-

The Senate tax reform proposal could force servicers to pay tax upfront on income that is currently tax deferred, according to the Mortgage Bankers Association and the Consumer Mortgage Coalition.

November 28 -

Mortgage applications rose slightly this week, increasing 0.1% from a week earlier, according to the Mortgage Bankers Association.

November 22 -

The three major hurricanes that caused so much devastation during August and September was largely responsible for the third-quarter increase in mortgage delinquencies.

November 17 -

Mortgage application activity rose 3.1% from one week earlier as refinance demand increased, according to the Mortgage Bankers Association.

November 15 -

A bill that would ease Basel III capital requirements on commercial real estate loans could level the playing field between depository and nonbank lenders and spur more construction lending if it passes in the Senate.

November 10 -

A slight decrease in the number of jumbo investor offerings contributed to lower consecutive-month credit availability in October, according to the Mortgage Bankers Association.

November 8 -

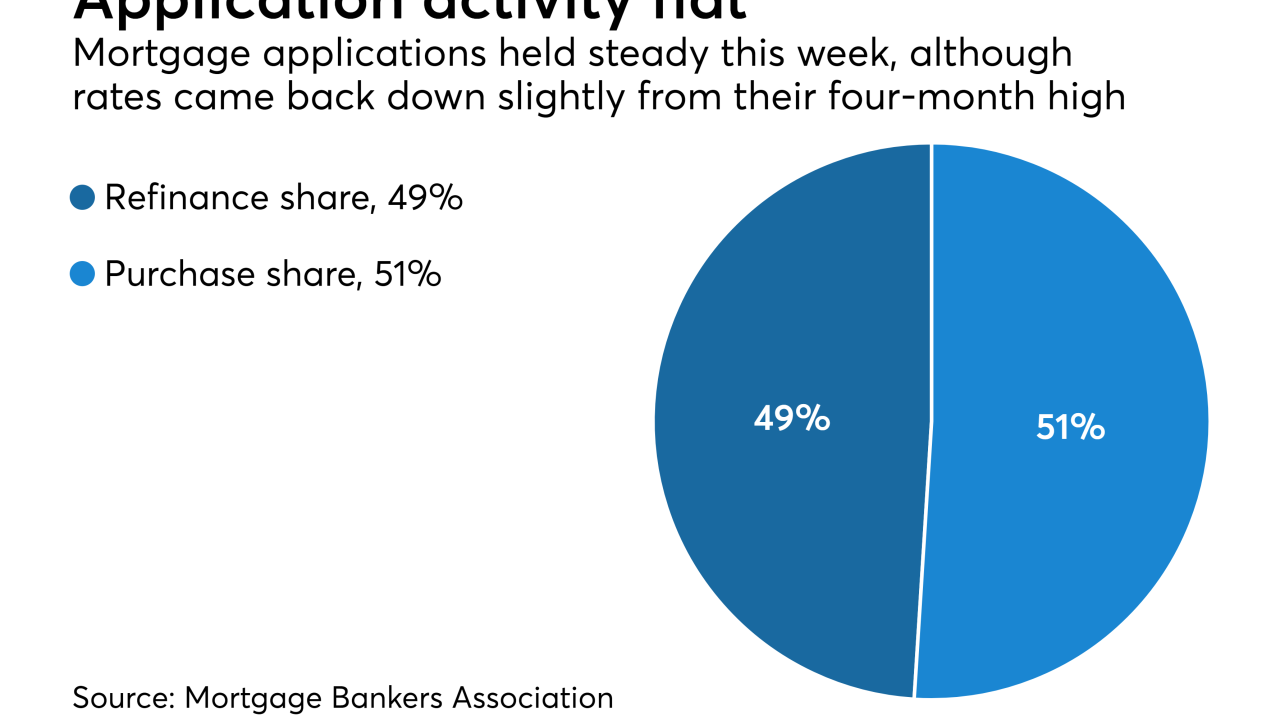

Mortgage application activity was unchanged from one week earlier although rates came back down slightly from their four-month high, according to the Mortgage Bankers Association.

November 8 -

From Secretary Carson easing lending concerns to Fannie Mae announcing its expansion of Day 1 Certainty, here's a look at seven things we learned at the 2017 MBA Annual.

November 3 -

A House Republican tax proposal that infuriated housing groups and sent homebuilder stocks sliding would only have a modest impact on the market for new homes and could end up being a net positive for the industry, according to Keefe, Bruyette & Woods analysts.

November 3 -

Mortgage rates rose to their highest level since July, leading to a 2.6% decrease in loan applications from one week earlier, according to the Mortgage Bankers Association.

November 1 -

Commercial and multifamily originations are projected to surpass the 2007 market peak this year, according to the Mortgage Bankers Association.

October 27 -

Days after revealing he was in full remission from cancer, David H. Stevens said he is retiring as president and CEO of the Mortgage Bankers Association.

October 25 -

Mortgage applications decreased 4.6% from one week earlier because of higher rates for conforming and government loans, according to the Mortgage Bankers Association.

October 25 -

Continued economic growth, a strong jobs market and higher wages will lead to a 7.3% increase in purchase origination volume next year, according to the Mortgage Bankers Association.

October 24 -

The CFPB's practice of "regulation by enforcement" forces mortgage companies to develop compliance standards based on the mistakes of their peers, rather than clear guidance from the enforcement agency, said David Motley, the new chairman of the Mortgage Bankers Association.

October 23 -

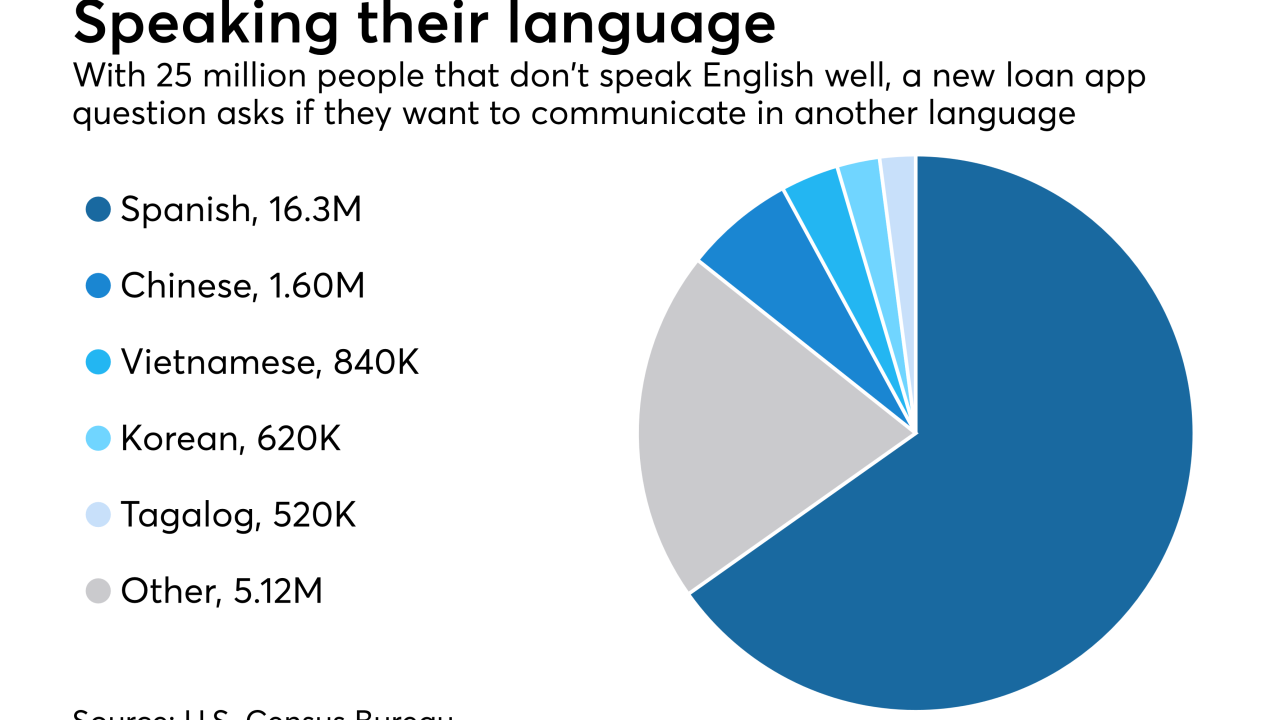

The Federal Housing Finance Agency added a language preference question to the loan application, rejecting the mortgage industry's wishes.

October 20 -

Mortgage applications increased 3.6% from one week earlier even though rates remained mostly flat during the period, according to the Mortgage Bankers Association.

October 18 -

Hurricanes Harvey and Irma affected new-home sales in Texas and Florida, resulting in a 7.5% year-over-year decline in mortgage applications to purchase these properties in September.

October 16 -

The share of mortgage refinance applications dropped below 50% for the first time since the start of September, as interest rates rose to a six-week high.

October 11 -

Slightly looser underwriting outside the government sector is primarily responsible for the latest increase in credit availability.

October 10