-

Increased sales of lower-priced newly built homes was not enough to counter a decline in mortgage application volume for the segment in August, according to the Mortgage Bankers Association.

September 14 -

Mortgage applications decreased 1.8% from one week earlier as refinance submissions fell to their lowest in nearly 18 years, according to the Mortgage Bankers Association.

September 12 -

Mortgage applications decreased 0.1% from one week earlier, dropping for the seventh time in eight weeks even with scant movement in interest rates, according to the Mortgage Bankers Association.

September 5 -

After their first increase in six weeks, mortgage applications declined despite lower interest rates, according to the Mortgage Bankers Association.

August 29 -

Mortgage applications increased 4.2% from one week earlier, rising for the first time in over a month, according to the Mortgage Bankers Association.

August 22 -

Mortgage applications waned for the fifth week in row, hitting their lowest levels in six months, as the summer's growing interest rates plateaued.

August 15 -

July's new-home sales were at their highest pace since April, leading to a 3.5% year-over-year increase in mortgage applications to purchase recently constructed homes, the Mortgage Bankers Association said.

August 10 -

Mortgage applications declined for the fourth consecutive week as interest rates remained at high levels.

August 8 -

Mortgage applications dropped for the third consecutive week around rising interest rates and languid housing starts.

August 1 -

As regulators move forward with policy changes designed to curb so-called refinance churning of Department of Veterans Affairs-insured mortgages, concerns have surfaced about the fate of loans originated during the transition period.

July 25 -

A lack of new and existing homes for sale led to a drop in purchase and overall mortgage application volume although refinances grew.

July 25 -

Rising median home prices and tight housing inventory led purchase and overall mortgage application volume to fall although refinances rose.

July 18 -

The job market gaining steam year-over-year pushed the purchase and overall mortgage application volume upward despite refinance activity dropping to an 18-year low.

July 11 -

The average millennial borrower credit score remained unchanged in May, but values by city painted very different pictures, according to Ellie Mae.

July 11 -

Volatility in the financial markets, uncertainty with foreign trade and the housing supply deficit caused mortgage applications to drop for the second straight week.

July 5 -

Mortgage applications fell by nearly 5% last week as concerns over foreign trade and tariffs outweighed other positive economic news, according to the Mortgage Bankers Association.

June 27 -

Here's a look at the 12 housing markets where mortgage lenders have to compete the most for borrowers' business.

June 21 -

Mortgage application activity increased 5.1%, rising for the second time in the past three weeks, according to the Mortgage Bankers Association.

June 20 -

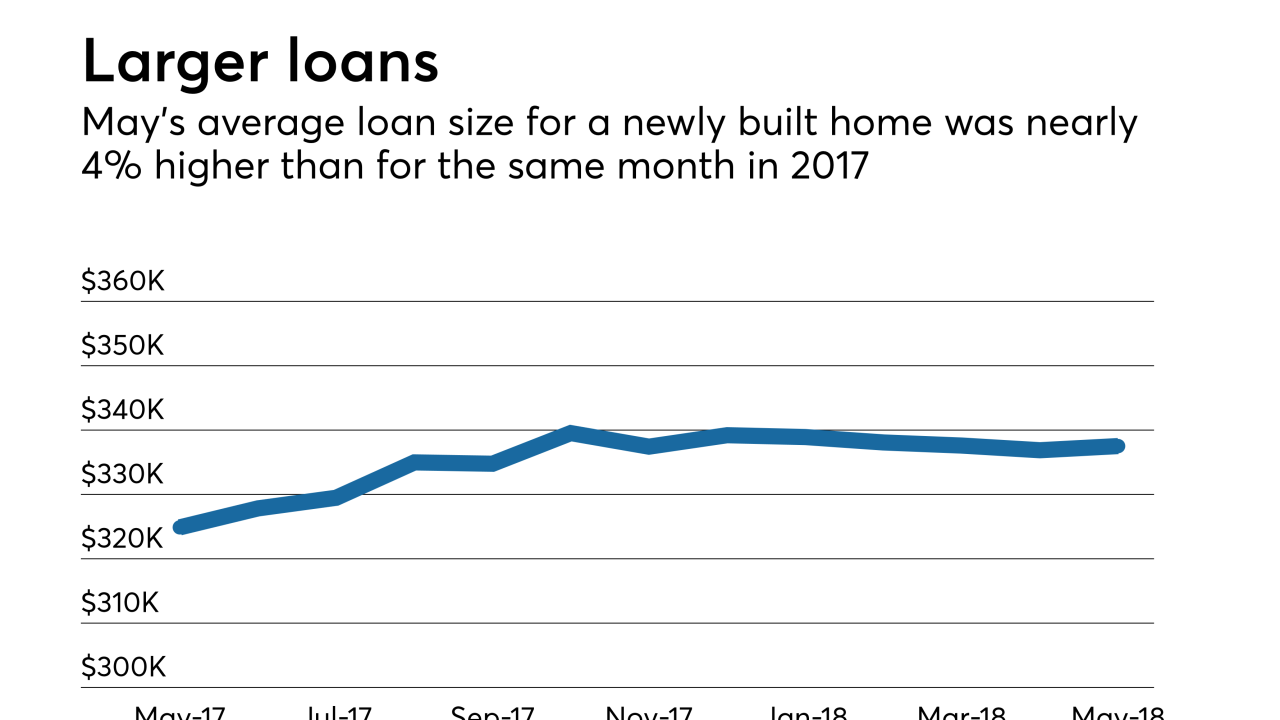

Mortgage applications for newly constructed homes declined in May as sales and supply are not keeping up with demand, the Mortgage Bankers Association said.

June 15 -

Mortgage applications fell 1.5% from the previous week, as rising interest rates ended a brief pickup in activity, the Mortgage Bankers Association reported.

June 13