-

Anticipated increases in 2019 mortgage rates also come with an expected 1 million households eliminated from affording the median-priced new home with every hike of 25 basis points, according to the National Association of Home Builders.

January 11 -

Sentiment among homebuilders fell in December to the lowest level since 2015, missing all forecasts and signaling that the industry's struggles are intensifying amid elevated prices and higher borrowing costs.

December 17 -

The nation is suffering from a housing affordability crisis and lower construction costs and increased government subsidies can ease the pain, consumers state in a National Association of Home Builders survey.

December 7 -

Confidence among homebuilders plummeted by the most since 2014 as the highest borrowing costs in eight years restrain demand, adding to signs of a cooling housing market that will weigh on the Federal Reserve's debate over how far to raise interest rates.

November 19 -

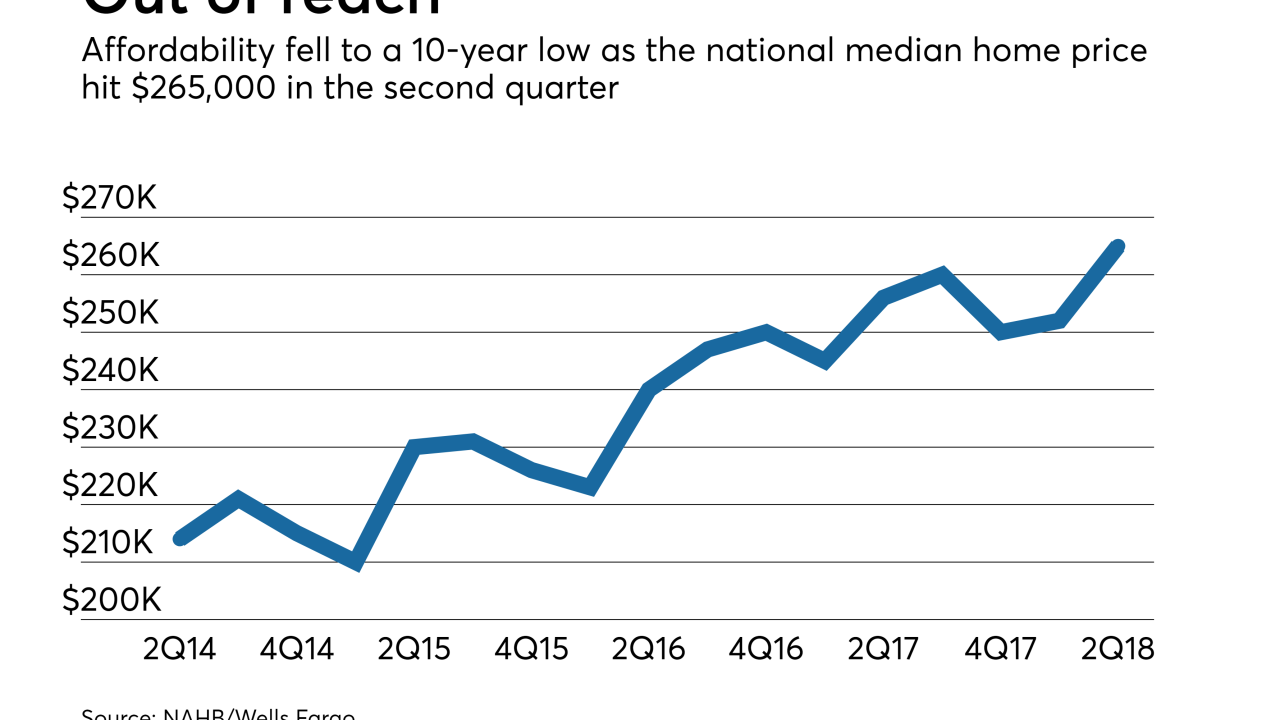

Rising home prices and climbing mortgage rates pulled down affordability to the lowest point since before the housing market crash.

November 9 -

New-home construction fell in September on a decline in the South that may reflect disruptions from Hurricane Florence, government figures showed Wednesday.

October 17 -

Confidence among homebuilders unexpectedly rose in October, registering the first gain in five months amid falling lumber prices and solid demand.

October 16 -

New-home construction rose more than forecast to a three-month high in August, while permits unexpectedly saw the biggest drop since February 2017, adding to signs that homebuilding is struggling to stabilize.

September 19 -

Confidence among homebuilders stabilized in September as demand held up and lumber prices fell, a National Association of Home Builders/Wells Fargo report showed.

September 18 -

As the demand for home rentals continues to rise, regulatory burdens could decrease the multifamily housing supply and drive up costs, witnesses said at a congressional hearing.

September 5 -

The average new home in the U.S. went for $324,467 in June, 28% more than the $254,200 price for existing homes.

September 4 -

Confidence among homebuilders fell to an 11-month low in August on rising construction costs and shortages of skilled labor, a National Association of Home Builders/Wells Fargo report showed.

August 15 -

The reliance on nonconventional financing to fund new single-family housing is dropping, with the share accounting for less than a third of the market for the second year in a row.

August 13 -

Housing market conditions pushed affordability to a 10-year low in the second quarter, according to the National Association of Home Builders/Wells Fargo Housing Opportunity Index.

August 10 -

The 55+ housing market showed continued strength in the first quarter on healthier economic conditions, but high lumber prices are causing hurdles for homebuilders trying to keep up with consumer demand.

August 3 -

Homebuilding industry leaders are pledging to train more laborers as part of an executive order from President Trump, marking an important step forward for the residential construction sector.

July 30 -

Confidence among homebuilders held steady in July, matching the lowest level of the year, as solid job gains support demand while elevated material costs pressure developers.

July 17 -

Sentiment among homebuilders fell in June to match the lowest level this year, reflecting sharply elevated lumber costs, according to a report from the National Association of Home Builders/Wells Fargo.

June 18 -

Regulation imposed by all levels of government accounts for 32% of multifamily development costs, according to the National Association of Home Builders and the National Multifamily Housing Council.

June 15 -

Maintenance and renovations aren't keeping up with the nation's aging housing stock, creating an influx of obsolete properties that's adding further strain to an already tight inventory of homes for sale.

June 15