-

The international standards-setting body is weathering the infatuation with isolationism in the U.S. and elsewhere better than expected.

April 24 -

The legislation would prohibit the CFPB from penalizing institutions that rely in good faith on guidance from the bureau.

April 23 -

The agency's acting chief said hundreds of data breaches justified a halt on collecting information from firms, but experts question that logic.

April 23 -

Lending, especially in some consumer segments, increased at Bank of America in the first quarter, and CEO Brian Moynihan expects that to continue this year. However, for market watchers skeptical about the industry's growth prospects, BofA's numbers may do little to change their minds.

April 16 -

One measure of how much things have changed in the last decade at Bank of America: The firm has stopped reporting fees from its mortgage business.

April 16 -

A panel of judges remained skeptical of claims by Leandra English, deputy director of the Consumer Financial Protection Bureau, that she is the rightful head of the agency. But they didn’t sound convinced that current acting Director Mick Mulvaney is, either.

April 12 -

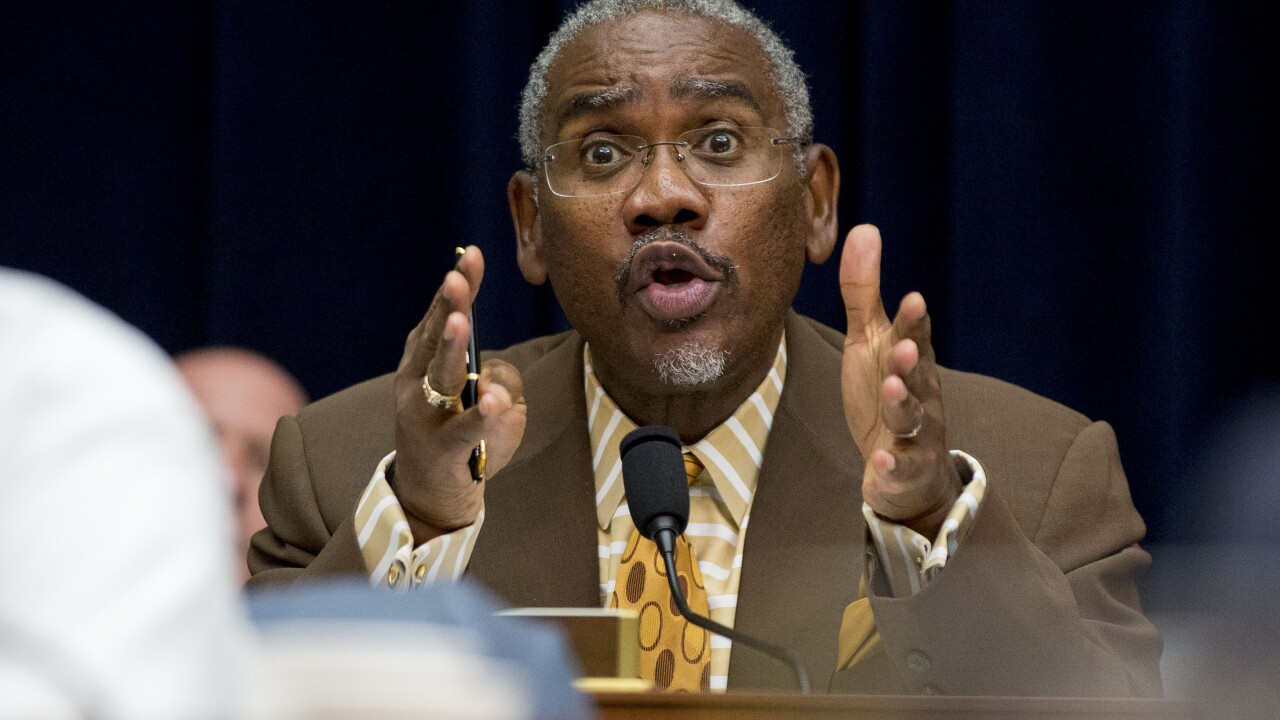

In his first of two Capitol Hill hearings this week, Democrats hammered the acting director of the Consumer Financial Protection Bureau for ignoring what they view as the agency's core purpose.

April 11 -

House Speaker Paul Ryan's decision not to seek re-election is another sign of the difficulties Republicans will likely face holding the chamber in November, heightening pressure to move a pending regulatory relief bill as soon as possible.

April 11 -

The Consumer Financial Protection Bureau on Wednesday asked for public input on the way it receives and processes complaints from consumers in what the agency said was a preliminary step toward making improvements.

April 11 -

Questions about the CFPB’s structure, high-profile enforcement actions and the acting director’s rift with Elizabeth Warren could dominate two days of hearings on Capitol Hill.

April 10 -

The acting head of the Consumer Financial Protection Bureau said he is “pleasantly surprised” with most personnel but raised concerns about those who lean toward the regulatory philosophy of Sen. Elizabeth Warren.

April 9 -

Bank regulators have not even proposed a plan yet for revamping the Community Reinvestment Act, but stakeholders likely to weigh in on the plan are already establishing battle lines.

April 9 -

According to the Reuters report, which cited unnamed sources, acting CFPB Director Mick Mulvaney is seeking a settlement with Wells over claims related to force-placed auto insurance and improper mortgage fees.

April 9 -

As lawmakers consider reforms to the Dodd-Frank Act, fresh data shows a dramatic reduction in new items issued by the regulatory agencies.

April 6 -

The agency’s acting director uses a reply letter to the senator not to answer her questions but to underscore that Congress lacks the ability to compel answers to such questions.

April 5 -

A "three-pronged" internship and management program at HUD Federal Credit Union is helping professionals across all stages of their careers, and the initiative has garnered notice from HUD Secretary Dr. Ben Carson.

April 5 -

The information request is the 11th issued by the agency since acting CFPB Director Mick Mulvaney in January launched a review to examine the bureau's practices.

April 4 -

The dominant player in manufactured housing lauded the Trump administration's review of construction standards, but other commenters worry the plan will undermine housing quality.

April 3 -

The Treasury's recommendations come as federal bank regulators have indicated they will soon release a proposal to reform Community Reinvestment Act policy.

April 3 -

The latest salvo by the acting director of the Consumer Financial Protection Bureau — proposing in the agency's semiannual report that all CFPB rules be subject to congressional approval — left many observers stumped if not outraged.

April 2