-

SL Green Realty Corp. is tapping the securitization market to refinance 485 Lexington Ave., a 32-story office building in Midtown Manhattan.

February 2 -

Companies whose financials have taken hits due to their holdings of mortgage servicing rights are in for a treat, according to Moody's Investors Service.

February 2 -

The share of refinance applications fell under 50%, a sign the industry could be shifting to a predominantly purchase market.

February 1 -

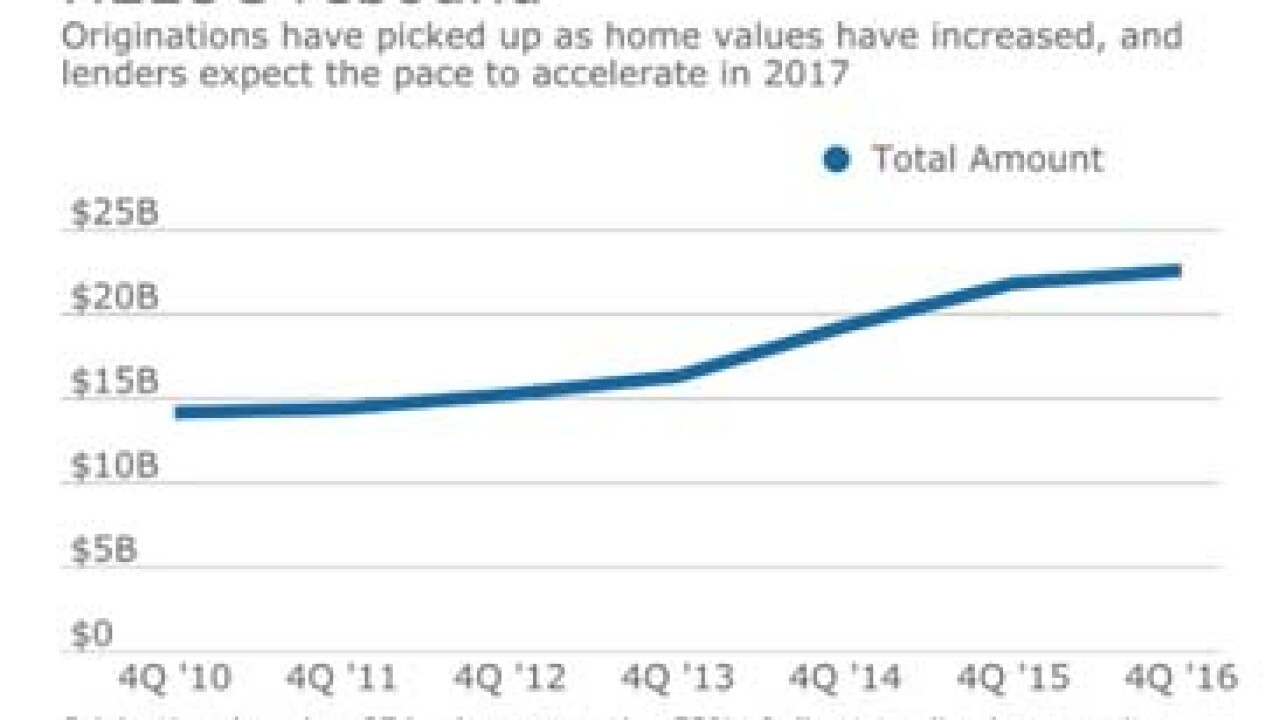

With home values and interest rates rising, homeowners finally seem ready to tap into their homes' equity to fund long-delayed home-improvement projects.

January 30 -

Home Point Financial Corp. will buy Stonegate Mortgage Corp. in an all-cash deal valued at roughly $211 million.

January 27 -

Invitation Homes, the real estate investment trust controlled by private equity firm the Blackstone Group, has found a new source of financing for its portfolio of single-family rental homes: Fannie Mae.

January 26 -

Radian Group reported fourth-quarter net income of $61.1 million, down 18% from $74.5 million for the same period in 2015.

January 26 -

The Dow Jones Industrial Average crossed the 20,000 threshold for the first time Wednesday, but the post-election stock market rally has produced a mixed bag for mortgage demand and the industry's publicly traded companies.

January 25 -

As mortgage rates continued to move higher, the share of home purchase loans began to increase in December, according to Ellie Mae.

January 18 -

There was a slight increase in application activity driven by consumers taking advantage of a downturn in mortgage rates to refinance.

January 18 -

The startup, known for refinancing millennials' student loans, is now writing more than $100 million of home mortgages a month, and expects this to be its fastest-growing product. Here's why.

January 17 -

Mortgage application volume started off 2017 on a good note as activity increased 5.8% from one week earlier, according to the Mortgage Bankers Association.

January 11 -

Refinance volume rose among millennial borrowers in November, reflecting a nationwide trend, according to Ellie Mae.

January 10 -

The Federal Housing Administration said it would cut the annual premium by 25 basis points starting on Jan. 27, giving President-elect Donald Trump a limited window to delay or scrap the cut.

January 9 -

Quicken Loans parent company Rock Holdings has agreed to buy two online marketing service providers, marking the Dan Gilbert-owned conglomerate's entrance into the lead acquisition space.

January 6 -

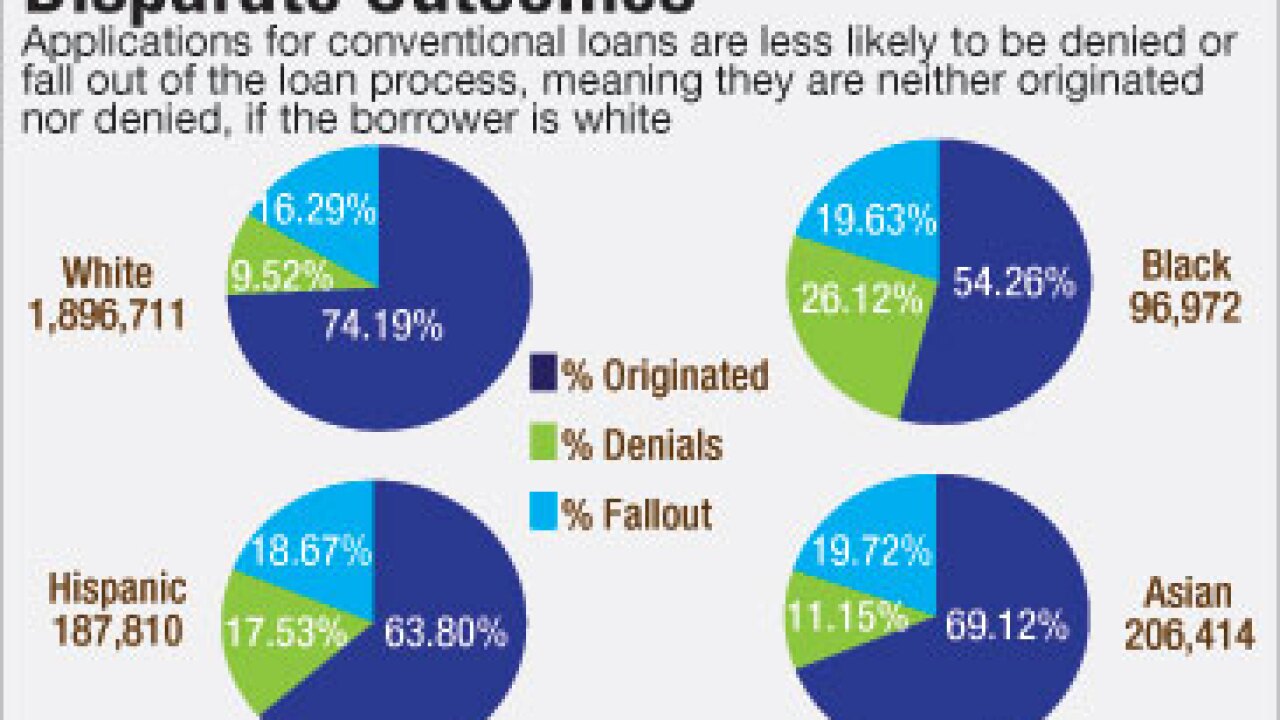

Initiatives aimed at a more inclusive credit box have long relied on costly approaches that are difficult to scale. Now, demographic shifts are intensifying industry demand for a more automated and efficient solution.

January 6 -

Demographics are shifting, creating more prospective minority homebuyers than ever before. But predominant underwriting processes and these would-be borrowers' financial backgrounds are holding them back.

January 5 -

Residential loan application activity continued its post-election slump, declining for the sixth time in the eight weeks, according to the Mortgage Bankers Association.

January 4 -

The commercial-and-industrial loan space is overheated and higher rates could stifle mortgage refinancings. Bankers could be fighting these fires and more in the new year.

December 29 -

Some of the most popular contributors to National Mortgage News' Voices community weigh in on what they see coming in the next year for origination, servicing, technology and regulation.

December 29