-

For the second consecutive week, mortgage application activity unusually moved in the same direction as interest rates, decreasing 2.2% from one week earlier, according to the Mortgage Bankers Association.

November 20 -

The Federal Housing Finance Agency has extended its deadline for investor comments on a proposal aimed at better aligning pooling practices for loans in uniform mortgage-backed securities.

November 19 -

With economic expansion expected to keep churning through at least the first half of next year, Fannie Mae upwardly revised its single-family mortgage origination outlook for 2019 and 2020.

November 18 -

Guild Mortgage CEO Mary Ann McGarry is giving up the president's title as the San Diego-based company continues its national expansion plans.

November 18 -

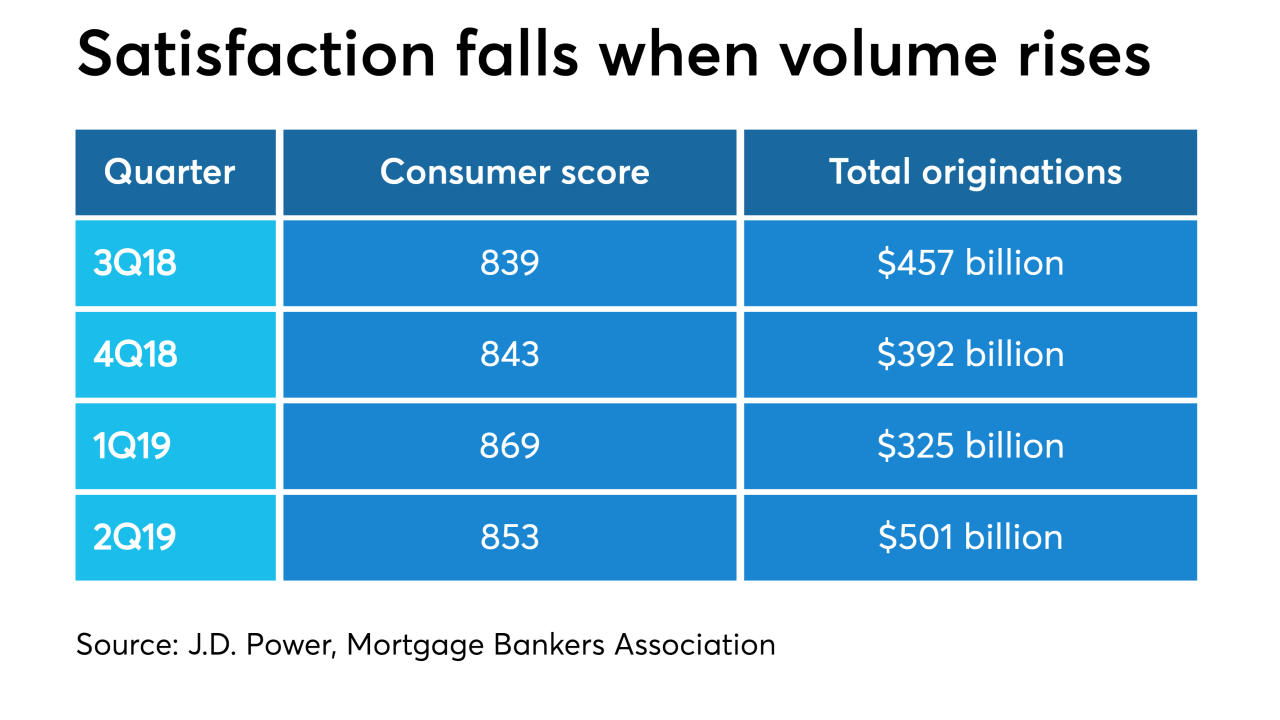

Consumer mortgage originator satisfaction scores fell in the second quarter as lenders had to work through the increase in application activity, a J.D. Power report said.

November 14 -

Mortgage applications increased from one week earlier, although conforming loan interest rates moved back over 4%, according to the Mortgage Bankers Association.

November 13 -

The sponsors of the Class A structure, deemed a “trophy asset” by Kroll Bond Rating Agency, are placing $825 million of a $1.2 billion whole loan into a transaction dubbed CPTS 2019-CPT.

November 12 -

The dollar volume of mortgages guaranteed by the Department of Veterans Affairs rose nearly 9% in the past fiscal year as interest-rate reduction refinancing loans surged nearly 75%.

November 11 -

The two newest private mortgage insurance companies had their best quarters ever for new insurance written, aided by the increase in consumers refinancing with less than 20% home equity.

November 8 -

It was activity at the upper end of the housing market that helped to keep mortgage application volume level with the previous week, the Mortgage Bankers Association said.

November 6 -

Ocwen Financial's cost-cutting initiatives are bearing fruit toward returning to profitability, management said, although the company's third-quarter loss was slightly higher than the same period one year ago.

November 5 -

Inventory shortages, favorable tax policies and a dearth of affordable options caused homeowners to increase the number of years lived in their home, according to a Redfin report.

November 4 -

Early payment mortgage defaults went to the highest level in nearly a decade, particularly among loans included in Ginnie Mae securities, a Black Knight report said.

November 4 -

Nonbank and bank mortgage employment has leveled off in line with typical seasonal trends, but some lenders remain more interested in hiring than is usually the case late in the year.

November 1 -

Freddie Mac is now forecasting back-to-back years of $2 trillion in mortgage loan originations rather than a drop-off in 2020.

November 1 -

More private mortgage insurers reported significant year-over-year gains in new business during the third quarter, mainly driven by the increase in refinance volume.

October 31 -

Record originations helped Mr. Cooper Group generate its first full-quarter profit since its formation through a merger between WMIH and Nationstar last year.

October 31 -

Mortgage applications increased slightly from one week earlier even as rates reached their highest level since July, according to the Mortgage Bankers Association.

October 30 -

Home lenders will benefit from elevated refinance activity through the first half of next year, but volume may then fall off quickly, according the Mortgage Bankers Association's latest forecast.

October 30 -

The acquisition of the Ditech forward mortgage business will double New Residential's year-to-date origination volume in the fourth quarter alone, and further double that next year.

October 25