-

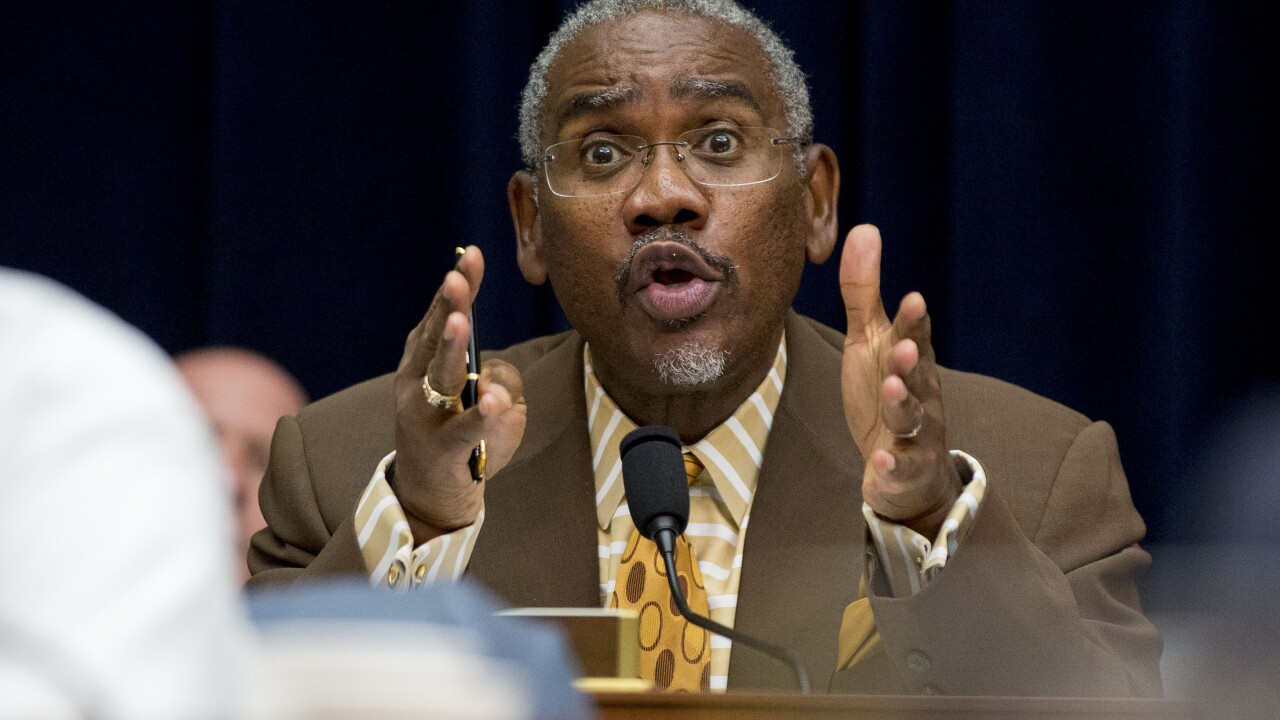

In his first of two Capitol Hill hearings this week, Democrats hammered the acting director of the Consumer Financial Protection Bureau for ignoring what they view as the agency's core purpose.

April 11 -

Momentum to overhaul the mortgage finance system had been slipping, and with Democrats divided over the Senate's banking relief bill there's virtually no chance more bipartisan deals can be worked out.

April 2 American Banker

American Banker -

One purpose of the Senate bill was for small banks to rein in skyrocketing costs, but some bankers question whether the changes will save them money, and adapting to the reforms may even increase spending.

March 28 -

With the Senate finishing its work on a regulatory relief package, a showdown in the House still looms while critics of Dodd-Frank weigh whether this is their last shot at unwinding it.

March 14 -

Former Rep. Barney Frank rejected concerns voiced by other Democrats that a Senate bill rolling back some provisions of the Dodd-Frank Act will fuel another financial crisis.

March 13 -

Unable to come to an agreement on which and how many amendments will be offered to a Dodd-Frank regulatory relief bill, the Senate will have to return next week before voting on the legislation.

March 8 -

The Senate is poised to pass the most substantial bank regulatory relief since the crisis, but any disruption of the post-crisis regime is still eclipsed by how much the bill enshrines Dodd-Frank.

March 2 -

House Chief Deputy Whip Patrick McHenry, R-N.C., said House lawmakers are having discussions with the Senate about ways to go further on rolling back Dodd-Frank before the Senate is expected to hold a floor vote.

February 26 -

As a bipartisan regulatory relief bill approaches the finish line in the Senate, the House has mostly stood on the sidelines. But no one expects the lower chamber to just rubber-stamp the deal.

February 23 -

Analysts believe a bipartisan coalition supporting limited regulatory relief will hold, but the toxic political environment and more looming budget battles to come could obstruct the banking bill's path.

January 25 -

Senate negotiators are working on a bill that would place Fannie Mae and Freddie Mac into receivership and replace them with multiple mortgage guarantors, according to sources.

January 18 -

Progressives have been setting off alarm bells this week over the Senate’s bill to ease some Dodd-Frank rules, but the changes are more modest than many assume.

January 17IntraFi Network -

Sen. Elizabeth Warren, D-Mass., was the only member of the Senate Banking Committee to oppose the nomination of Federal Reserve Board Gov. Jerome Powell to lead the central bank.

December 5 -

The ill will between Democrats and Republicans in the controversy over appointing an acting Consumer Financial Protection Bureau chief adds a new wrinkle to bipartisan efforts to pass regulatory relief.

December 1 -

Brian Montgomery seems on his way to being confirmed to lead the Federal Housing Administration. But once he gets there, he may find it difficult to be as innovative as he was during his first stint as commissioner — particularly when it comes to reducing FHA premiums.

November 29 -

The Senate Banking Committee voted to advance the nomination of Brian Montgomery to serve as commissioner of the Federal Housing Administration, despite ongoing criticism from some Democrats that he is too close to the financial services industry.

November 28 -

The regulatory relief bill would raise the SIFI threshold to $250 billion of assets and allow mortgages held in portfolio to be counted as "qualified," among other items, but it is far less sweeping than institutions had hoped.

November 13 -

Congress may soon try to limit the personal identifiable information that companies and the government can collect on consumers based on their reaction to the massive data breach at Equifax.

October 4 -

Sen. Bob Corker has been a key voice in the housing finance reform debate. His departure at the end of next year puts a deadline of sorts on his efforts to unwind and replace Fannie Mae and Freddie Mac.

September 26 -

Democrats have strived to paint recent scandals at Wells Fargo and Equifax as prime examples of why a regulatory rule banning mandatory arbitration agreements should be upheld, but Republicans are not wavering in their campaign to overturn it.

September 21