-

The Trump administration's Financial Stability Oversight Council is likely to remove the systemically important financial institution label for the remaining nonbanks on the list, but it might consider adding other firms such as Fannie Mae and Freddie Mac.

December 28 -

The Consumer Financial Protection Bureau on Wednesday launched a rate spread calculator and validation tool for financial companies reporting Home Mortgage Disclosure Act data starting Jan. 1.

December 27 -

From deregulation to digital innovation, here's a look at the top storylines that defined the mortgage industry in 2017.

December 26 -

A federal judge appeared to be leaning toward siding with President Trump during oral arguments Friday in a case in which Consumer Financial Protection Bureau Deputy Director Leandra English is challenging the president's ability to appoint Mick Mulvaney as acting director.

December 22 -

The legislation and public perceptions of it are expected to play a major role in 2018 elections that will determine whether Republicans retain control of Congress.

December 22 -

The Consumer Financial Protection Bureau said Thursday that it plans to reopen its rulemaking for the Home Mortgage Disclosure Act and will not assess penalties against mortgage lenders for any errors in data collected in 2018.

December 21 -

The announcement Thursday that Treasury Secretary Steven Mnuchin and Federal Housing Finance Agency Director Mel Watt agreed to let Fannie Mae and Freddie Mac each build a $3 billion capital buffer avoided a potential crisis.

December 21 -

Fannie Mae and Freddie Mac will be allowed to build capital buffers to protect against losses under an agreement between the Treasury Department and the Federal Housing Finance Agency announced on Thursday.

December 21 -

The Trump administration and acting Consumer Financial Protection Bureau chief Mick Mulvaney won round one in a legal battle challenging Mulvaney's leadership. His critics will have a tall order trying to win round two.

December 20 -

The two government-sponsored enterprises have relied on the “classic” FICO credit scoring model for the past 12 years. But the Federal Housing Finance Agency is weighing whether the GSEs should upgrade to more recent scoring alternatives.

December 20 -

Comptroller of the Currency Joseph Otting said in a press conference Wednesday morning that there is a place in the banking world for some kind of fintech charter, though the exact parameters of such a charter are still unclear and have to be worked out.

December 20 -

The Consumer Financial Protection Bureau on Tuesday withdrew a

plan to conduct a web survey for its debt collection proposal while acting Director Mick Mulvaney reviews the rulemaking.December 19 -

The executive tasked with reshaping Wells Fargo's embattled retail banking unit will now also be responsible for mortgage, auto and student lending.

December 18 -

The U.S. Chamber of Commerce said Monday that an attempt to oust Mick Mulvaney as acting director of the Consumer Financial Protection Bureau would raise "grave questions" about the constitutionality of the consumer agency.

December 18 -

When the acting director of the Consumer Financial Protection Bureau announced plans to bring aboard political appointees, many viewed it as antithetical to an independent regulator. But technically there is nothing stopping him.

December 15 -

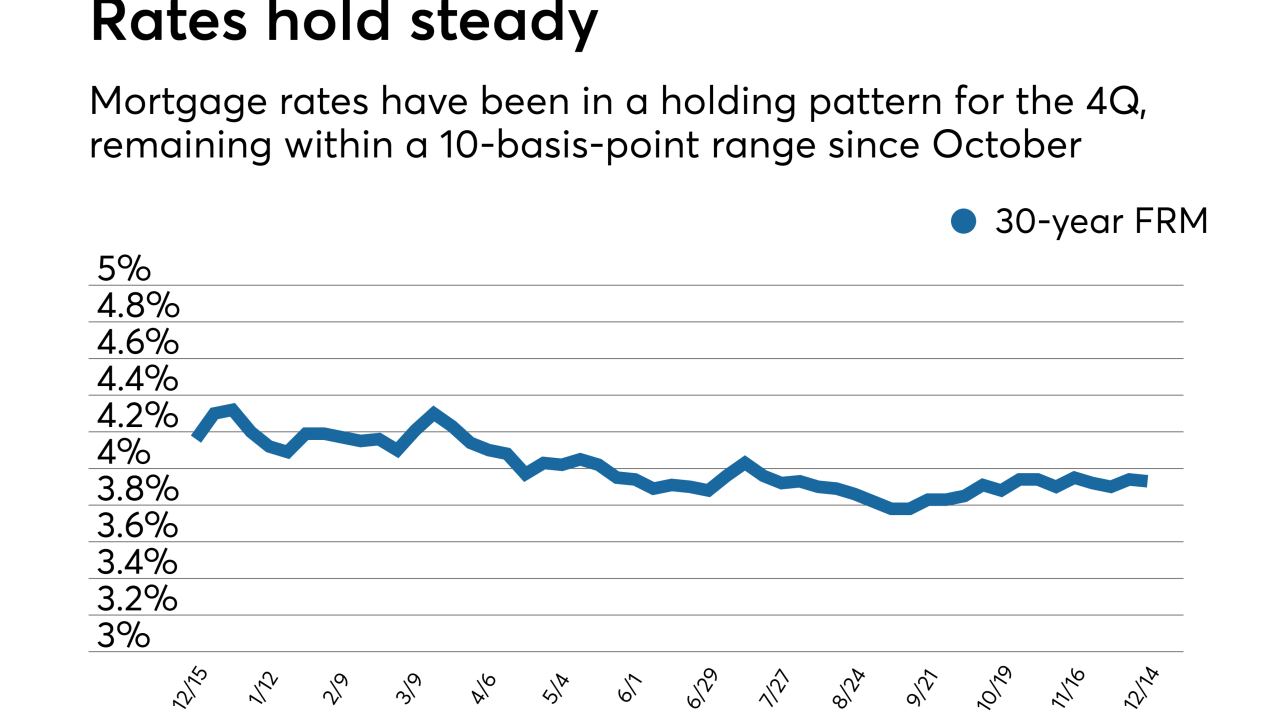

The mortgage market had already priced the Federal Open Market Committee's 25-basis-point hike into its rates so there was little change, according to Freddie Mac.

December 14 -

The Community Home Lenders Association wants Mick Mulvaney, the acting director of the CFPB, to delay implementation of the Home Mortgage Disclosure Act that goes into effect on Jan. 1.

December 13 -

The Obama administration had tried to ease restrictions on the Federal Housing Administration's condominium program, but the agency under President Trump is seen as moving more aggressively.

December 13 -

The House Financial Services Committee passed 13 bills (and scrapped a vote on one) Wednesday, including one that would stop Fannie Mae and Freddie Mac from being released by the government and another hailed as helping the underbanked in rural areas.

December 12 -

Past statements by Office of Management and Budget Director Mick Mulvaney about the Consumer Financial Protection Bureau should disqualify him from leading the agency, according to New York Attorney General Eric T. Schneiderman and 16 other state AGs.

December 12