-

Also, loanDepot adds recent HUD official to board, Cherry Creek names CTO, Homebot taps former Ellie Mae executive to lead enterprise sales and Stewart Title hires, promotes team members across the U.S.

August 16 -

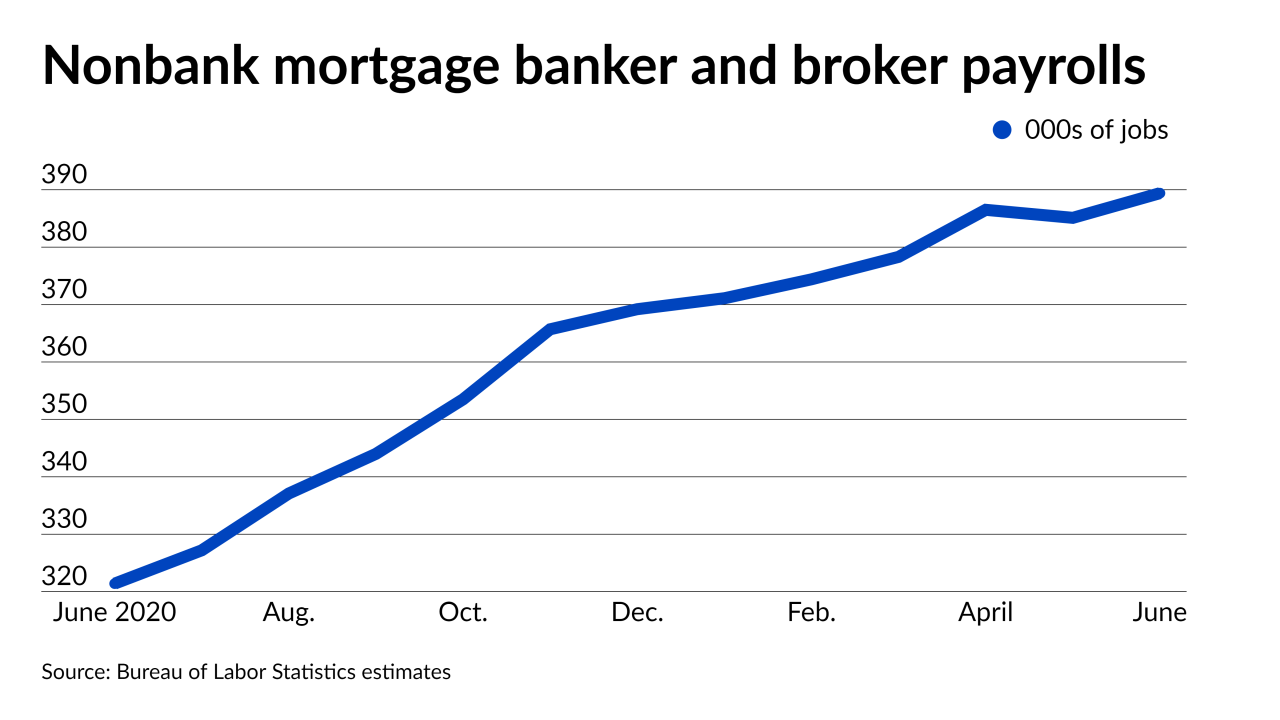

The gain reinforces other estimates that suggest more work-intensive purchase originations have spurred companies to increase staffing. Hiring addressing changing needs in servicing may come next.

August 6 -

Co-chair Susan Rice, a former United Nations Ambassador, has made racial equity a central issue to her agenda as domestic policy council chair.

August 6 -

This is the third major executive hire at the company amid an industry-wide push to attract more minorities to its ranks.

August 2 -

In late July, the Justice Department notified the Houston bank of a potential lawsuit alleging violations between 2013 and 2017, according to a securities filing. Cadence said that its prospective merger partner, BancorpSouth, supports the settlement discussions.

August 2 -

The pandemic made it harder for many Americans to qualify for mortgages. But it hit middle-to low-income minority borrowers harder than most.

July 30 -

The tool is designed to help lenders adjust their underwriting to address the growing faction of non-W2 employees, which is expected to make up half of the workforce by 2027.

July 29 -

In the midst of ongoing discussions on how to better leverage analytics and digitize the home inspection process, there are some clear actions that we can take to reduce bias in the mortgage industry, writes the executive vice president of corporate strategy at Clear Capital.

July 28Clear Capital -

The newly public technology provider will use community and industry partnerships to give banking access to historically underserved communities.

July 27 -

Also, Envoy Mortgage and Anchor Loans hire chief officers, Evolve expands in eMortgage, NMB launches digital platform, commercial lenders Trez Capital and Walker & Dunlop aim for Western growth and more.

July 27