-

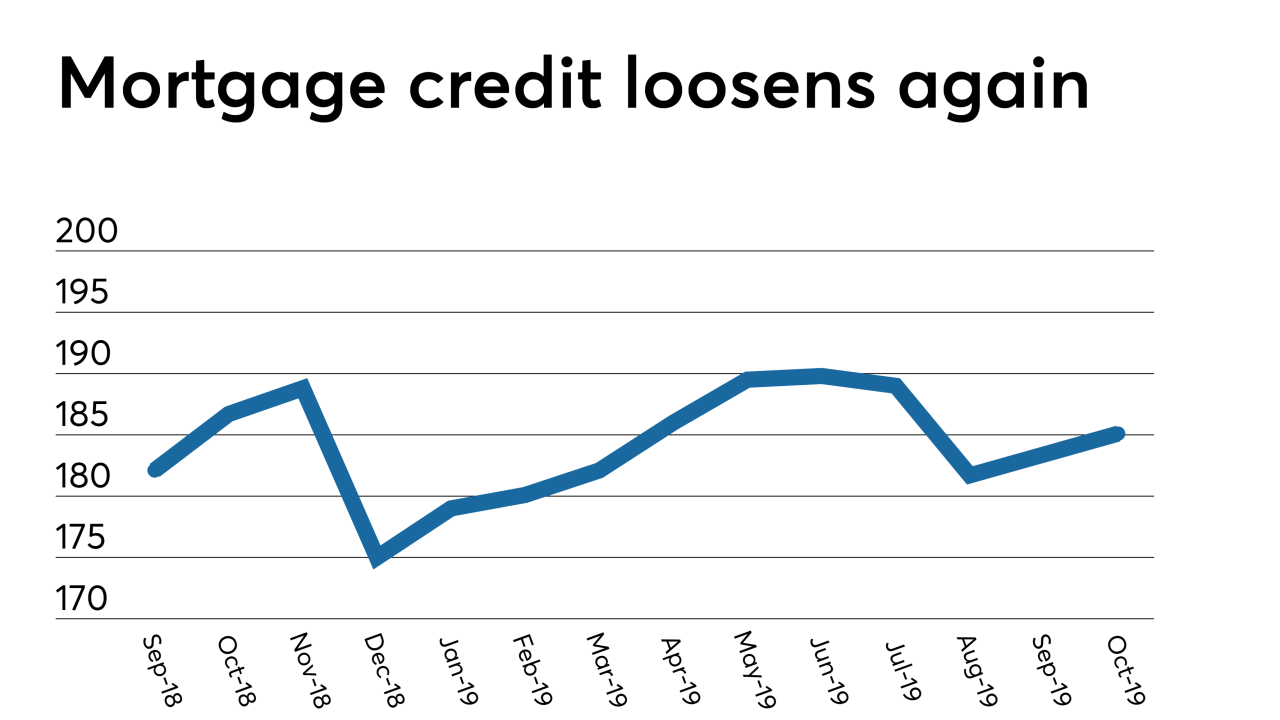

Mortgage credit availability increased in October from the previous month, as mortgage lenders increased their product offerings outside the government market, according to the Mortgage Bankers Association.

November 12 -

The dollar volume of mortgages guaranteed by the Department of Veterans Affairs rose nearly 9% in the past fiscal year as interest-rate reduction refinancing loans surged nearly 75%.

November 11 -

It was activity at the upper end of the housing market that helped to keep mortgage application volume level with the previous week, the Mortgage Bankers Association said.

November 6 -

From the Tennessee-Kentucky border through coastal North Carolina, here are the 15 metro areas where millennial VA purchase-loan activity increased the most over the past fiscal year.

November 5 -

Mortgage applications increased slightly from one week earlier even as rates reached their highest level since July, according to the Mortgage Bankers Association.

October 30 -

Interest rate swings during this past week resulted in a decline in both refinance and purchase mortgage applications compared with the previous period, according to the Mortgage Bankers Association.

October 23 -

Mortgage applications increased 0.5% from one week earlier, although interest rate instability affected consumers' ability to get the best price for their loan, according to the Mortgage Bankers Association.

October 16 -

The Department of Veterans Affairs distributed more than $400 million in refunded home loan fees after finding exempt borrowers were mistakenly charged due to clerical errors related to their disability status.

October 10 -

Mortgage applications jumped 5.2% from one week earlier as a drop in rates caused another surge in refinances, according to the Mortgage Bankers Association.

October 9 -

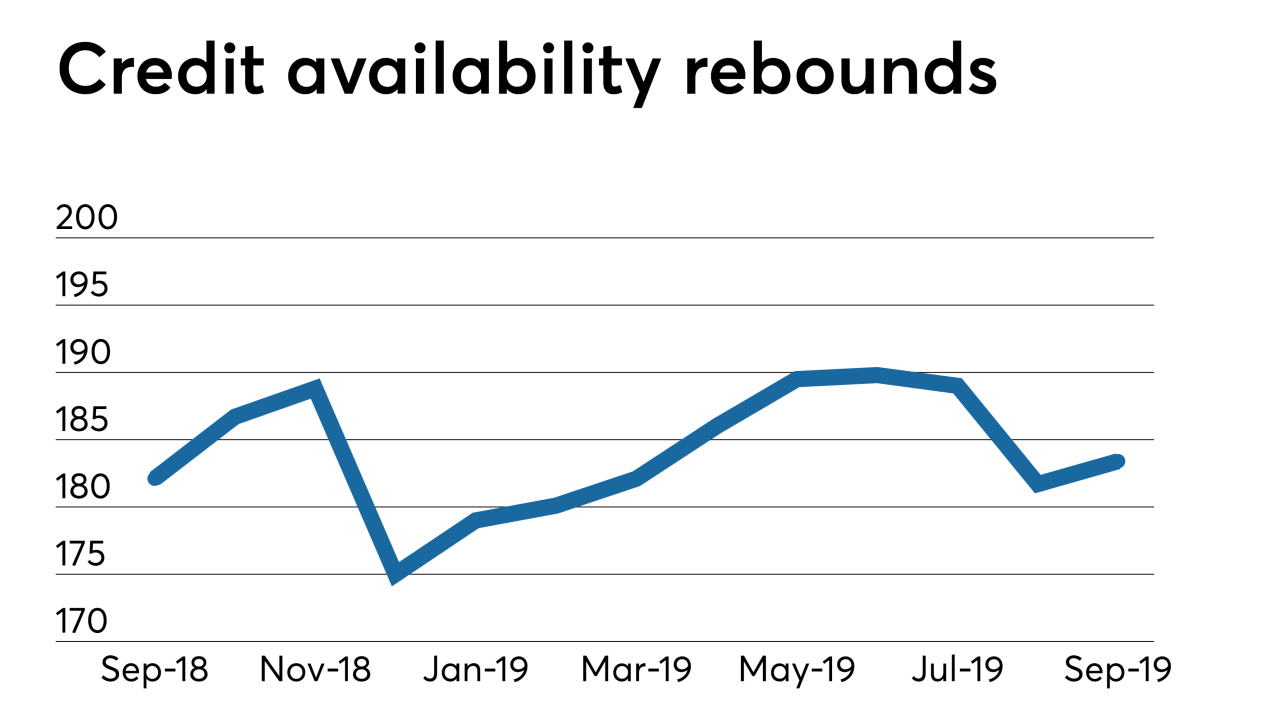

September's increase in mortgage credit availability was driven by the expansion of jumbo products to record levels, which overcame a retrenchment in both conforming and government programs, the Mortgage Bankers Association said.

October 8