a consultancy run by former mortgage banker David Lykken and former Texas Capital Bank executive Gary Ort.

October 15 -

As the mortgage industry confronts tight margins, shifting market share and regulatory uncertainty, a new leader emerges at the Mortgage Bankers Association.

October 14 -

It's a critical time in Washington, with many key institutions in the mortgage and housing industries getting new leaders. At the Mortgage Bankers Association, there's a renewed focus on maintaining effective influence with decision makers on initiatives like housing finance reform, innovation and the evolving needs of home buyers.

October 14 -

From discussing the future of mortgage tech to debating the shifting sands of political policies, here's a preview of the big issues, topics and ideas when the industry gathers in the nation's capital for the Mortgage Bankers Association's Annual Convention & Expo.

October 12 -

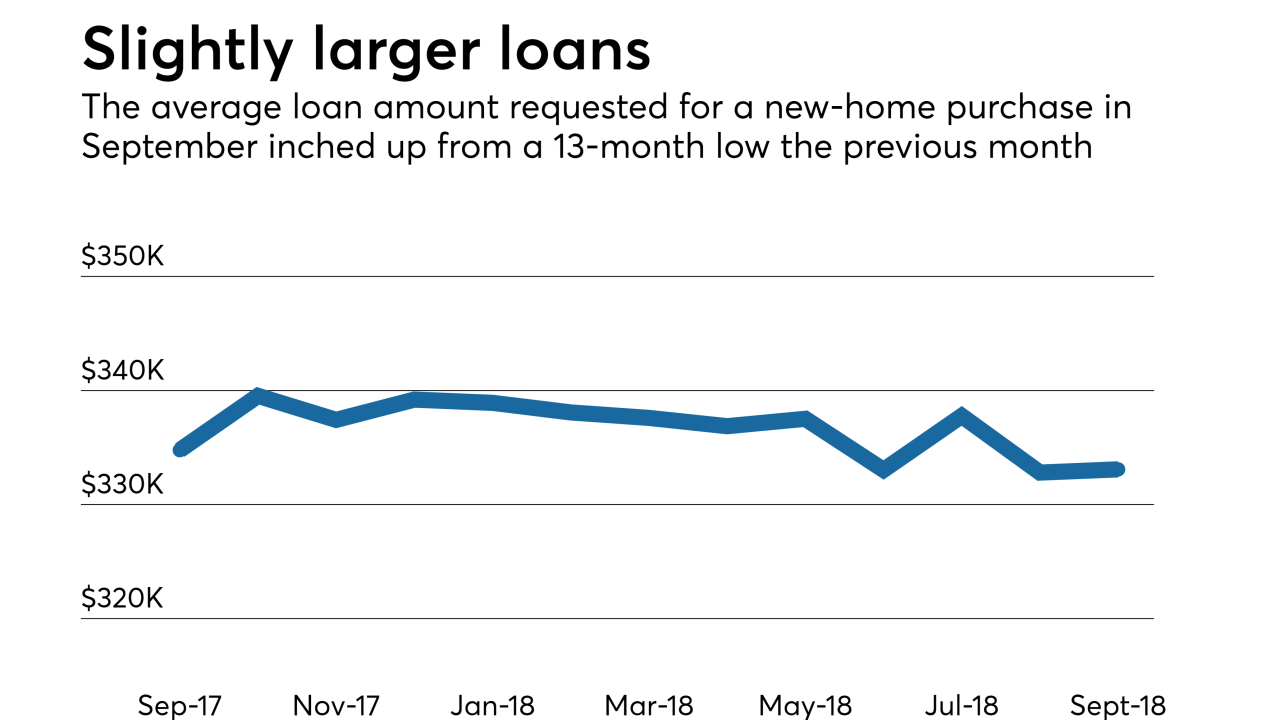

Mortgage borrowers buying new homes generated more loan applications this September than they did a year ago, even though interest rates are higher this year.

October 11 -

Proposition 10 would give local jurisdictions a freer hand to restrict rents, but critics say that would lead to property devaluations. Some see an effect regardless of whether the measure passes.

October 10 -

Mortgage applications fell last week as rates for the 30-year fixed conforming loan topped 5% for the first time since 2011, the Mortgage Bankers Association reported.

October 10