-

The mortgage broker trade group put out a white paper calling for lowering transaction costs, increasing housing supply and reducing regulatory barriers.

February 13 -

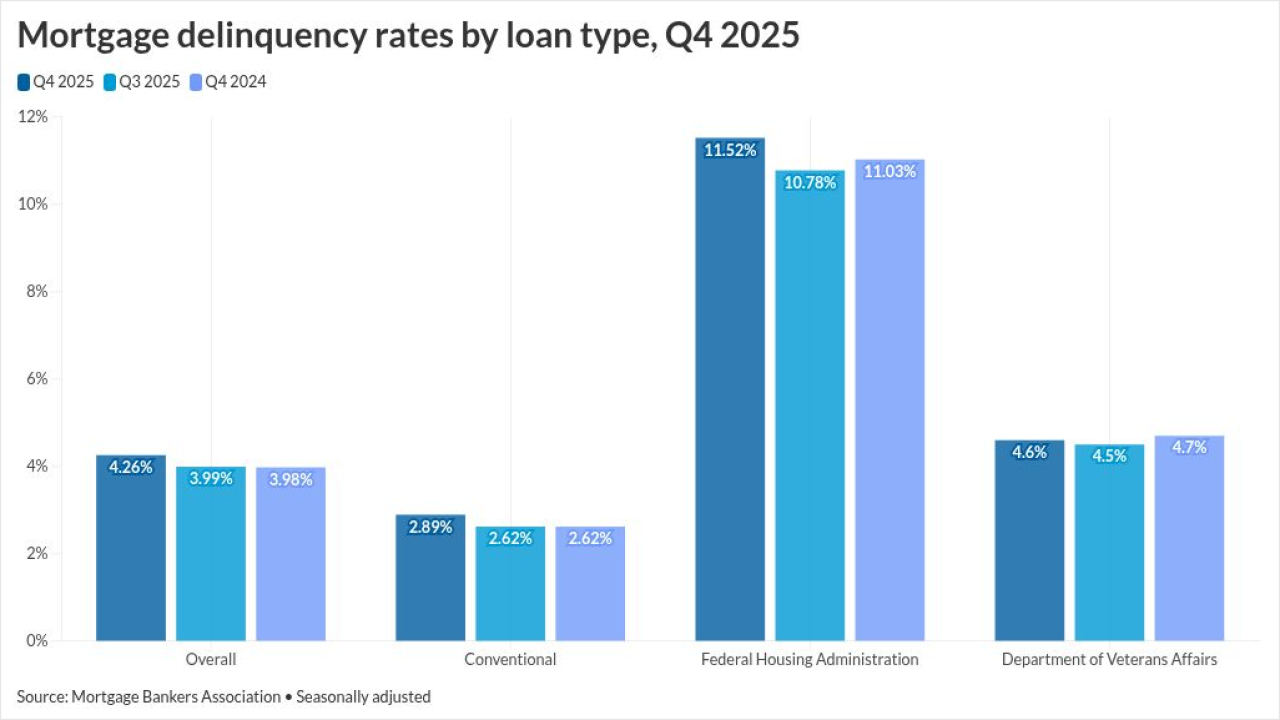

Mortgage delinquencies increased across loan types, and while 30-day late payments showed overall improvement, later-stage distress worsened.

February 13 -

-

The Consumer Financial Protection Bureau's complaint portal has been flooded in recent years, but corporate debt collectors, industry attorneys and consumer advocates question whether the bureau's efforts to reduce the volume will help consumers as much as it helps the firms they're complaining about.

February 13 -

The 30-year fixed-rate mortgage averaged 6.09% Thursday, down two basis points from last week, while the 15-year rate fell to 5.44%, according to Freddie Mac.

February 12 -

Contract closings decreased 8.4%, the biggest drop since February 2022, to a 3.91 million annualized pace in January, according to National Association of Realtors data released Thursday.

February 12 -

The income needed to afford a home had been rising on an annual basis nearly every month for five years, but affordability has been improving since the summer.

February 12 -

More than half of respondents in a National Mortgage News survey predict AI-backed underwriting will fundamentally change mortgage processes in 2026.

February 12 -

A Washington court denied a plaintiff request, pointing to past Supreme Court rulings that showed a compelling interest for the state's special-purpose credit program.

February 12 -

Federal Reserve Bank of Kansas City President Jeff Schmid said the US central bank should hold rates at a "somewhat restrictive" level, as he expressed continued concerns over inflation that remains too high.

February 11