-

The latest plans include details on promoting housing development in underserved areas and increasing secondary market access to rural institutions.

November 27 -

The push comes amid what one expert highlighted as lax funding efforts for two Department of Housing and Urban Development grant programs.

April 17 -

The agency now sees applications for mortgage-recovery advances approaching 3,000 per month.

May 16 -

In a new report, the Government Accountability Office issued a list of recommendations for the department’s Native American Direct Loan program, which has benefited less than a tenth of one percent of eligible U.S. borrowers in 10 years.

April 20 -

But both fell short under the Duty to Serve goals in rural housing.

November 2 -

The legislation takes aim at third-party bank service vendors, the backlog of FHA appraisals, rural housing assistance and other issues where there is broad agreement.

September 11 -

Seeking to expand financial services access, tribal officials and some firms want regulators to award Community Reinvestment Act credit to any bank that funds projects in Native American communities.

September 2 -

The current debate around changes to the Community Reinvestment Act should include discussions about how the law can be used to better support low-income communities in remote areas.

April 3 Hope Enterprise Corp., Hope Credit Union and Hope Policy Institute

Hope Enterprise Corp., Hope Credit Union and Hope Policy Institute -

Across rural America, the government shutdown has eliminated one of the best options for low-to-middle income homebuyers, a zero down payment mortgage from the U.S. Department of Agriculture.

January 24 -

The banking industry has long been critical of the government-sponsored enterprise, but the system could provide valuable banking services to large swaths of the country currently lacking access to them.

January 7 Duke Financial Economics Center

Duke Financial Economics Center -

Freddie Mac is expanding its Home Possible loan program to allow borrowers in rural locations to use "sweat equity" for down payments and closing expenses.

November 20 -

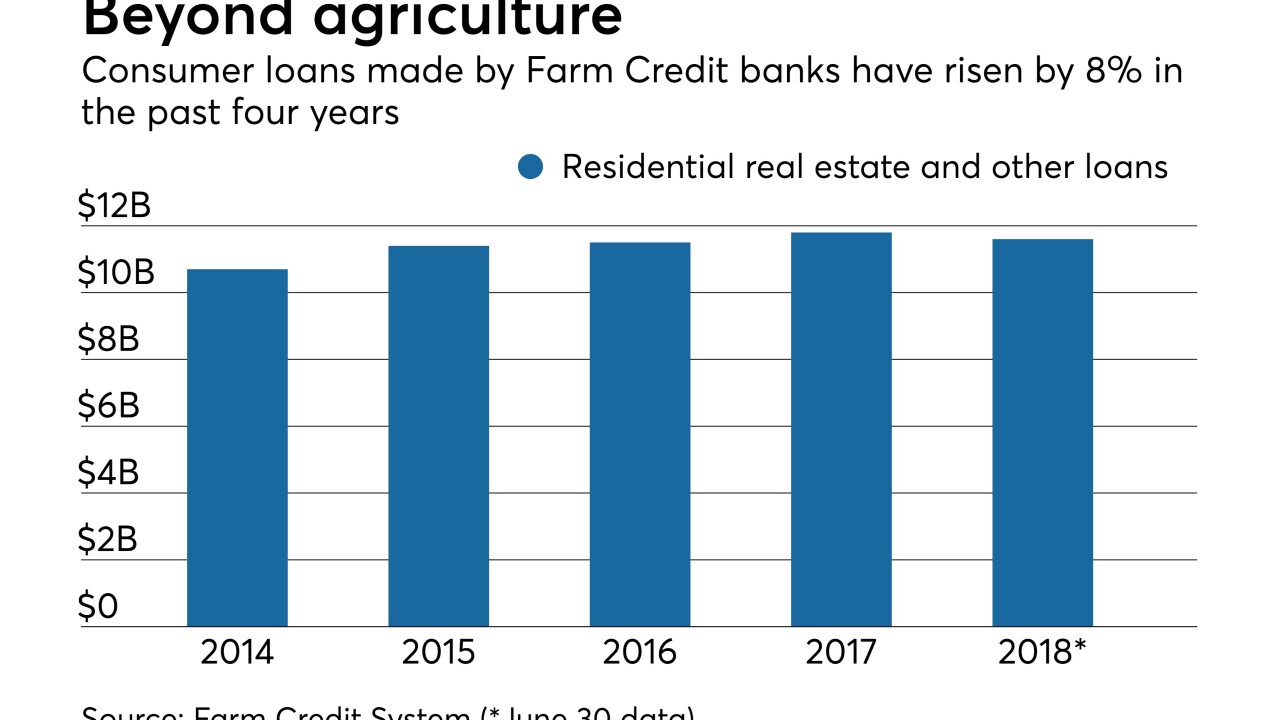

Bankers complain that the quasi-governmental system's new program designed to make more residential loans in four states goes well beyond its original mission.

October 31 -

The dominant player in manufactured housing lauded the Trump administration's review of construction standards, but other commenters worry the plan will undermine housing quality.

April 3 -

The Federal Agricultural Mortgage Corp. reported significant gains in new business volume, but also realized a big jump in 90-day delinquencies.

March 9 -

The U.S. Department of Agriculture's Rural Housing Service is piloting a new construction-to-permanent loan program after a previous venture in 2016 to spur construction lending in rural areas failed to attract many participants.

January 29 -

Housing finance reform proposals could make it challenging for community banks and credit unions to serve rural mortgage markets, according to a report issued Wednesday by Brookings and the Center for Responsible Lending.

January 10 -

The Federal Housing Finance Agency's Duty to Serve program must increase manufactured housing lending in rural communities.

September 29 NeighborWorks America

NeighborWorks America -

Farmer Mac's second-quarter net earnings increased 46% year-over-year, driven by a boost in net interest income that was enhanced by its growing loan and securities portfolio.

August 9 -

New home purchase loan application activity reached its highest point in March as builders looked to fill the growing demand for housing.

April 13 -

The lender relationships resulted from a partnership the government-sponsored enterprise entered into with a non-profit housing group.

April 11